The Great Resignation has affected the labor market across the country. Higher education institutions are no exception. Finance and accounting professionals have always been in short supply and now many institutions are scrambling to fill vacant positions while still maintaining essential business functions.

Critical risks associated with business office operations

Business office functions are fundamental to the operations of any college or university. Many institutions do not have the proper head count or place too much reliance on one or a small group of employees. A business office assessment may be required to reallocate employee work loads, better utilize technology or identify key skills that are lacking in the business office.

Key human capital risk

Many institutions have long-tenured employees that possess a wealth of knowledge and understanding of integral business operations. These individuals are consistently relied upon to ensure that these functions are properly maintained. The seasoned employee or small team may be involved in every function of the business office such as billing, payables, endowments, grant reporting, financial aid, reporting, etc. They have often been with the institution for a long time and realize the big picture – the mission – but have no succession plan in place. If this person were to leave, the institution may struggle to execute key functions.

Lack of managerial accounting skills

Higher education institutions can be very complex. A trending issue that many institutions struggle with is accounting for foundation activity. Foundations are separate legal entities that are created to receive donations on behalf of the university or college. The accounting responsibilities normally fall to the institution’s business office, but these employees may not have the proper knowledge, skill or access to records to execute these responsibilities. Additionally, foundation accounting follows not-for-profit accounting standards whereas institutions follow Governmental Accounting Standards Board (GASB) principles. It is crucial to have accounting professionals that understand these differences, or the institution may be exposed to unknown compliance risk.

Underutilization of technology

As accounting rules have become more complex, so too has the technology to manage these requirements. Many different software applications are used to prepare financial statements, receive tuition payments and pay vendors. The maintenance of these applications requires qualified information technology (IT) professionals as well as business professionals that understand the optimal manner to leverage these technologies. Insufficient use of technology may lead to duplicate efforts, over-processing and/or inaccurate reporting.

Inadequate process documentation and cross-training

For business offices that experience high turnover, it is vital to have documented policies and procedures in place. Documented procedures encourage operational consistency and mitigate risk. Proper documentation will assist in cross-training new (and experienced) hires, which also helps mitigate the “key human capital risk.” A formal training process will be extremely difficult to implement without documented procedures.

While the list above identifies some of the key risks associated with business office operations, it is not comprehensive. There are numerous related risks may lead to sub-optimal institutional business operations. Therefore, it is critical for institutions to identify their campus’ specific risks and ensure there are sufficient mitigation strategies in place.

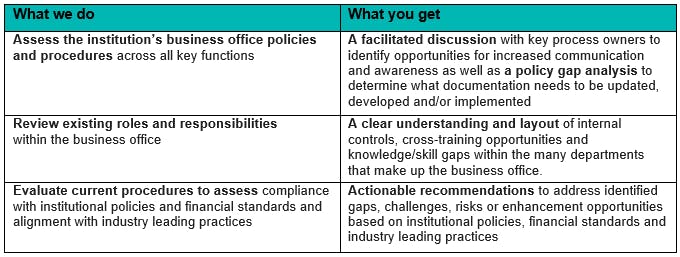

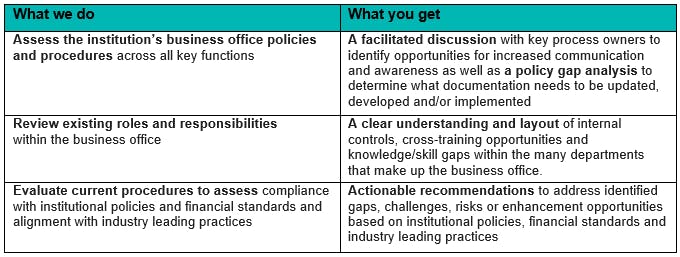

How Baker Tilly can help

Baker Tilly can help your institution’s business office by evaluating the existing organizational model and recommend improvements to operating effectiveness and efficiency. Our specialized higher education risk team will provide recommendations to strengthen efforts based on the results of this approach along with industry leading practices.