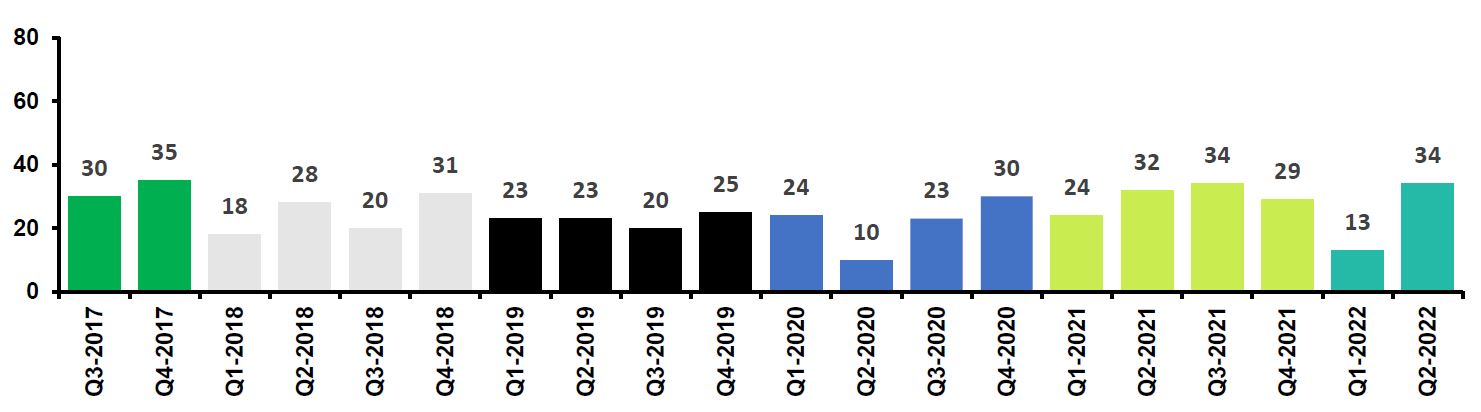

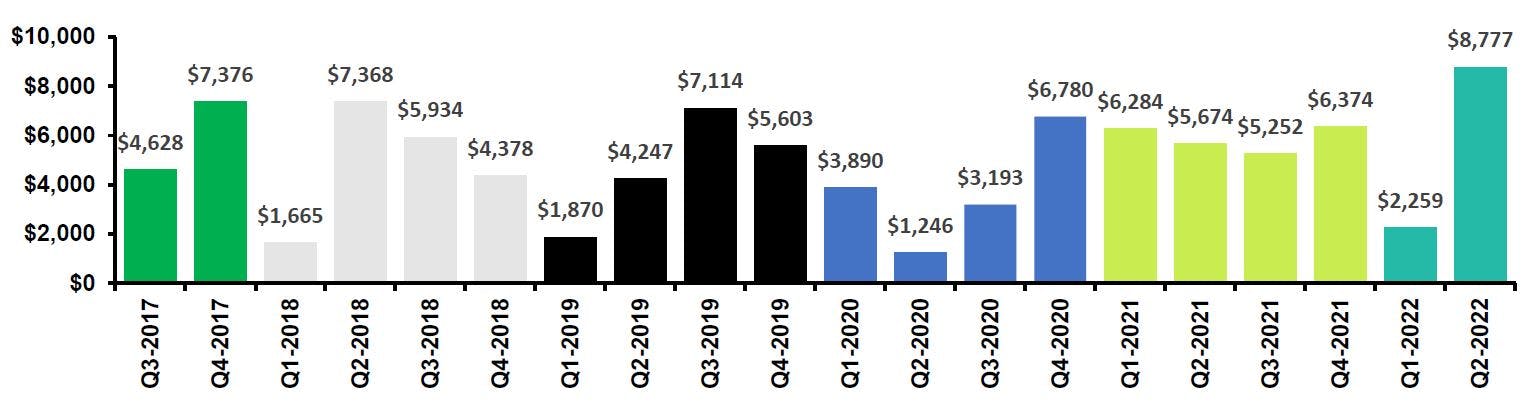

Strategic buyers continue to drive M&A activity

Based on number of announced transactions, strategic buyers continued to be the most active buyer type in the first and second quarter of 2022. During these quarters, strategic buyers represented all but one of the announced transactions.

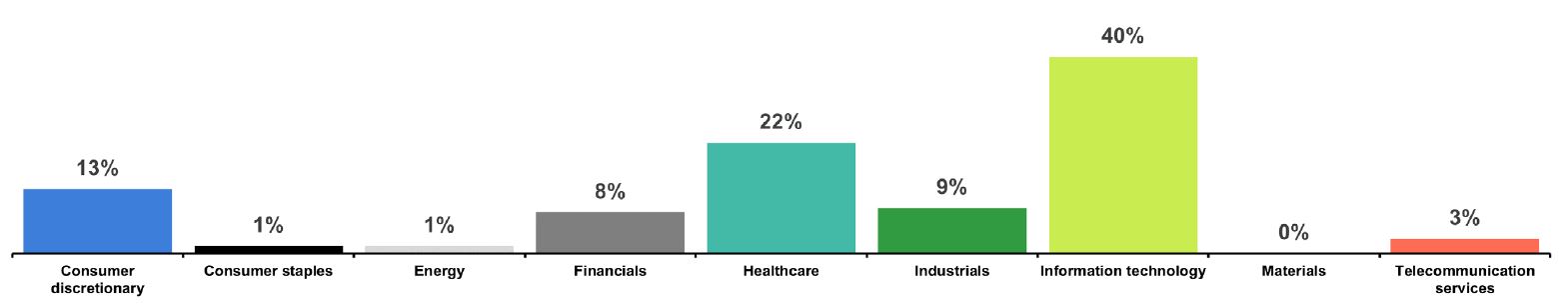

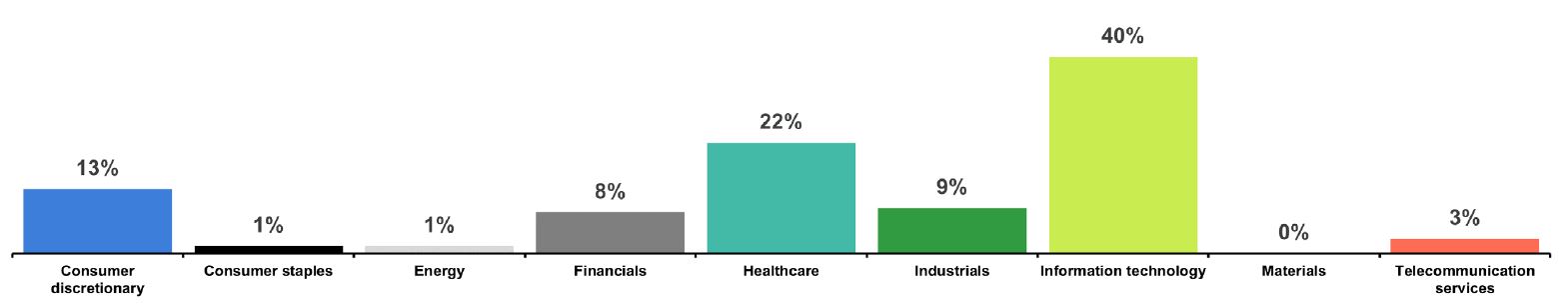

The information technology segment continued to be the most active during the first half of 2022, accounting for 40% of M&A deals closed. The healthcare and consumer discretionary segments accounted for the second and third largest categories for the period, with 22% and 13% of transaction volume, respectively.

H2 2021 New England middle market M&A transactions

Number of transactions by industry sector (1) (2)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 million and $1 billion.

(2) Percentages may not total 100% due to rounding.