Business continuity planning will help mitigate COVID-19-related losses

The coronavirus (COVID-19) pandemic is affecting the lives of people around the world. It’s also having a significant impact on the economy and individual organizations everywhere — big and small.

COVID-19 is not your average business disruption. In fact, we have never seen a situation quite like this. Moreover, because many businesses never anticipated the impact of COVID-19, it is critical to use the crisis as an opportunity to build a resilient business today for a stronger tomorrow.

This article – based on Baker Tilly’s webinar, Mitigating your losses from COVID-19: business continuity planning and management during the coronavirus pandemic – will help you understand business continuity planning best practices and how to overcome roadblocks, as well as how to identify areas that can potentially mitigate business losses, and assist in determining the financial impact.

Adaptation key to resiliency

Whether you have a robust business continuity plan (BCP) in place or are developing one on the fly, the key to resiliency is the same: an ability for your organization to adapt quickly and learn on the go. To mitigate financial losses and achieve business continuity during the COVID-19 pandemic, begin by creating, updating or adhering to your BCP.

A BCP can help your organization successfully navigate temporary business disruptions — planned or unplanned, seen or unforeseen. The ultimate goal? To protect the safety of your employees, keep promises to your customers and safeguard the future of your company against existential business threats.

According to Gartner, when a pandemic strikes, a strong BCP can help your organization:

- Minimize the impact on staff, the organizational supply chain, service delivery and IT infrastructure

- Protect the organization’s reputation

- Reduce financial impact

- Return to new normality sooner

About 80% of business leaders and executives attending the webinar said they have already deployed their BCP in response to COVID-19.

An effective BCP must address all of the practical considerations relevant to the organization or business: people, facilities, technology, critical operations, reputation and overall impact of the disruption on the business. It should be a living, breathing protocol document that is continually updated — incorporating lessons learned and growing alongside the organization’s changing needs. It should outline what to do, when to do it, and who takes care of it.

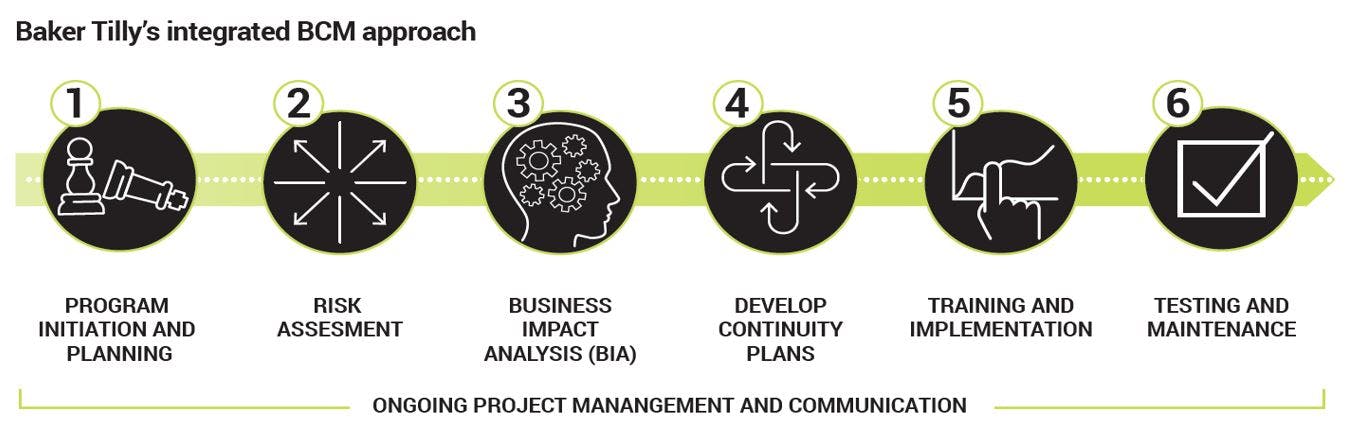

It is important to note that business continuity planning is part of the larger business continuity management (BCM) process. Baker Tilly’s integrated BCM approach is demonstrated in the graphic below.

For business leaders who haven’t developed a BCP or are not sure where to start, Baker Tilly developed a Business Continuity Checklist that your organization can use as a foundation for the planning process.

If you already have a BCP in place, evaluate it in real time to effectively support employees, gain visibility into supply chain resilience, and gauge the short- and long-term effects of COVID-19 on your organization. Your existing BCP might focus on a short-lived or pre-planned event, and the coronavirus is neither — so it may require updating.

Preparing for and responding to business continuity planning challenges

Now: maintain documentation

To assist in determining the financial impact, it is important to maintain documentation. Adequate documentation is critical to track costs/losses during the disruption period, and it is much easier to do as the disruption is happening versus after the fact.

Now: establish a business continuity taskforce

If you haven’t already, establish a business continuity taskforce — a designated group of leaders who stay up to date on the impact of a disruption to the business and who are responsible for making critical decisions to resume operations.

The business continuity taskforce should be responsible for the following:

Develop effective internal communications

- Address, at a human level, the challenges employees battle both internally and externally. Employees should hear from the taskforce frequently, understand policies and feel that their safety is their organization’s top priority

- Facilitate messages from the CEO or key leaders on COVID-19 updates to ease employee anxiety and keep people connected

- Guide management in encouraging, motivating, educating, uplifting, supporting and boosting the morale of employees

- Keep lines of communication open with customers, suppliers, vendors and employees

- Develop and disseminate consistent, clear and frequent messages to employees, including corporate-wide calls or town halls, an employee “helpline,” and dedicated space on an intranet or another easily accessible communication channel to provide updates for stakeholders

- Have a communication plan and strategy ready in the event of an office outbreak

Develop tools and training — for both employees and customers

Oversee enhanced facility policies and protocols

- Implement social distancing

- Provide job rostering/shifts of critical roles to reduce staff

- Offer hand sanitizer, masks and other personal protective equipment (PPE)

- Hire cleaning companies to do deep cleaning of facilities regularly

- Close locations where possible

Review technology needs

- Invest in and use video conferencing tools for more intimate interactions

and connections (compared to phone or email) - Design and communicate best practices around conferencing systems (e.g., Zoom), including updates to conferencing security

- Manage risks related to cybersecurity and phishing, especially given a remote workforce

Assess and adjust critical functions and the supply chain

- Understand the impact of the pandemic on your suppliers’ businesses

- Look at contingency plans for sourcing products, materials or services from other suppliers or vendors

- Determine which geographies are affected and focus your attention there

- Implement greater oversight of key vendors across the supply chain, using SOC reports or SOC for supply chain as tool

Redeploy non-essential resources to respond to customer inquiries or fill business needs that may be elevated during the crisis

Now/next: understand financial impact and how to minimize financial damages

There are three key focus areas where a BCP can help to minimize and mitigate financial damages: revenue, cost and resources.

Revenue – being nimble, flexible

- Shifting your sales strategy/modifying sales channels (e.g., brick-and-mortar retail adapting for online sales, professional services companies working remotely, pivot to new products)

- Assessing if revenue-generating activity can be deferred until later, reassigned or continued using alternate arrangements

- Postponing potential sales, so they become a delay rather than a loss

- Using existing inventory to meet an immediate sales demand

- Revising project timelines

Costs – evaluating necessary costs

- Evaluating and reducing unnecessary costs (proceed with caution so you can “switch the lights back on quickly” and get back to business)

- Recognizing that operating costs may increase and forecast accordingly – forces of supply and demand

Resources

- Protecting employee health, especially where reduced operations remain in place

- Protecting key employees to ensure knowledge and skills retention for recovery

- Protecting your reputation in the marketplace – manage your own message

- Assessing financial recovery/assistance options (e.g., the CARES Act, federal/state programs, SBA, other potential sources)

Consider setting up a “loss account” in the general ledger to record and track costs directly associated with COVID-19 losses. By doing so, a business can avoid comingling these costs with normal operating costs and expenses. For COVID-19-related costs, maintain supporting documentation so it is readily available when needed.

It is also important to take the time to review all lease agreements to determine if an abatement clause exists, and to review all contracts to determine if they include a force majeure clause. Speak with your vendors and suppliers to learn about and evaluate any barriers that may impact performance.

Now/next: understanding the financial impact – revenue

The following are some factors to consider when projecting revenue/sales during the downtime or period of disruption:

- Is the business seasonal?

- Was the business experiencing growth at the time of the disruption?

- Were there any one-time events or projects that affected revenues?

- Can revenue/sales be postponed versus lost?

- Was the business operating at full capacity at the time of the shutdown?

- Was the business established, or in startup phase?

Keep in mind that any actual revenue/sales during the downtime period will need to be deducted when determining lost revenue/sales (e.g., restaurants with online/delivery versus having people in the restaurant).

Now/next: understanding the financial impact – costs and expenses

Misunderstanding the impact of the events on cost structure can lead to a misunderstanding of the financial impact of the event, and in turn, produce inaccurate information on which to base business continuity decision-making.

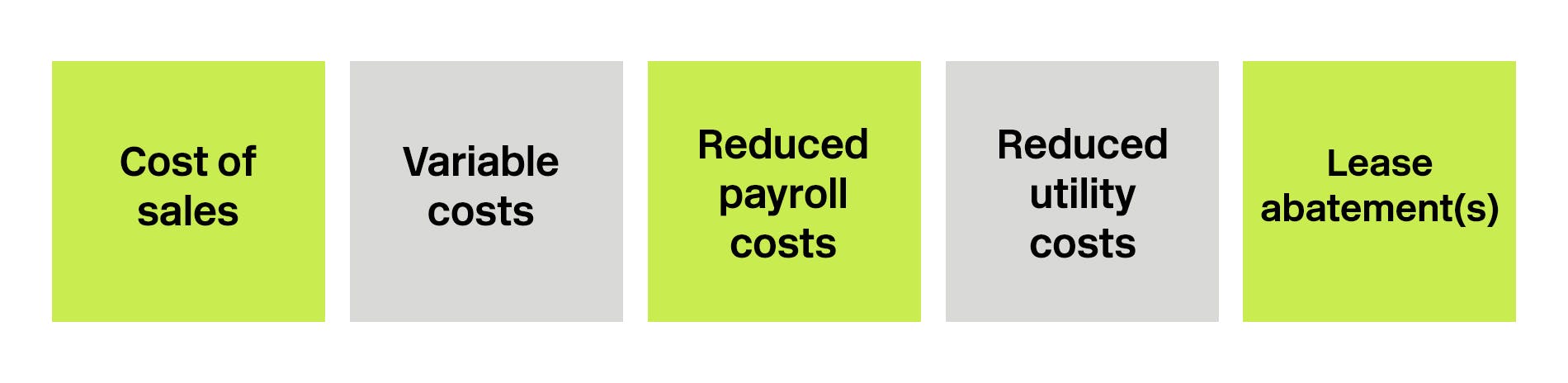

Any saved or avoided costs and expenses will need to be deducted from lost sales/revenue when determining the financial impact and any lost profits. Examples include:

The longer the downtime or interruption period, the increased likelihood of fixed costs becoming saved or avoided.

In addition to deducting saved/avoided costs in determining the financial impact, you should also consider any additional (incremental) costs incurred as a result of the event. For example:

- Overtime payroll costs to make up lost sales/production in the post-loss period

- Outsourcing costs (above normal)

- Increased delivery/shipping/transportation costs

- Costs to shift sales/production to other unaffected locations

Next: strategize for the recovery phase

More than half of the webinar participants said they have already begun the COVID-19 recovery phase: developing and executing a strategy to transition back to normal operations.

As we begin to see the start of recovery, organizations need to develop a road map to ramp up operations. This includes making strategic decisions on when to reopen facilities, bring back furloughed employees, outline what a “new normal” looks like and determine how interactions, travel or protocols may change as a result.

Remain disciplined, ensuring that appropriate quality control is in place for decision-making. This is not the time for cutting too many corners that could lead to reputational problems or other operational issues. The new normal may look very different than the pre-COVID-19 operational landscape, and this will mean new operational risks.

Include a re-evaluation of your business impact analysis and re-assess the sustainability of critical functions and supply chain to determine where the organization should focus its attention.

You should also establish lessons learned and after-action reports with key observations for improvement. Ask questions like, How did our business plan hold up? What flaws/issues came up? How can we improve future processes? Where do we need to diversify suppliers? Where are the bottlenecks in our supply chain? Can we increase oversight of key vendors and suppliers? Using the lessons learned, you can update your BCP accordingly.

As you review your plans, it is also beneficial to conduct walkthroughs and exercises. This will help identify gaps in your procedures and allow active participants to become familiar with their responsibilities, as well as the reasoning behind goals and objectives of the plan.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.

Related sections

- Risk Advisory

- Family Business

- Government Contractors

- Healthcare & Life Sciences

- Higher Education

- Manufacturing & Distribution

- Not-for-Profit

- State & Local Government

- Construction

- Real Estate

- Food & Beverage

- Agribusiness

- Multifamily Housing

- Real Estate Investors

- Lodging

- Coronavirus Recovery & Growth Resources

- Business Continuity