Are you prepared to transition your family business?

Leverage Baker Tilly’s Value Architect model for exit planning

Exit planning has become an increasingly relevant and important topic. In the U.S., Baby Boomers account for an estimated 2.3 million small businesses in the U.S., and a large number of these businesses are thriving. However as they near retirement, nearly 60% of Baby Boomer-owned small businesses do not have succession or transition plans in place (Unsexy But Thriving Businesses: The Hidden Opportunity Gifted To Us By Baby Boomers, Forbes, Jan. 2022).

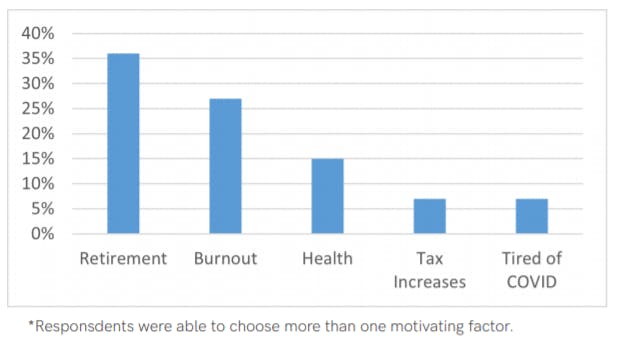

Recently, the International Business Brokers Association and M&A Source (IBBA and M&A Source) conducted research to determine the reasons these owners have decided to sell their businesses. While 36% of the business owners reported retirement as the main motivating factor, almost 50% reported a combination of burnout, health and COVID-19 as motivating factors.

Source: IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold in Main Street (values $0-$2MM) and the lower middle market (values $2MM -$50MM). The national survey was conducted with the intent of providing a valuable resource to business owners and their advisors. The IBBA and M&A Source present the Market Pulse Survey. The Q1 2021 survey was conducted April 1-23, 2021 and was completed by 301 business brokers and M&A advisors from 44 states. Respondents completed 266 transactions this quarter.

Notwithstanding the reasons, most business owners reported that they have no formal plans regarding how to retire or exit from their businesses.

Baker Tilly’s point of view on exit planning is based upon Peter Christman’s seminal work on the topic. Christman, co-founder of the Exit Planning Institute, is an icon in the world of exit planning. Author of three books, “The Ten Trillion Dollar Opportunity,” “The Master Plan” and “Master Planning Success Stories”, Christman literally invented the discipline. His process focuses on developing an exit plan in three distinct areas to: 1) maximize the value of the business, 2) define a personal financial plan and 3) create a life plan for post-transaction.

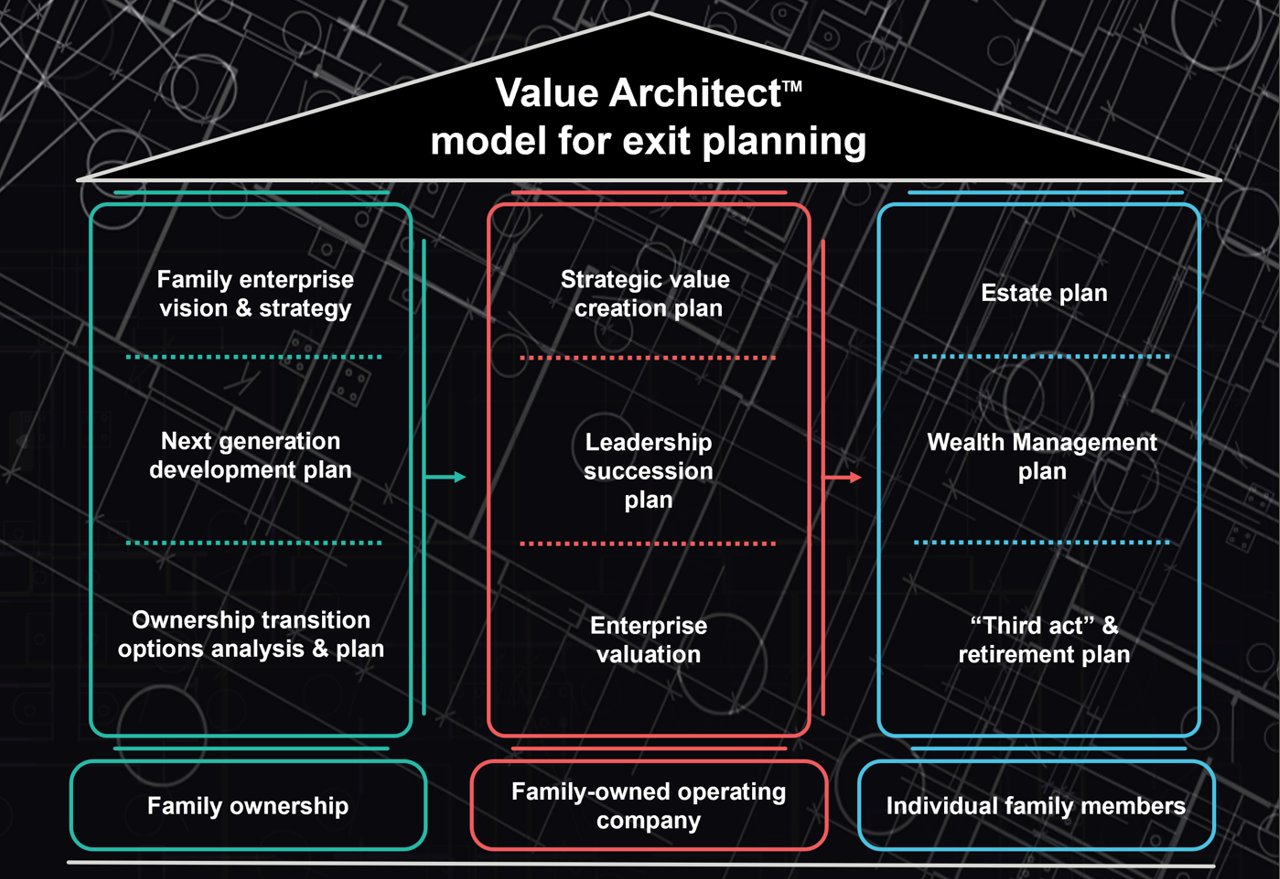

Baker Tilly’s approach, the Value Architect™ model for exit planning, builds off Christman’s concepts, while also organizing around the family enterprise ecosystem.

Baker Tilly’s Value Architect™ model for exit planning

Rooted in Baker Tilly’s mission of enhancing and protecting our client’s value, working as Value Architects™ we develop a comprehensive, integrated blueprint with our clients. We work side-by-side to:

- Define the roadmap for the family enterprise

- Address the desires and requirements of the family enterprise – ownership group of the family business(es), the family-owned operating company and individual family members

- Enhance and protect the value of the family enterprise as well as the net worth of the individual family members

Our model is comprised of three pillars:

Individual family members

Considers the specific needs of individual family members

Family ownership

Includes owners active in management, passive owners and current/next generation owners

Family-owned operating company

Focused on preserving and enhancing the value of the business

Nine key building blocks

While each exit plan is as unique as the business for which it is designed, the three pillars of our Value Architect™ model for exit planning include nine key building blocks that allow family owners to leave their businesses when they want, for the money they need and to whomever they choose.

Pillars of the Value Architect model: defined

- Family ownership

- Family-owned operating company

- Individual family members

Baker Tilly’s Value Architect™ model for exit planning starts with gaining a thorough understanding of the family enterprise/ownership group. We seek to understand current situations, future goals and family objectives, as well as any ideas or desires for getting there. In order to develop an overarching strategy and roadmap with time-based milestones, we ask probing questions and consider the challenges of exit planning including family alignment, individual family member complexities and ownership transition goals.

The second block of the family ownership pillar assesses the next generation’s readiness for leadership. Multiple factors specific to family businesses can lead to unfit or ill-prepared family members being placed into or pursuing unsuitable positions including unrealistic expectations, familial assumptions and feelings of obligation or entitlement. These root causes can be exacerbated by unclear role definitions, limited focus on professional development and weak or no policies on family employment. Once we understand their readiness level, we will help create a next generation development plan incorporating best practices for employing family members.

The final key building block addresses ownership transition. We explore different options for ownership transition, including selling to family, a third party, management or other sales and transition options. At the conclusion of our analysis, we deliver strategic alternatives and timelines for the transition of ownership in a manner that supports the established goals of the family enterprise/ownership group.

The second pillar addresses the family-owned operating company(ies). The first block of this pillar focuses on a strategic value creation plan to preserve and enhance value. Built on a solid foundation of robust operating systems and procedures, reliable financial information and controls, an understanding of the market, customers and competitors, stable and available workforce, a loyal and motivated management team and a diversified supplier base, the plan will drive the reduction of risk to protect value, as well as identify ways to grow additional value.

Next, the leadership succession planning process often involves identifying, assessing and developing future leaders, developing a succession plan for the medium term, broadening the decision-making process, strengthening the role of the board and clarifying goals for retirement.

The last key building block of the family-owned operating company pillar is enterprise value. Baker Tilly acknowledges that the valuation of a closely held business is more art than science, and the valuation is based on assumptions and judgment made by both the appraiser and the client. The objective of an enterprise valuation is to understand the value drivers and determine a hypothetical value range and net after tax proceeds. Both a market and income approach are often used to perform a preliminary valuation analysis.

The final pillar of the Baker Tilly Value Architect™ model for exit planning focuses on estate, wealth management and “third-act” planning for individual family members. Our estate planning seeks to facilitate family, business and charitable legacies, while minimizing tax impacts. We work, often in concert with a client’s attorney, to define goals and objectives for the ultimate disposition estate as well as review any current estate planning documents in order to find gaps between goals.

The second key building block is wealth management planning. Our comprehensive wealth plan considers current and future cash flow, modeling potential retirement income to meet near- and long-term financial objectives. We develop a plan to match objectives and requisite cash flow from current and future income-producing assets. Our plan also includes charitable and legacy goals and objectives.

Finally, we place an emphasis on the family enterprise owners’ needs and their plans after the transition or sale. We encourage them to consider what he or she will do after the transition, including hobbies, philanthropy or pursuing other business opportunities. “Third-act” and retirement planning is often overlooked but is a vital step in any successful exit plan. It has been our observation that a large percentage of business owners without a plan for life after business become dissatisfied after the transition out of their business. Discussion of interests and a documented plan will lead to a fulfilling pursuit of interests and can ease the conversion to roles with less responsibility.

Conclusion

Baker Tilly’s Value Architect™ model for exit planning addresses the three constituencies of family enterprise/ownership group, family-owned operating companies and individual family members in order to provide a complete and successful exit plan. Now’s the time to consult a professional and get a formal transition and third act plan in place.