Food and beverage faces slow start to 2022

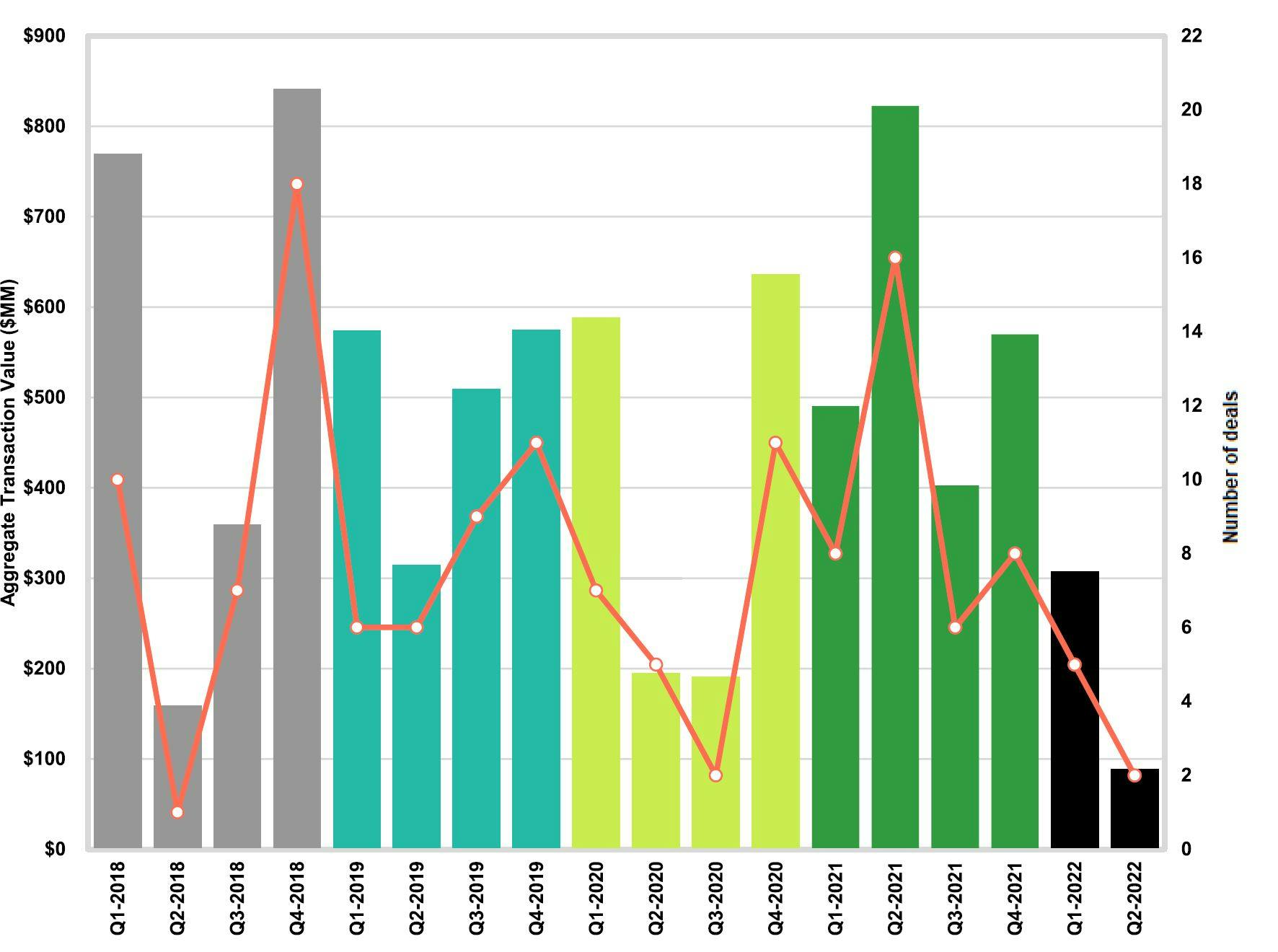

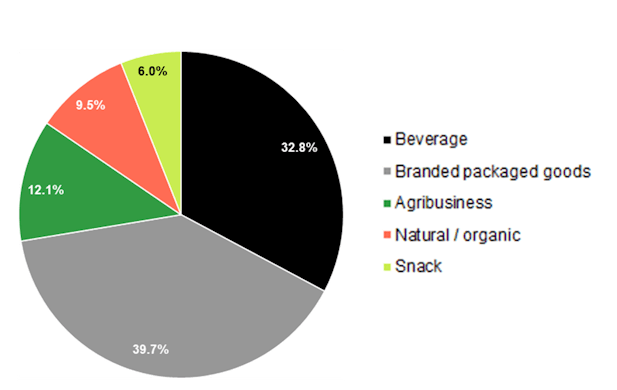

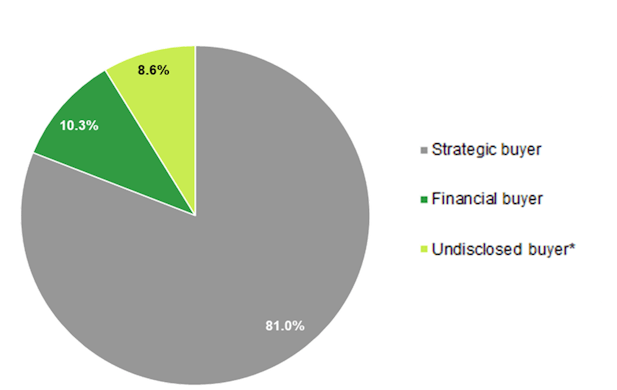

After a strong year of M&A activity in 2021 in the food and beverage industry, the start of 2022 experienced a decrease in closed deals and a significant slowdown in total deal transaction value. Despite the slowdown, strategic buyers maintained their role as the most active buyers in the sector by capitalizing on consolidation. H1 2022 total deal value and activity resembled H1 2019, potentially indicating a return to “normalcy” for M&A in the food and beverage industry.

Market volatility:

The stock market faced unexpected volatility with persistent supply chain issues intensified by the war in Ukraine, soaring inflation, the end of quantitative easing by the Federal Reserve, and fears of an economic slowdown. Aggregate deal value of the middle market M&A transactions had a 70% decrease from total deal value of middle market M&A transactions with reported values in H1 2021. Within the last five years, H1 2022 was slowest first half of the year by reported number of closed middle transactions.