Pre-construction audit services save a public university over $70,000 on construction contract value

Our client’s need

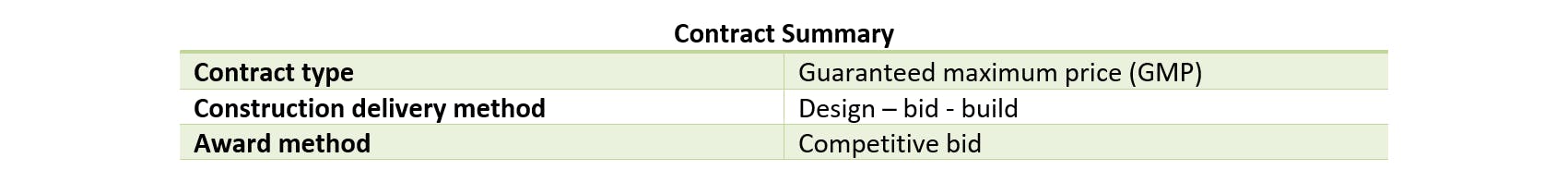

A major Tier One research university planning to expand its biomedical engineering program, was set to build a $12.6 million, 26,250 square foot engineering building. Equipped with glass-walled, open concept labs and classrooms, this competitively bid project was a cost plus overhead and profit contract. The client needed assurance that the contracted billing rates for labor, vehicles and tools represented their costs without embedded profit or overhead costs.

Baker Tilly solution

Because the construction contract had not yet been signed, a pre-construction audit was necessary. This type of audit is applied to the financial terms of a construction contract, potentially exposing an owner to unnecessary financial risk, hidden profit and ambiguous and/or contradictory contract terms and conditions. A pre-construction audit brings transparency to the project’s pricing terms, therefore empowering the university to effectively negotiate final contract terms, conditions and price.

Results achieved

Baker Tilly’s pre-construction audit found that several billing terms included non-allowable components that would have increased the project cost if not discovered.

- Payroll taxes, benefits and insurance calculations were incorrectly embedded within the billable labor rate overstating the contract by roughly $22,000.

- Vehicle rates were overstated by $32,000. They included non-allowable cost components and the vehicles were assigned to personnel not on the jobsite.

- Tool rate charges were applied to office personnel, overstating the contracted rate by $32,591. The rate was also incorrectly applied to consumable tools including extension cords and tape measures not allowed in the contract terms.

The university’s total contract adjustment was $70,542, a 14:1 Baker Tilly fee return on investment.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.