Food and beverage M&A remained strong in 2021

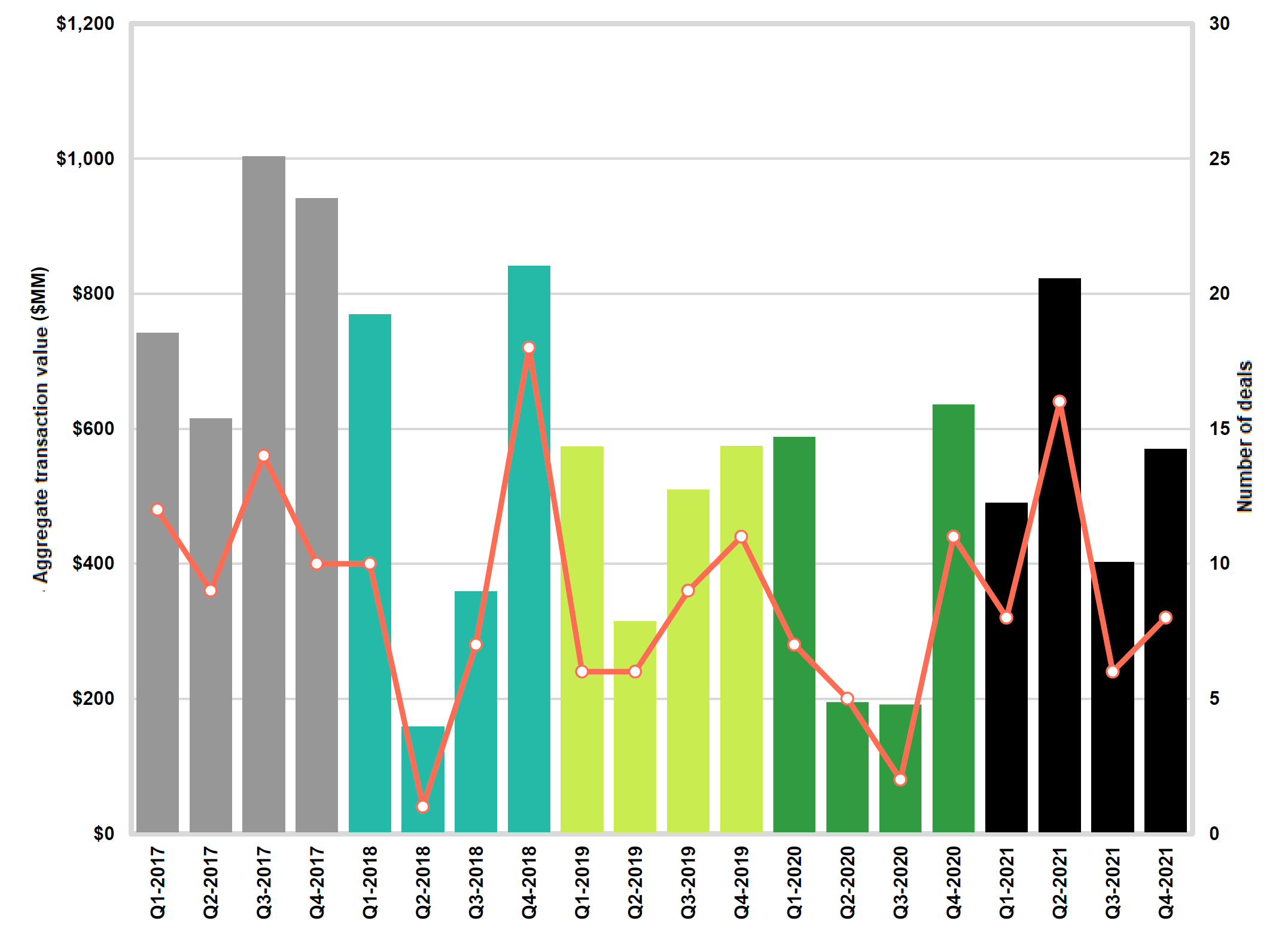

After some speculation of how the food and beverage sector would fair in 2021, M&A activity continued the recovery first seen in the second half of 2020, with deal volume surpassing what was seen in that year and total deal value increasing significantly. The rise in deal volume and value can be attributed to the confluence of monetary policy pushing for low interest rates and strong consumer demand, which led to high valuations and a robust stock market.

The reported number of M&A transactions that closed during 2021 was 305, up from the 299 reported transactions that closed in 2020. There were 38 middle market transactions that closed in 2021, a 52% increase from the 25 middle market transactions that closed in 2020. Among the major middle market transactions which closed in 2021 were:

- Barilla Group acquired the dry pasta business of Catelli Foods Corp.

- Neptune Wellness Solutions obtained controlling interest in Sprout Foods

- Post Holdings acquired the ready-to-eat cereal business of TreeHouse Foods

- Utz Brands acquired R.W. Garcia Holdings

The aggregate deal value of the middle market M&A transactions with reported values was $2.3 billion in 2021. This was a 42% increase from the total deal value of middle market M&A transactions when compared to the $1.6 billion seen in 2020. During the last five years, 2021 was the second-highest year in terms of aggregate deal value of closed middle market transactions with reported deal values.