Opportunity zones 101: what is the program and how does it work?

The opportunity zones program, established through the Tax Cuts and Jobs Act, aims to spur long-term private sector investments in low-income communities nationwide. Investors in qualified opportunity funds (QOFs) participating within the designated qualified opportunity zones (QOZs) can take advantage of federal tax benefits in exchange for their contribution to economic growth and investment in distressed communities.

Virtually any entity or individual required to report capital gains can receive opportunity zone benefits. This includes individuals, C corporations (including regulated investment companies and real estate investment trusts), partnerships, S corporations, and trusts and estates.

For project sponsors, the program may also help accelerate capital formation, reduce capital cost, fill gaps in the capital stack and enhance other federal tax credit transactions. The program applies to varied asset classes, project types and operating ventures

How it works

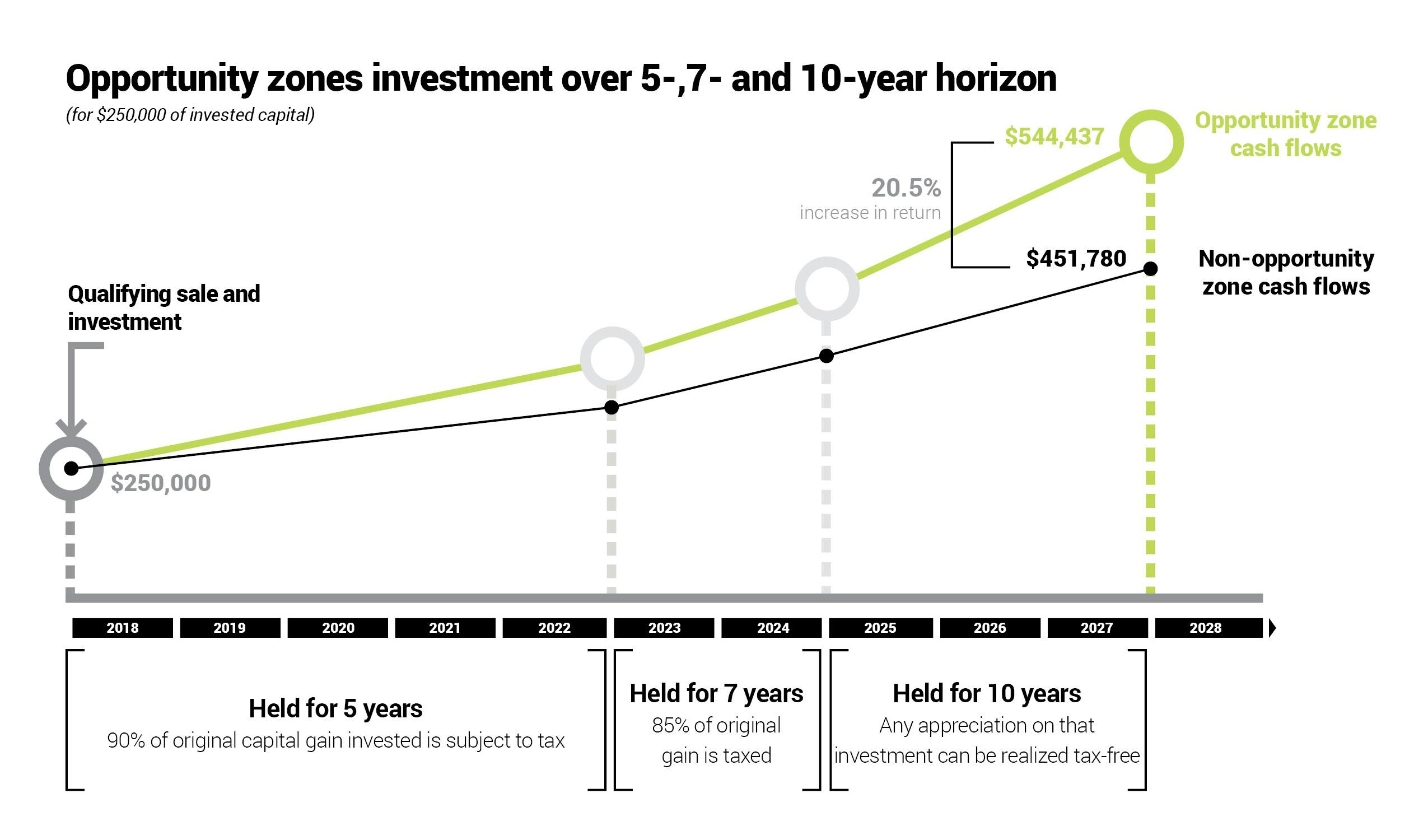

The opportunity zones program offers federal tax incentives for investing unrecognized capital gains in QOFs, which are investment vehicles created specifically for these purposes. The amount of benefit ultimately recognized depends on the holding period of the investment.

Deferral: Investors receive a temporary deferral of tax on capital gains reinvested into QOFs. The reinvestment must be made within 180 days of the sale creating the gain, or in certain situations, within 180 days of the end of the taxpayer’s tax year. Special rules apply to a taxpayer’s distributive share of gains reported on a Schedule K-1. Generally, the period of deferral ends upon the earlier date of the sale of the reinvestment in the QOF or Dec. 31, 2026. There are also other events that may accelerate inclusion of the originally deferred gains and terminate the OZ benefits.

Reduction: The reduction benefit provides investors a step-up in basis, the amount of which is contingent on the length of time they maintain the investment in the qualifying fund. If the investment is held for five years prior to Dec. 31, 2026, 10% of the original gain is eliminated. If the investment is held for seven years prior to Dec. 31, 2026, 15% of the original gain is eliminated.

Exclusion: If the investment in the qualifying fund is held for at least 10 years, any appreciation on the investment can be permanently excluded from taxation at the election of the taxpayer. If the qualifying fund, that is not a C corporation, sells any of its assets, investors with a 10-year hold can generally exclude their share of any resulting gain on the asset sale, with the exception of gain associated with the sale of inventory.

*This model assumes a 23.80% federal tax rate and state tax rate of 5.36%. This model is for illustration purposes only, and contains certain financial assumptions as to the possible future results that are inherently uncertain and subjective. We make no representation or warranty as to the attainability of those assumptions or whether future results will occur as illustrated.

In addition to the three potential tax benefits, this program is an attractive incentive to diversify concentrated asset positions with unrealized capital gains and can be an effective estate planning strategy for investors.

Where are the opportunity zones?

To establish the qualifying zones, states, U.S. possessions and Washington D.C. nominated various low-income communities. The governor of each state could select 25 percent of the state’s qualifying areas for the program. The qualifying areas were designated by census tract data and had to meet the definition of low-income as defined under the New Markets Tax Credit program. Search the complete list of QOZs that have been nominated, certified and designated, with our interactive mapping tool.

What’s next?

Treasury released final regulations in December that provided clarity in many areas of uncertainty that remained after the two rounds of proposed regulations were issued. Further, the finalized guidance includes mostly taxpayer-friendly changes from the proposed rules, which provide investors, QOFs and QOZ businesses additional flexibility to take advantage of the program’s benefits and comply with its governing provisions.

How we can help

By leveraging our expertise in real estate development, transactions and specialty tax planning, Baker Tilly is uniquely positioned to help potential investors and project sponsors maximize the benefits afforded by the opportunity zones program. If you are looking to invest gains in or leverage the opportunity zones program for a business or project benefiting low-income communities, connect with us today.