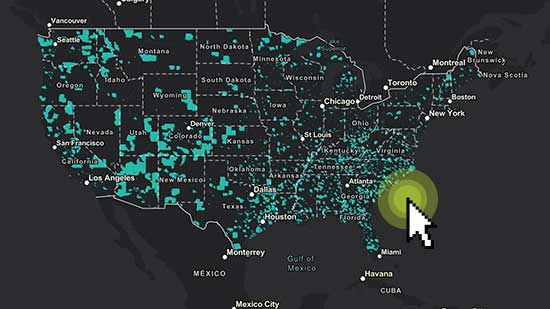

Opportunity zones mapping tool

The opportunity zones program offers federal tax benefits for investors in low-income communities. To establish the qualifying zones, states, U.S. possessions and Washington D.C. nominated various low-income communities. The governor of each state was permitted to select 25% of the state’s qualifying areas for the program. The qualifying areas were designated by census tract data and had to meet the definition of low-income as defined under the New Markets Tax Credit program. The states could designate up to 5% of their qualifying opportunity zones in areas that were not classified as low-income but were contiguous to qualifying areas. They were also required to consider the following when identifying their zones:

- Areas that are currently the focus of economic development initiatives to attract investment and foster business activity

- Demonstrated success in target areas from other programs such as Promise Zones, Renewal Areas, Enterprise Zones and New Markets Tax Credits

- Areas that have recently suffered significant job loss due to business closure or relocation

Now certified by the U.S. Department of Treasury, the opportunity zones will remain fixed from the date of designation through the close of the tenth calendar year.

This mapping tool can help you determine if a project may qualify within eligible census tracts.

Use the interactive opportunity zones mapping tool

Disclaimer: The data presented in this map are provided as a reference and the validity cannot be guaranteed. All data should be verified with the U.S. Department of Treasury and CDFI Fund before using it in your decision making process.