Philadelphia regional M&A update: Q3 2019

M&A Activity

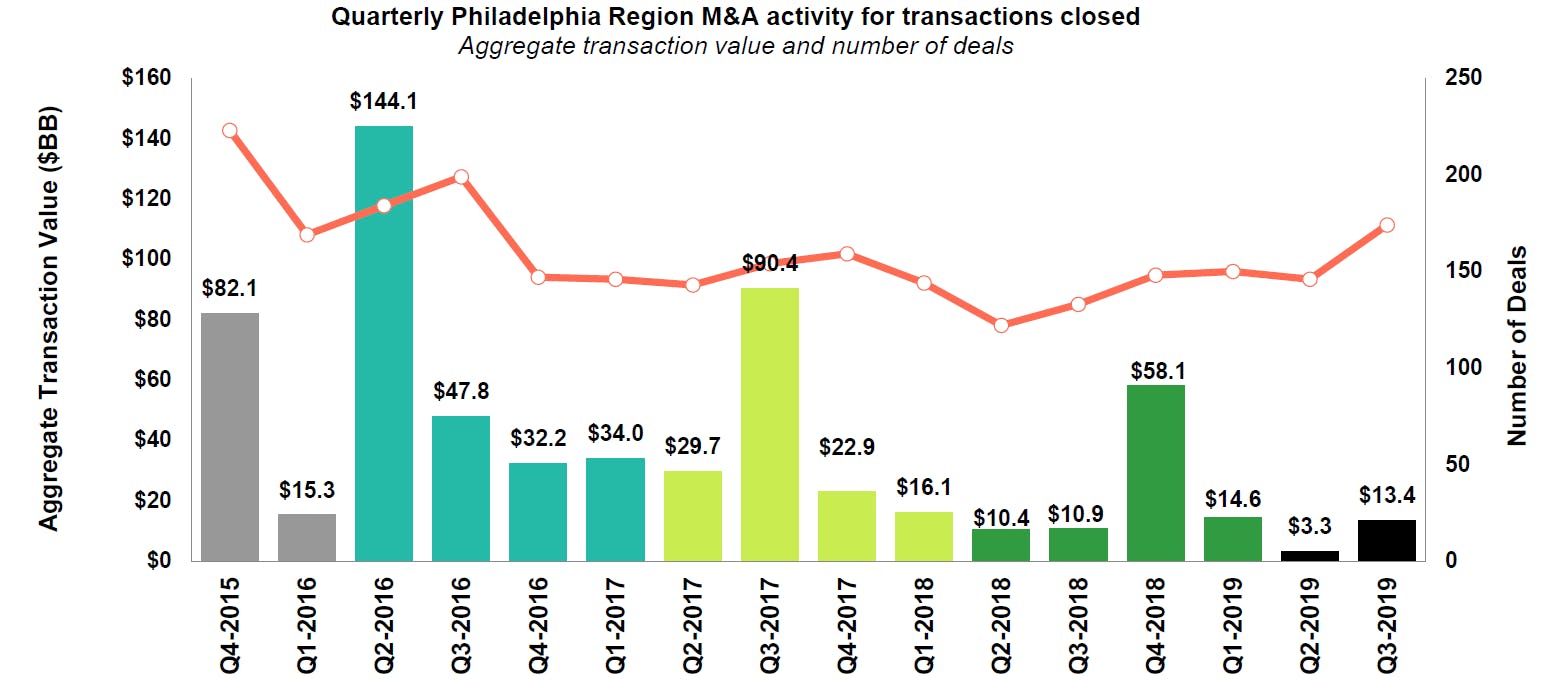

M&A activity There were 174 transactions that closed in the Philadelphia regional market during the third quarter of 2019 (Q3 2019), an increase of approximately 19.2 percent from the 146 closed transactions in the prior quarter. The 174 closed transactions mark an increase from the 133 closed transactions during the same period in 2018. Additionally, aggregate reported transaction value increased approximately 22.8 percent from Q3 2018.

In Q3 2019, North America’s overall M&A activity remained robust, totaling over $600 billion. So far, as of Q3 2019, more than 8,000 deals have closed with an aggregate transaction value of roughly $1.6 trillion. In Q3 2019, eight megadeals closed with valuations greater than $10 billion, accounting for more than one-third of total deal value. Median deal size in North America rose to $93.5 million through Q3 2019, a dramatic increase from $57.0 million in 2018. One factor that has influenced markets in Q3 2019 is the tense relationship and trade war between the U.S. and China. Aside from the day-to-day volatility of international relations, the M&A market has been one of the areas hit hardest by the trade war. Deal value for North American target companies with a Chinese acquirer are on pace to fall by more than 90% since the peak in 2016.

With the increased prominence of startups and companies staying private for longer periods, high-growth companies have contributed to lofty valuations. The median valuation / EBITDA multiple for M&A transactions rose slightly to 10.4x through Q3 2019, up from 9.4x in 2018.

M&A activity by industry

The consumer sector led the Philadelphia region’s M&A activity with 28.7 percent of the total deals closed in Q3 2019. Industrials represented 24.1 percent and information technology and healthcare each represented 14.9 and 13.8 percent, respectively, while financials followed with 7.5 percent. Other accounted for the remainder of the transactions representing 10.9 percent

Source: S&P Capital IQ, PitchBook and Baker Tilly Capital research (October 2019)

Read the full update

Baker Tilly Capital, LLC disclosure

Baker Tilly Capital, LLC privacy policy

Baker Tilly Capital, LLC social media disclaimer

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.