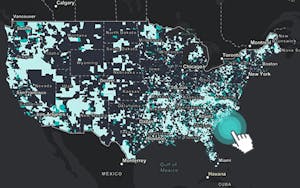

Energy Community Mapping Tool

Energy Community Mapping Tool

Thomas E. Unke

CPA

Principal

Joel M. Laubenstein

Principal

Cory R. Wendt

Principal

David Capitano

CPA

Principal

Gideon Gradman

Baker Tilly Capital, LLC Managing Director

Donald N. Bernards

CPA

Principal

Jeffrey J. Petrell

J.D., CPA, CGMA

Principal

Michelle Abel

J.D.

Principal

Tyler R. Inda

J.D.

Principal

Bryan Halpin

Director

Robert Moczulewski

CPA

Director

Energy community

The Inflation Reduction Act of 2022 defines an energy community as either:

- a brownfield site, or

- metropolitan statistical area or non-metropolitan statistical area which has 0.17% or greater direct employment or at least 25% of local tax revenues related to the extraction, processing, transport or storage of coal, oil or natural gas, and has an unemployment rate greater than the national average unemployment rate for the previous year, or

- a community which is in proximity to a coal mine which has closed after Dec. 31, 1999, or in proximity to a coal-fired electric generating unit that was retired after Dec. 31, 2009. A closed coal mine or retired coal-fired electric generating unit must have been closed within the census tract, or in a directly adjacent tract.

Our interactive mapping tool can help you determine if a project might be located in an "energy community" that may qualify for the energy community bonus component of the Investment Tax Credit and Production Tax Credit under the Inflation Reduction Act.

Let us review your project

If you’d like to verify that your project is located in a qualified energy community, or if you want to understand what other federal tax credits and incentives may be available for your project, please fill out the form below. Our energy team and tax credit specialists will review your project.

Disclaimer

Your use of this map and any information contained herein are provided as a reference and are for informational purposes only. Baker Tilly makes no representations or warranties as to the accuracy, completeness, validity or applicability of information provided. The U.S. Department of the Treasury has not yet issued all official guidance for the Inflation Reduction Act of 2022, including guidance regarding the eligibility criteria of what qualifies as an energy community. No client relationship is formed between you and Baker Tilly unless and until a formal engagement agreement is signed, and any professional services performed shall be subject to the same. Connect with a Baker Tilly specialist for more information.

Data sources

The above mapping tool utilizes available public data sources, including EPA FRS (ACRES) Database, U.S. Bureau of Labor Statistics and U.S. Department of Energy, National Energy Technology Laboratory.

The U.S. Department of the Treasury has not yet released all formal clarifying guidance on the eligibility criteria for what qualifies as an energy community under IRC §45(b)(11)(B). These data sources are used as proxies to identify potentially eligible communities; results are subject to change based on guidance from the U.S. Department of the Treasury and periodic updates to referenced data sources.