What is a working capital true-up calculation?

In most mergers and acquisition transactions, the asset purchase agreement states that the seller is required to deliver to the buyer an agreed-upon amount of working capital (excluding cash in most cases). This is known as the Target Working Capital and for the purposes of this post, let us assume $1 million is the Target Working Capital. The Target Working Capital is essential because it works in tandem with the valuation of the company and ultimately, the purchase price of the company. To explain, the valuation of the company considers the level of working capital required to operate the company and any short fall of working capital reduces the value of the company and vice versa. Therefore, the amount of working capital delivered to the buyer is an important issue in the transaction. So, what are the mechanics to true-up working capital?

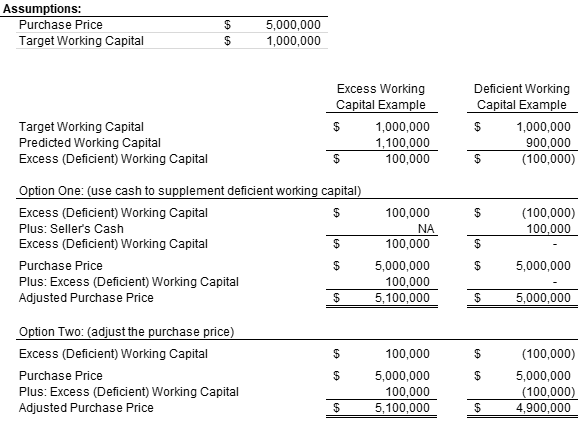

Most contracts ask the seller to make a reasonable effort to predict the working capital of the company (excluding cash) as of the transaction date (the “Predicted Working Capital”). The Predicted Working Capital is then compared to the Target Working Capital Amount to understand if there is an excess in working capital or a deficit in working capital. When an excess exists, the purchase price increases, dollar-for-dollar. Alternatively, when a deficiency exists in working capital, the parties have a couple of options. Option one: the seller can supplement the delivered working capital with cash to make up for the deficiency, or option two: the purchase price will decrease equal to the amount of the working capital deficiency. See below for an example of the mechanics of working capital true-up calculations.

In some contracts, the language allows the buyer to confirm the working capital accounts two-to-three months after the closing date to ensure the accuracy of the Predicted Working Capital. Accordingly, usually a third-party consultant is hired to confirm the balances of the Predicted Working Capital.

Lastly, it is possible to flush out working capital issues in a sell-side due diligence project. This type of engagement analyzes existing working capital accounts before the company goes to market.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.