The personnel perspectives of succession planning

The topic of succession planning typically triggers a discussion about transfer of ownership – family member, key employee, external entity or a combination. There are many ownership options that can be considered to meet the needs of the exiting owner and ensure the company’s financial sustainability in the future.

Ideally, ownership succession aligns the desired exit plan with the business value and cash flow while minimizing taxes. Personal assets and the definition of financial security are unique to each exiting owner, so an ownership succession plan should be built to meet both the current and future needs of the individual and the business. The business perspective in this process is critical because an effective succession plan needs to provide the appropriate structure and resources to reward and retain the leadership team.

Regardless of how the sale, merger, or acquisition allows the owner to exit, management succession must also be addressed. Employees are a company’s greatest asset. They are responsible for business results and competitive advantage. An effective succession plan focuses both on the financial transaction of ownership and the personnel issues of management succession in which you define the competencies and capabilities necessary for success, assess leadership potential, and focus on developing and retaining key personnel.

The relationship between business valuation and management succession

If you question that management succession is as important, if not more important, than the actual financial ownership transaction, consider the impact employees have on a business valuation.

Financial profile: Companies that can maximize their financial profile can command higher valuations. Size, growth, profitability and consistency impact a business valuation. Consistency in profitable projects is a direct result of employees following the right process on every project. This is true for every position in the company: sales, management, accounting, etc.

Management depth: Companies that develop a deep management bench mitigate the reliance upon a few key people, thereby increasing the value of the business. Having clearly defined roles and responsibilities prevents companies from being too reliant on key employees who possess a disproportionate share of industry experience and connections. Clear definition of roles for every process in the business ensures that no one person has sole ownership over a process. It also provides guidance on what competencies are necessary to promote into another position. There is no shortage of business and organizational effectiveness books that point to the importance of ‘having the right people in the right seat’. Management succession starts with this agreement and focuses on identifying and developing talent to meet the future needs of the organization.

Competency modeling

To understand whether an individual will be successful in a role, it is important to understand the competencies required of the position. Korn Ferry, a global organizational and talent management consulting firm, defines competencies as “observable and measurable skills and behaviors that contribute to workplace effectiveness and career success.”

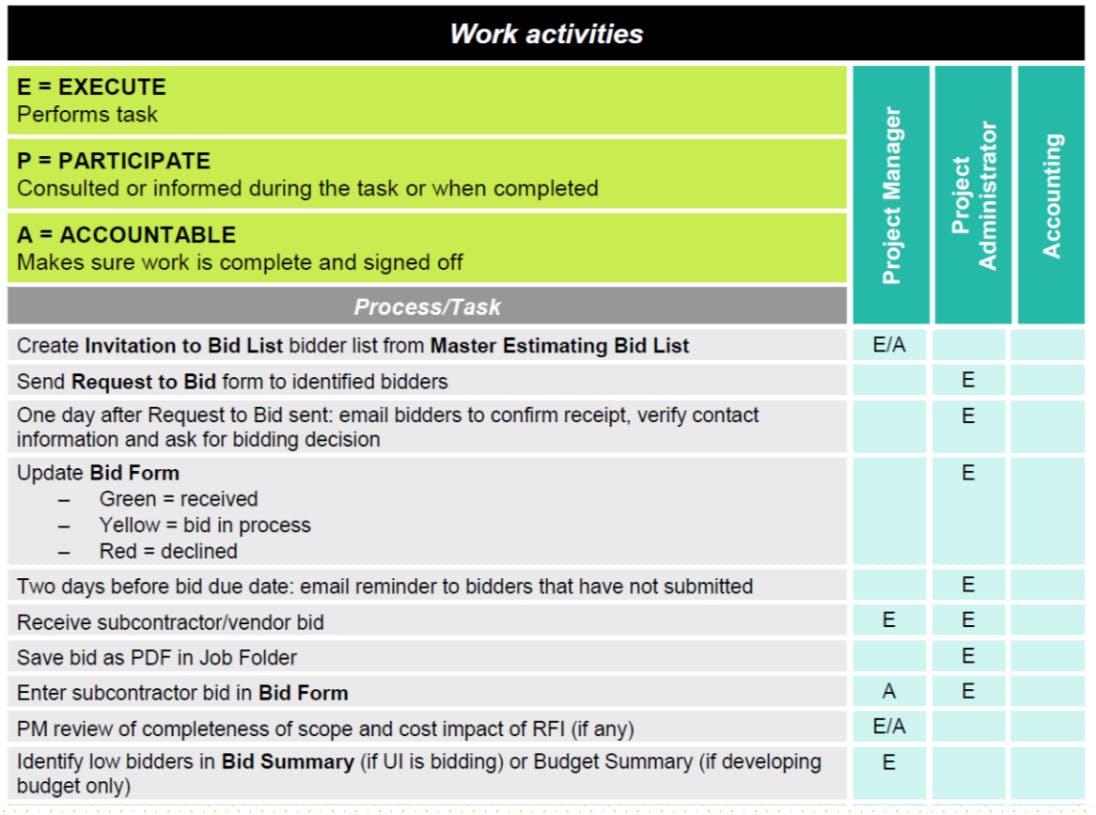

Clearly defined roles and responsibilities are necessary in order to define the competencies required for a position. The roles and responsibility matrix below demonstrates an effective way to understand and define competencies required for a position. In this example, a construction team defined the most effective and efficient way to handle each step in the bidding process and assigned responsibility to either the project administrator, project manager or accounting. This responsibility could be executing (completing the work), participating (consulted or informed about the work) or accountable (owns the completion). In an ideal scenario, activity in the process has at least two people involved – one that is doing the work (executing) and another that is either consulted or approving the work. This ensures that work is not impacted when an employee leaves unexpectedly, as there is always another employee that has been involved in the process and understands what the work entails.

The value of a matrix like this is clear definition of what is required to perform each position. The matrix is also invaluable to talent management and having well-defined processes creates efficiencies and improves productivity.

Once you know the responsibilities of a position, a competency model determines what skills and behaviors are necessary for success in a position. Korn Ferry’s competency model considers the extent each position requires the following for success:

- Understanding the business

- Making complex decisions

- Creating the new and different

- Taking initiative

- Managing execution

- Focusing on performance

- Building collaborative relationships

- Optimizing diverse talent

- Influencing people

- Being authentic

- Being open

- Being flexible and adaptable

There are a number of reasons that creating competency models for positions is highly effective. Clearly defined job responsibilities and success criteria make it easier to interview and hire the right employees. It is also easier to determine the right development opportunities for an employee that is looking to advance into a new or more challenging role.

Through the millions of individuals that have been assessed, Korn Ferry has identified the top 12 competencies that define business success:

- Ensures accountability

- Manages complexity

- Plans and aligns

- Nimble learning

- Cultivates innovation

- Drives results

- Decision quality

- Directs work

- Courage

- Situational adaptability

- Resourcefulness

- Attracts top talent

When considering management succession, having a clear understanding of the competencies required for success in key positions allows the organization to evaluate readiness of future leaders, define development needs, and identify where gaps in talent exist.

Natural born leaders

Most industries provide plenty of advancement opportunity for high performers. It is very common for a skilled operational person to advance into higher levels of management. Yet this strategy of promoting high performers is not always effective when looking at future leadership positions.

A High-Potential Management Survey by the Corporate Leadership Council defined high potentials as the pool of future organizational leaders that are assessed as having the ability, organizational commitment, and motivation to rise to and succeed in more senior positions in the organization. The finding that only 29% of high performers are high potentials for key leadership positions is the reason that some individuals fail when promoted. High performers demonstrate effectiveness in their current role and, regardless of their potential to advance into key positions, are critical at all levels of an organization. Effective management succession does not rely on high performance as the sole indicator of future success. High potentials have the capacity to develop into an effective performer in higher level roles. So, how does a company identify the 29% that have the potential for higher roles?

Korn Ferry has an assessment of leadership potential that evaluates an individual’s “capacity and interest to develop the qualities required for effective performance in a significantly more challenging leadership role.” Their 50 years of analytics and nearly five million professional assessments define what separates success from derailment for leaders in any role.

The Korn Ferry Assessment of Leadership Potential evaluates an individual on seven signposts of leadership potential:

- Drivers: the interest and drive to pursue the challenges and work of a leader

- Experience: utilizing past experience to prepare for more challenging roles

- Awareness: awareness of personal strengths/weakness, development needs and the impact of events or others

- Learning agility: leveraging past experiences for new situations

- Leadership traits: natural disposition for focus, persistence, tolerance of ambiguity, assertiveness and optimism

- Capacity: the ability to apply logic and reasoning to identify patterns in unfamiliar experiences

- Derailment risks: properly controls volatility, micro-management and closed behavior

The assessment report evaluates if an individual has the potential to advance into the target level defined by the organization and identifies if the individual’s prior experience, desired role and career aspirations align with the organization’s future needs. If there is not alignment, the assessment outlines development opportunities to prepare the individual.

A formal leadership assessment tool like Korn Ferry’s is a highly effective way to use 50 years of leadership assessment data to ensure you are correctly identifying high potentials that are critical to your management succession plan.

Strategies to retain key leaders

As mentioned earlier, management depth has a significant impact on business valuation. Even if an ownership succession plan is not in your organization’s future, it is critical that retention of key employees and management succession be an ongoing priority. Population demographics, industry demands to hire post-pandemic, and the ‘talent gap’ have made workforce a primary concern for all industries. It will become tougher to recruit skilled employees so it is crucial that you retain the key employees that you have.

To prepare for the workforce challenges that businesses will continue to face, the WorldatWork report on Future of Work and Rewards summarizes what employers need to consider in order to retain talent. “Employees who can compete in the future marketplace are expected to be compensated handsomely through increased base and variable pay, as well as more and better defined benefits, more flexibility and increased development opportunities.” This report, as well as many studies on millennials and generation Z point to the increased importance of developing employees.

Compensation, benefits, development and culture are components of a total rewards strategy that can be effective in helping an organization recruit, reward and retain employees. The strategy behind compensation warrants a separate article. At a basic level, compensation has an important role in the succession process as it can be used to:

- Retain key talent necessary for future business success

- Incent desired results or behaviors (such as protecting or growing business value)

- Provide a funding source for ownership transition

Historically, employee development was a topic limited to human resource discussions but today it is considered an important component of business strategy. There are a number of business reasons to support investing in the development of your employees:

- They are your greatest asset and responsible for your business success

- If you do not provide growth opportunities employees will leave for another company

- It is critical to prepare your key employees to sustain the future of your organization

- It makes it easier for an owner to ‘step back’ or exit the business

The American Society of Training and Development documents the number of hours and amount of money spent by employers on training. Nationally, across all industries, employers spend approximately $1200/employee or 3.6% of payroll on employee development. This equates to an average of 30 hours of development a year for every employee. Is your company keeping up with these trends, across all levels of your organization?

Mandatory industry certifications, technology training and supporting the completion of required continuing education is not going to ensure an organization is building a leadership pipeline that allows the company to be sustainable. Proactive development of leadership requires that you:

- Understand the competencies required for key leaders’ success

- Identify individuals that have potential to promote into future positions

- Offer development opportunities to prepare the individual for the future role

It is very common for a business owner to enter into succession planning with clear ideas about the ownership transfer (passing down to children or selling to key employees). When asked who will replace the 40 years of knowledge and experience that he/she is going to take with when exiting, the response is frequently one of uncertainty or concern. The reality is that personnel are an important component of both the ownership and management succession. Employees have a direct impact on company cash flow, which impacts the value of the company and therefore the exiting owners’ ability to get cash out of the company. Effective management succession does not begin when an owner plans to exit the business but proactively focuses on developing and retaining key personnel that demonstrate the competencies, capabilities and potential necessary for future success. Succession really is a personnel matter.

A version of this article was originally published in Construction Accounting and Taxation (March/April 2019). Copyright 2019 Thomson Reuters/Tax & Accounting.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.