2024 retirement plan contribution limits

Wealth management

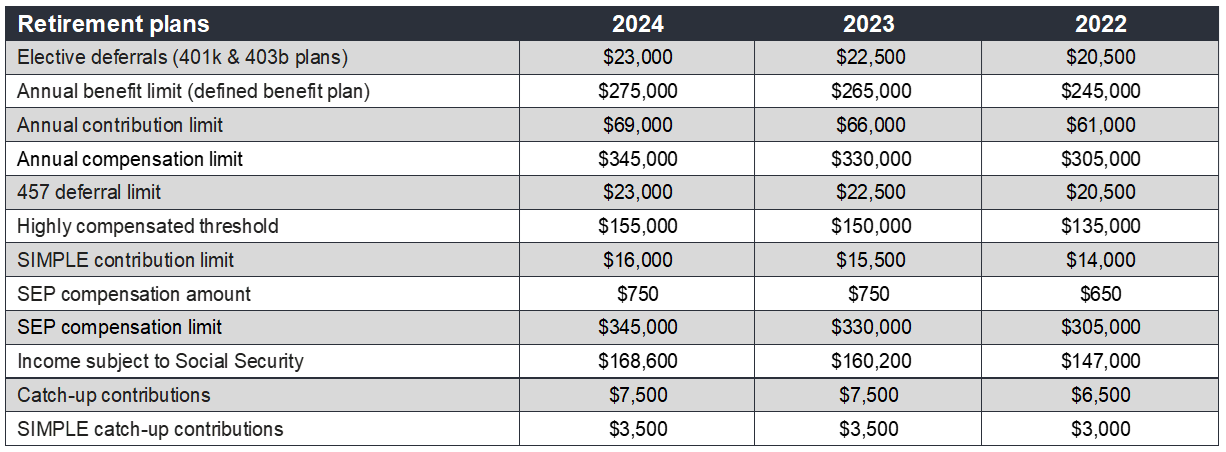

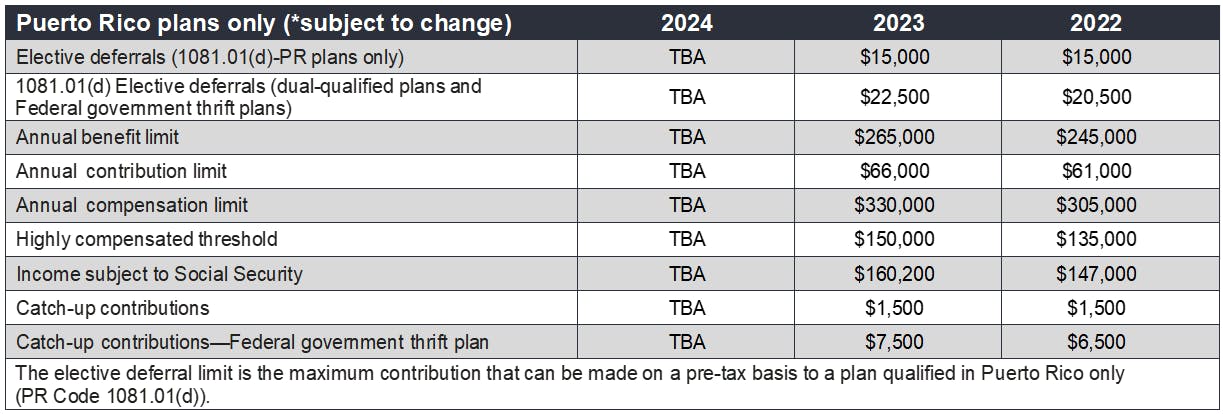

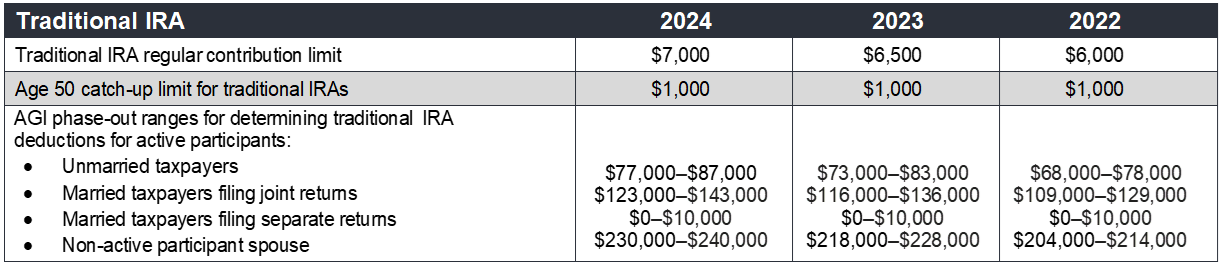

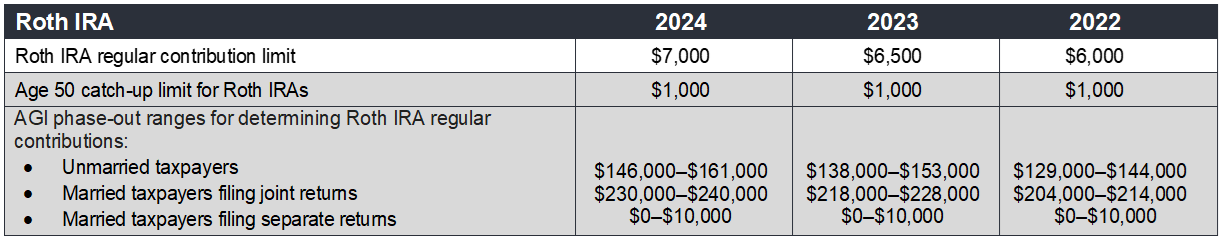

Retirement plan limits

- Elective deferral limit: maximum contribution that can be made on a pre-tax basis to a 401(k) or 403(b) plan.

- Annual benefit limit: maximum annual benefit that can be paid to a participant (IRC section 415). Applied limit is the lesser of the dollar limit above or 100% of the participant's average compensation (generally the high three consecutive years of service). The participant compensation level is also subjected to the annual compensation limit.

- Annual contribution limit: maximum annual contribution amount that can be made to a participant's account (IRC section 415). Limit is expressed as the lesser of the dollar limit or 100% of the participant's compensation, applied to the combination of employee contributions, employer contributions, and forfeitures allocated to a participant's account.

- Annual compensation limit: In calculating contribution allocations, a plan cannot consider any employee compensation in excess of this limit. In calculating certain nondiscrimination tests, all participant compensation is limited to this amount.

- 457 deferral limit: Similar restriction, applied to certain government plans (457 plans).

- Highly compensated threshold (section 414(q)(1)(B)): minimum compensation level established to determine highly compensated employees for purposes of nondiscrimination testing.

- SIMPLE contribution limit: maximum annual contribution that can be made to a SIMPLE (Savings Incentive Match Plan for Employees) plan. SIMPLE plans are simplified retirement plans for small businesses that allow employees to make elective contributions, while requiring employers to make matching or non-elective contributions.

- SEP coverage limit: minimum earning level for self-employed individual to qualify for coverage by a Simplified Employee Pension plan (a special individual retirement account to which the employer makes direct tax-deductible contributions.

- SEP compensation limit: applied in determining the maximum contributions made to the plan.

- Catch-up contributions, SIMPLE catch-up deferral: Under the Economic Growth and Tax Relief Act of 2001 (EGTRRA), certain individuals aged 50 or over can make catch up contributions.

IRS cost-of-living adjustments

Baker Tilly Wealth Management, LLC (BTWM) is a registered investment advisor. BTWM does not provide tax or legal advice. BTWM is not an attorney. Estate planning can involve a complex web of tax rules and regulations. Consider consulting a tax or legal professional about your particular circumstances before implementing any tax or legal strategy. The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought.

Baker Tilly Wealth Management, LLC is controlled by Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm that provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Wealth Management, LLC