Compliance+

Baker Tilly helps turn your regulatory compliance into an easier, more strategic process that enhances value for your company.

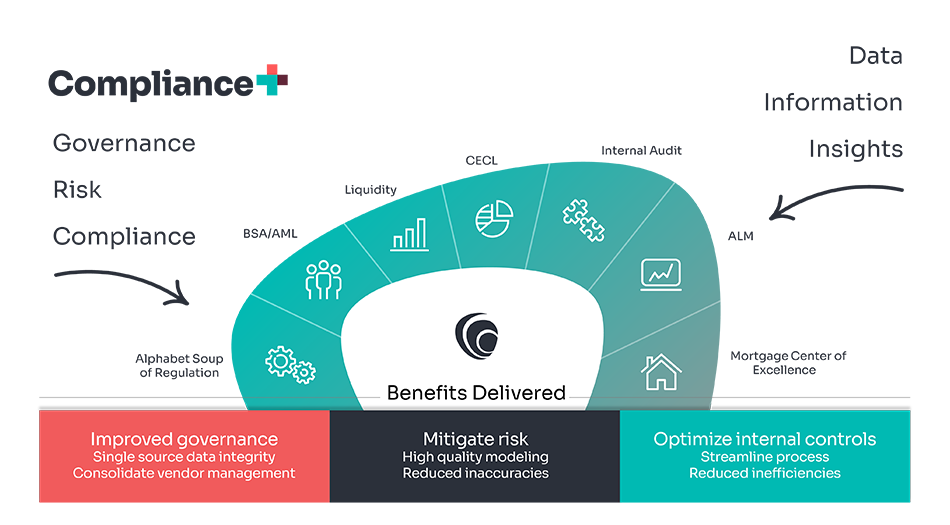

A company’s approach to the regulatory environment must balance the governance, risk and compliance programs with managing the data, information and insights used to build and run each compliance model. Baker Tilly brings an improved governance approach focused on delivering value to your organization beyond simply satisfying your regulatory requirements.

Too often, compliance work is conducted in silos, leading to redundancies, inconsistencies and troublesome inaccuracies. Our team utilizes a consistent data source to maximize transparency across your compliance needs, giving your board and management teams the confidence they demand.

Baker Tilly’s Compliance+ team of industry professionals brings accounting, compliance and modeling experience that will not only help improve governance and mitigate your risk but will optimize your internal controls processes so you can leverage resources (people, time and budgets) in more efficient and effective ways.

Streamline compliance

Organizations must comply with the crowded environment of regulations, and there are often commonalities and connection points between these regulations. Similar or related data sets, assumptions, and shared models often factor into seemingly disparate regulatory compliance requirements. Yet those compliance needs may usually be handled by different teams within an organization.

Identifying connections to streamline regulatory compliance

With our compliance philosophy and consistent source of data approach, Baker Tilly helps organizations connect multiple compliance requirements so your organization can reduce redundancies and efficiently streamline the number of service providers involved.

Baker Tilly’s compliance services

We can combine any of the following requirements and services into one effective scope of work, streamlining processes, providers and your resources.

CECL

Baker Tilly CECL specialists navigate the complexities of current expected credit losses (CECL) with a flexible approach and full suite of services, including implementation, model validation and outsourced third-party modeling.

BSA/AML

At Baker Tilly, we assist clients in responding to and mitigating damages from suspected fraudulent activity, as well as help clients design the structure and validate the models used to prevent the problem.

Our anti-money laundering (AML) programs are designed to protect organizations that are subject to Bank Secrecy Act (BSA) regulations. This includes financial institutions, as well as a wide range of cash intensive nonbank financial institutions, from real estate lawyers to jewelers to casinos.

ALM

Baker Tilly’s complete asset-liability management (ALM) solution includes model validation, scenario modeling, financial projections, and stress testing to address all asset lifecycle stages and provide clients confidence in the data on which critical business decisions are based.

Mortgage Center of Excellence (MCOE)

Baker Tilly’s mortgage compliance team provides the regulatory compliance, quality control, risk management and digital technology understanding necessary to support our clients that originate, sell and/or service mortgage loans.

Liquidity

Our financial services professionals help institutions evaluate their liquidity under various market scenarios. Results can range from identifying excess liquidity to insufficient liquidity. It’s critical for an institution to know where it falls. We can assist in implementation or validation of liquidity models.

Internal audit

Leading financial services organizations view Internal Audit as a catalyst and valued partner, challenging the status quo and proactively identifying and focusing on emerging risks. Baker Tilly’s Internal audit approach applies agile principles and is at the forefront of change and disruption. Our team brings innovative audit strategies, collaborating with management on identifying and improving the organization’s operations. We adopt a flexible approach supported by the right talent.

Model risk management

Financial services organizations subject to these various regulations are also managing multiple models, calculations and data sets. Baker Tilly’s data specialists help clients streamline processes and build greater efficiency and accuracy in their model management.

Alphabet soup of regulation*

Regulatory requirements seem to grow in numbers every day, and their various acronyms share a striking resemblance to alphabet soup but are far less appetizing. Baker Tilly’s Compliance+ solution helps clients manage federal regulations, improve governance and leverage the data for critical business decisions.

*What's in the alphabet soup of regulation?

Expand the regulations below to learn more.

- A – Extensions of credit by Federal Reserve Banks

- B – Equal Credit Opportunity Act; Fair lending

- D – Reserve requirements of depository institutions and money markets

- E – Electronic funds transfers

- F – Interbank liabilities

- G – Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act)

- H – Federal Reserve membership

- I – Issue and cancellation of Federal Reserve Bank capital stock

- J – Check collection

- K – International banking operations

- L – Management interlocks

- M – Truth in Lending Act

- N – Relationships with foreign banks and bankers

- O – Insider loans

- Q – Capital adequacy of bank holding companies, savings and loan holding companies, and state member banks

- R – Exceptions for banks from the definition of Broker Securities Exchange Act of 1934

- S – Reimbursement to financial institutions for providing financial records; recordkeeping requirements for certain financial records

- T – Credit by brokers and dealers

- U – Credit by banks and persons other than brokers or dealers for purchasing or carrying margin stock

- V – Fair Credit Reporting Act; Incorporates Fair and Accurate Credit Transactions Act of 2003

- W – Transactions between banks and their affiliates

- X – Real Estate Settle Procedures Act

- Y – Bank holding companies

- Z – Truth in lending

- BB – Community Reinvestment Act (CRA); Data collection

- CC – Funds availability

- EE – Netting eligibility for financial institutions

- FF – Obtaining and using medical information in connection with credit

- GG – Prohibition on funding of unlawful internet gambling

- HH – Designated financial market utilities

- II – Debit card interchange fees and routing

- JJ – Incentive-based compensation arrangements

- KK – Swaps margin and swaps push-out

- LL – Savings and loan holding companies

- MM – Mutual holding companies

- NN – Retail foreign exchange transactions

- OO – Securities holding companies

- PP – Definitions relating to Title I of the Dodd-Frank Act

- QQ – Resolution plans

- RR – Credit risk retention

- TT – Supervision and regulation assessments of fees

- VV – Proprietary trading and relationships with covered funds

- WW – Liquidity risk measurement standards

- XX – Concentration limit

- YY – Enhanced prudential standards

- Americans with Disabilities Act (ADA)

- Bank Bribery Act

- Bank Protection Act (BPA)

- Check Clearing for the 21st Century (Check 21)

- Community Reinvestment Act (CRA)

- Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA)

- Escheat - abandoned property

- Fair Credit Reporting Act (FCRA) incorporates the Fair and Accurate Credit Transactions Act of 2003 (FACTA)

- Fair Debt Collection Practices Act (FDCPA)

- FDIC – deposit insurance regulations; advertising regulations

- Fair Housing Act (FHA)

- Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA)

- Financial Crimes Enforcement Network (FinCEN)

- Flood Disaster Protection Act (FDPA)

- Gramm Leach Bliley Act of 1999 (GLBA)

- Homeowners Protection Act of 1998 (HOPA)

- HUD - homeownership counseling

- Non-Deposit Foreign Asset Control (NDIP)

- Office of Foreign Assist Control (OFAC)

- Right to Financial Privacy Act (RFPA)

- Servicemembers’ Civil Relief Act (SCRA)

- The USA Patriot Act of 2001

Featured insights

Bank Director: Taking model risk management to the next level – better business decisions from data consistency across models

This Baker Tilly article discusses how data consistency across models allows executives to go beyond box-checking compliance exercise and make better business decisions.

Multibillion dollar mutual insurance company saves time, money and mitigates risk with a strategic health check

Multibillion dollar mutual insurance company saves time, money and mitigates risk with a strategic assessment and road map from Baker Tilly before the launch of a large transformation project.