Congress passes latest round of stimulus legislation

Both houses of Congress have now passed the American Rescue Plan Act of 2021 (the Act). In the process, the Senate made several substantive changes to the version the House passed at the end of February. The Act now heads to the White House where President Biden is expected to sign it into law prior to March 14, when unemployment benefits are set to expire.

Notable changes by the Senate include expansion of the employee retention credit (ERC), additional restrictions on executive compensation deduction limitations for public companies, tax exclusions for a portion of unemployment benefits, and a faster phaseout for the income threshold for individual tax rebates.

Key provisions

Employee retention credit

The ERC is extended to apply to qualified wages paid by eligible employers through Dec. 31, 2021. Beginning after June 30, 2021, the credit is expanded to apply to recovery startup businesses, defined as employers that began operations after Feb. 15, 2020, with average gross receipts of $1 million or less, and have not experienced a full or partial suspension or significant decline in gross receipts for the calendar quarter. Additionally, “severely financially distressed” employers, with gross receipts for a calendar quarter that have declined by more than 90% from the same calendar quarter in 2019, can claim the ERC on any wages paid to employees during the calendar quarter. The credit also becomes refundable against the Medicare tax after June 30, 2021.

Paycheck Protection Program

The Act further expands the PPP to include certain internet publishing organizations (NAICS code 519130) and increases program funding another $7.25 billion. The Act also creates new eligibility for certain not-for-profit organizations with not more than 300 employees and that spend less than $1 million or 15% of receipts and expenses on lobbying activities. In addition, charitable organizations can be eligible for PPP loans if they employ 500 or fewer employees per physical location.

Individual tax rebates

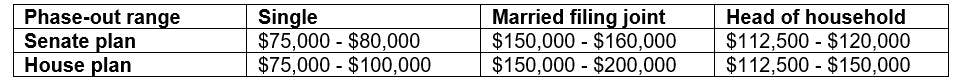

The Act provides rebate checks of $1,400 per individual (including dependents) based on their adjusted gross income (AGI) reported on their 2019 tax return (or 2020 return, if filed). However, the final version accelerates the phase-out range of taxpayers no longer eligible for the direct payments.

Eligible individuals mean any individual other than nonresident aliens or individuals who are a dependent of another taxpayer at the beginning of the year. Trusts and estates are also ineligible.

Restaurant Revitalization Fund

The Act establishes the Restaurant Revitalization Fund. Through this program, the Small Business Administration (SBA) will provide grants to restaurants, food trucks, bars, brewpubs and other eligible entities to cover payroll, rent, utilities, food costs and other expenses essential to operations. Entities with more than 20 locations, publicly traded companies and entities that have applications pending under the grants for shuttered venue operators program are not eligible. Of the $28.6 billion appropriated for this program, $5 billion is earmarked for businesses with gross receipts of $500,000 or less. Further, during the initial 21-day period of the program, the Act directs the SBA to prioritize grants to small businesses owned by women, veterans, and socially and economically disadvantaged small businesses. Grants received under this program are exempt from federal income tax, and expenses paid with the funds are deductible.

Child tax credit and dependent care benefits enhancements

The Act increases the child tax credit to $3,000 per qualifying child ($3,600 in the case of children under the age of 6 as of the close of the tax year) and makes it refundable for 2021. The increased credit over the $2,000 available under prior law would phase out at AGI levels of $150,000 for joint filers, $112,500 for head of household and $75,000 for all other taxpayers. The AGI phase-out levels for the $2,000 previously available credit remain the same ($400,000 for joint filers, $200,000 for all others). The Act additionally instructs the Treasury Department to establish a program under which taxpayers will receive periodic advance payments that in total equal 50% of the estimated credit they are entitled for the year.

Paid leave payroll tax credits extensions

Originally provided for by the Families First Coronavirus Response Act, the payroll tax credits for providing paid sick and family leave are extended through Sept. 30, 2021. Additionally, effective for calendar quarters beginning after March 31, 2021, the limit on wages that can be taken into account for computing the family leave credit with respect to all calendar quarters in total increases to $12,000 from $10,000, and the 10-day limit on the emergency paid sick leave credit resets. In other words, if, as of the end of the first calendar quarter of 2021, an employer reaches both of these respective limits for a given employee, the employer would be able to claim an additional family leave credit up to $2,000 of qualified family leave wages plus an emergency paid sick leave credit up to 10 days for qualified sick leave wages paid to that same employee during the second and third quarters of 2021.

Taxability of student loan forgiveness

Student loans forgiven after Dec. 31, 2020, and before Jan. 1, 2026, can be excluded from gross income except in certain circumstances. The Act does not itself include student debt forgiveness, but it could be a sign that potential legislation may be on the horizon.

Unemployment benefits

The federal unemployment subsidy remains at $300 per week and is further extended through Sept. 6, 2021. For taxpayers with AGI of less than $150,000, the first $10,200 of unemployment benefits received in 2020 will not be subject to income tax (in the case of a joint return, the first $10,200 received by each spouse).

Election to allocate interest expense worldwide repealed

The Act repeals a provision allowing U.S. affiliated groups to elect to allocate and apportion interest expense on a worldwide basis to determine taxable income applied to foreign tax credit limitations. Section 864(f) was enacted as part of the American Jobs Creation Act of 2004, but its implementation has been deferred several times. This section is relevant in computing the foreign tax credit limitation, which is based on the amount of taxable income from foreign sources and the allocation and apportionment of deductions between U.S.- and foreign-source gross income from different limitation categories. Allocating and apportioning interest expense on a worldwide basis would generally result in increasing the ability to use foreign tax credits.

Executive compensation deductibility limitations

The Act expands the executive compensation deduction, which is limited to $1 million each for the highest paid executives at public companies. The limitation will now apply to the CEO, CFO and the next five highest-paid employees. Currently, this limit applies to the CEO, CFO and the top three highest-paid employees.

The purpose of this provision is to offset the costs of providing funding relief to financially struggling multiemployer and single-employer pension plans as described below. It is effective for tax years beginning after 2026.

Excess business loss limitation

First enacted in the Tax Cuts and Jobs Act (TCJA), the limitation of certain current trade or business losses of noncorporate taxpayers was extended through 2026. Indexed for inflation, the TCJA placed a $250,000 ($500,000 for married filing joint taxpayers) limit on using these losses originally through 2025. The Coronavirus Aid, Relief, and Economic Security (CARES) Act temporarily suspended the limitation for the 2018, 2019 and 2020 tax years.

Pension plan relief

The Act contains provisions to assist troubled multiemployer pension plans as well as single-employer pension plans.

- Multiemployer plans – The Act creates a special program to allow the Pension Benefit Guaranty Corporation (PBGC) upon application by plan sponsors to make direct cash payments to financially troubled pension plans to ensure they remain solvent. Applications must be submitted by Dec. 31, 2025.

- Single-employer plans – The Act provides that shortfall amortization bases for plan years beginning in 2019 and 2020 would be reduced to zero. For plan years beginning after Dec. 31, 2019, all shortfalls would be amortized over 15 years rather than seven years under current law.

Cost-of-living adjustment freeze for qualified retirement plans

The Act contains provisions to freeze cost-of-living adjustments for certain annual limitations beginning after Dec. 31, 2030. The 2030 dollar amount would remain in effect until further notice.

Defined benefit plans – The limitation on annual benefits

Defined contribution plans – The limitation on contributions and other additions

Compensation – The limitation on the annual compensation taken into account under the plan

The freeze on the cost-of-living adjustments described above would not apply in the case of a plan maintained by one or more collective bargaining agreements.

The freeze on cost-of-living adjustments applicable to benefits, contributions and compensation is designed to:

- Raise revenue and help offset the cost of the multiemployer plan reforms.

- Fill a budget hole in the 10-year scoring window.

The freeze may also serve to foreshadow future legislative proposals to cut back on tax incentives for retirement plans as revenue raisers to offset the cost of other policy proposals.

Expanded 1099 reporting

The Act expands the 1099 reporting threshold for third-party settlement organizations to $600 annually with no fixed number of transactions from $20,000 and 200 transactions per payee under current law. This provision would be effective for transactions after Dec. 31, 2021. This provision is intended to capture more of the money earned by independent contractors in so-called “gig economy” jobs. This will primarily affect companies like eBay, Airbnb, Amazon, but the final rules and ensuing guidance will need to be reviewed to see how expansive this change may be.

We encourage you to reach out to your Baker Tilly adviser regarding how any of the above may affect your tax situation.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.