Family Office

Family Office

Kristin Alinder

CPA

Director

Amy Allen

CPA

Principal

Kate Anderson

CPA

Principal

Kelly Baumbach

CFP®, CEPA

Executive Managing Director

Steven Blatt

CPA

Principal

Duncan Campbell

CPA

Principal

Michele McAllister

CPA

Director

Jeanette Musacchio

Principal

Kelly Nelson

CPA

Principal

Melissa Santas Peterson

CFA®

Executive Managing Director

We know that legacies nowadays are not static. Your multigenerational family-owned enterprise is constantly shifting and scaling over time with an eye toward the future.

At Baker Tilly, family-owned enterprises are synonymous with family offices. Based upon your aspirations, we’ll build a tailored blueprint using sophisticated services to surpass your expectations now and future goals.

At a glance

Baker Tilly’s family office practice has clients ranging in size from one or two families to multiple families and generations. Our experience enables us to work collaboratively with all family members and their related entities, while maintaining confidentiality.

Our professionals provide a bespoke experience, meaning that we can help with anything your family office needs. Our services span tax compliance, consulting, wealth management, financial reporting and analysis, as well as structuring, management and support.

As your family office evolves, we will consistently recommend new, innovative solutions to address even the most complex desires. Our specialists will guide you along your quest toward establishing a lasting legacy.

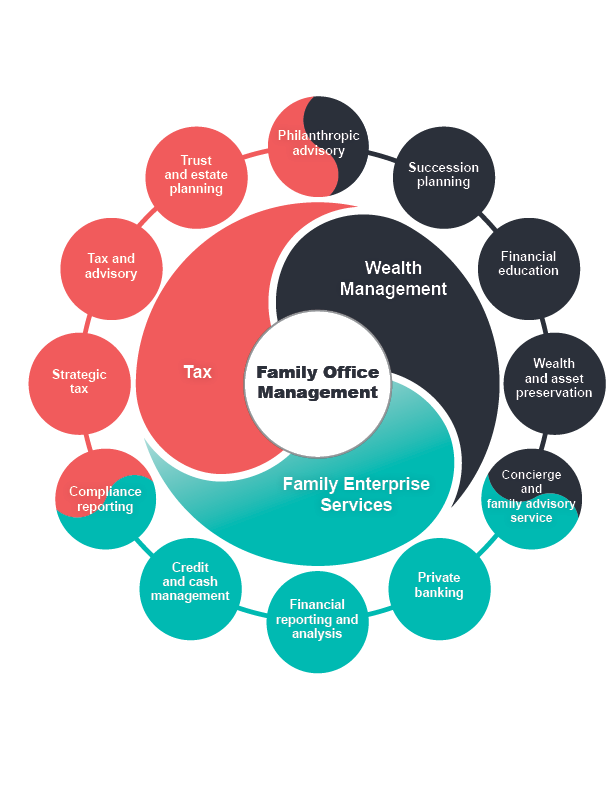

Our comprehensive family office approach

Given the unique structure of family offices, every service your advisor provides impacts another. Without a comprehensive view, your family office can have blind spots, creating issues that impede your ability to move forward. Having an advisor who understands – and more importantly can provide – these interconnected services is crucial. It allows for an all-encompassing view of your portfolio and sets you up to achieve your objectives faster.

Baker Tilly’s comprehensive family office approach gathers specialists who work together under one point of contact. This approach provides valuable insights for you to make decisions about your future path.

Our family office services

Every family office has different aspirations. We have the distinctive knowledge to navigate the intricacies of your family regardless of size or generation. Your family office may only need one of our services now, or several in the future. Our professionals will consistently work with you and your existing advisors to cultivate the right mix.

As you grow or your goals transform, we stand ready with additional guidance and benefits. Working with Baker Tilly means continuous progression toward an enriched future.

- Personal and business returns

- Fiduciary returns

- Gift tax returns

- Estate returns

- International tax

- Household and employee reporting

- 1099 reporting

- State and local tax

- Tax advocacy and controversy services

- Cost segregation

- Research and development (R&D) credits

- Income tax planning

- Stock option planning

- Executive compensation

- International tax

- Trust accounting and fiduciary consulting

- Lifetime transfer strategy

- Wealth transfer economic and tax analysis

- Multistate and international estate design

- Special needs planning

- Estate management and distribution planning

- Foreign trusts

- Donor Advised Funds

- Private foundations consulting

- Charitable trust planning

- Endowments

- Generational ownership transition design

- Exit strategies for outside sale

- Mergers and acquisitions

- Generational wealth resources and coaching

- Portfolio management

- Alternative investments

- Wealth planning

- Life insurance

- Distribution planning

- Tax-efficient consulting

- Office and family governance and ongoing support

- Insurance coverage/selection

- Medical claims

- Mortgage selection

- Payroll processing

- Private physical and electronic mailbox maintenance

- Electronic document management and retention

- Coordination with outside advisors

- Bill pay

- Customer, inter-company and inter-family billing

- Bank and brokerage account reconciliations

- Account balance and credit limits monitoring

- Coordination of bank transfers and wire payments

- Personal, special purpose and entity reporting, analysis and review with family members

- Bookkeeping

- Securities based lending advisory

- Specialty asset financing advisory

- Home financing advisory

- Premier credit financing advisory

- Budgeting, forecasting and cash flow analysis

- Monitor liabilities and debt covenants

Client spotlight: Integration and innovation: How Baker Tilly leverages Addepar to power optimal family office outcomes

Baker Tilly Wealth Management’s Kelly Baumbach was recently interviewed by Addepar. She discussed our new solution, Family Wealth Insights, and its benefits to our clients as well as integration capabilities. She also discussed Baker Tilly’s investment in the family office space and why the time is now. Read the article on Addepar’s website to learn more.

Family office-related services

Individual Income Tax Planning & Compliance

Taxes are inevitable, but have you proactively planned for tax compliance? Baker Tilly’s private wealth tax professionals can optimize your tax strategy now, for tomorrow.

Family Wealth Insights

Transparent. Personalized. Instant.

Trust & Estate Planning

Everyone has an estate and needs to plan for it. Baker Tilly’s trust, gift and estate professionals will coordinate a plan based on your objectives now and for the future.

Outsourced Accounting

Outsourcing your accounting needs can help transform your financial management and provide data to drive strategic planning, guide business decisions, and support overall growth — all while saving you time, money and stress.

Ownership Transition & Exit Strategies

One of the most significant changes to a business and its stakeholders can be the transfer of ownership. Baker Tilly can help you prepare for transition now, for tomorrow.

Wealth Management Consulting

Your wealth is measured in more than just numbers. That’s why our wealth management advisors take the time to get to know you and your goals first.

Valuations

Baker Tilly’s valuation professionals provide supportable, defensible and unbiased valuation opinions that can stand up to the highest levels of scrutiny.

Due Diligence

Whether it is for an acquisition, sale or refinancing, Baker Tilly provides due diligence services tailored to meet your specific needs.

Entertainment, Media & Sports

From business to individual goals, our dedicated industry professionals can help you plan, manage and execute your wealth

Charitable Giving & Philanthropy

If giving back is key to enhancing your legacy, let us work with you to maximize the benefits.

Research & Development Credits

Baker Tilly's research and development credit professionals can help you find R&D activities in areas you may not have thought qualify.

Transaction Advisory Services

Baker Tilly’s transaction advisory services team provides straightforward advice to clients on every critical business decision before, during and after a transaction.

Cost Segregation

Individuals and companies that build, purchase, remodel or expand any kind of real estate can benefit financially from using cost segregation.

Private Equity & Portfolio Companies

From private equity firms and their portfolio companies to family office, Baker Tilly leverages industry knowledge and operational experience to offer clients value from the fund level down through the entire portfolio.

Technology

We help technology companies go to market with confidence.

Benefits & Compensation

Every day, companies are aware of the pressure and need to attract, retain and motivate top talent, but struggle to understand how to develop effective strategies and launch initiatives that will engage their workforce.

Cybersecurity

Proactively protect and address your cybersecurity and information technology (IT) risks.

“Baker Tilly works with multigenerational families that possess a desire to leave a lasting legacy, whether charitable, generational or both. We work alongside each family to design a structure that aligns with each generation’s goals. From there, we apply our concierge approach to help govern your family enterprise using seasoned professionals and solutions.”Duncan Campbell, Principal

The information provided here is of general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances a professional should be sought. Baker Tilly Wealth Management, LLC (BTWM) is a registered investment advisor. BTWM does not provide tax or legal advice. BTWM is not an attorney. Estate planning can involve a complex web of tax rules and regulations. Consider consulting a tax or legal professional about your particular circumstances before implementing any tax or legal strategy.

BTWM is controlled by Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm that provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Wealth Management, LLC