The ASC 606 transition for construction contractors: Identifying the contract – Contract modifications

Contract modifications or change orders

Contract modifications or change orders are extremely common in the construction industry. ASC 606 requires additional judgment and documentation when determining how to properly account for a contract modification. A contract modification must change the scope or price (or both) originally agreed by the parties. The modification can be written, oral, or in accordance with customary practice as long as it has commercial substance. A modification can also occur when both parties have agreed to the scope change, but not the price. When that occurs, the contractor must estimate the consideration it expects to receive in accordance with guidance on variable consideration.

The new accounting standard provides a number of prescribed methods to account for modifications including 1) as a separate contract; 2) as a termination of the original contract and creation of a new contract; or 3) as part of the existing contract.

Contract modifications are accounted for in two ways, either as a separate contract or as modification to the original contract, depending on the following guidance:

Separate contract:

- The scope of the contract changes due to the addition of promised goods or services that are distinct; and

- The price of the contract increases by an amount of consideration that reflects the contractor’s standalone selling price.

Modification (the changes are not accounted for as a separate contract):

- A contractor shall account for the contract modification as if it were a termination of the existing contract and the creation of a new contract, if the remaining goods or services are distinct from the goods or services transferred on or before the date of the contract modification and the consideration does not reflect the standalone selling price. The revenue recognized to date on the original contract (i.e. the amount associated with the completed performance obligations) is not adjusted. Instead, the remaining consideration from the original contract is combined with the additional consideration promised in the modification to create a new transaction price, which will be accounted for on a prospective basis that is allocated to all remaining performance obligations.

- A contractor shall account for the contract modification as if it were a part of the existing contract if the remaining goods or services are not distinct and, therefore, form part of a single performance obligation that is partially satisfied at the date of the contract modification. The effect that the contract modification has on the transaction price, and on the contractor’s measure of progress toward complete satisfaction of the performance obligation, is recognized as an adjustment to revenue (either as an increase in or a reduction of revenue) at the date of the contract modification (that is, the adjustment to revenue is made on a cumulative catch-up basis).

- If the remaining goods or services are a combination of the two preceding paragraphs, then the contractor would not adjust the accounting for completed performance obligations that are distinct from the modified goods or services (consistent with the prospective basis). However, the contractor would adjust revenue previously recognized to reflect the effect of the modification on the estimated transaction price allocated to performance obligations that are not distinct from the modified portion of the contract and measure of progress (consistent with the catch-up basis).

Example of a separate contract

An aggregate mining contractor entered into a contract on March 15, 2017 to provide 100,000 tons of aggregate materials to a governmental entity to be used for road maintenance at a price equal to $5.00 per ton, which is to be delivered with transfer of control over a period of 6 months. On July 15, 2017, the contractor has delivered 75,000 tons of aggregate materials under the original contract and the governmental entity has requested the contractor provide a bid for an additional 50,000 tons of aggregate materials, which is to be delivered with transfer of control over a period of 3 months from the contract modification date. The contractor’s bid of $4.00 per ton for the additional 50,000 tons of aggregate materials is reflective of the standalone selling price based on observable transactions with unrelated customers at the time of the bid which was approved by the governmental entity.

Conclusion

The delivery of the additional 50,000 tons of aggregate materials is considered to be a distinct good and the price represents the contractor’s standalone selling price. This contract modification or change order should be accounted for as a new and separate contract. Revenue on the remaining 25,000 tons of aggregate materials under the original contract should be recognized at $5.00 per ton and revenue from the contract modification should be recognized at $4.00 per ton as the transfer of control occurs and the performance obligations have been satisfied.

Example of a modification resulting in a new and separate contract

A general contractor was awarded a contract to build a new school for $100 million. After construction has started, the customer approves a modification for an additional gym to be built on the school grounds. Both the contractor and the customer agree to modify the contract to include the construction of the gym for a total price of $105 million, to be completed within six months. Based on similar contracts, the general contractor would normally charge $5.2 million to build the gym; however, the contractor expects to take advantage of various efficiencies at the job site, given that most of the equipment and labor resources necessary for the additional build-out are already on site. Accordingly, the $5 million reflects the standalone selling price of the additional service to be provided at the date of the modification.

Conclusion

The modification for the build-out of an additional gym is considered to be a distinct service that increases the scope of the contract. The additional consideration (adjusted for the specific circumstances of this particular contract, regarding the available resources on site) is considered to be the standalone selling price. As such, the contract modification for the gym build-out is accounted for as a new and separate contract that does not impact the accounting for the existing contract, given that both required factors are met.

Example of a modification resulting in a cumulative catch up

A general contractor enters into a contract to construct a commercial building for a customer on customer-owned land for promised consideration of $1 million and a bonus of $200,000 if the building is completed within 24 months. The contractor has determined that the goods and services to be provided are a single performance obligation satisfied over time because the customer controls the building during construction. At contract inception, the general contractor expects to attain 30 percent gross profit on the contract excluding the performance bonus. The general contractor has determined that the completion of the building is highly susceptible to factors outside their ability to influence, including weather and regulatory approvals. In addition, the general contractor has limited experience with similar types of contracts. As a result, the general contract has excluded the $200,000 bonus from the transaction price.

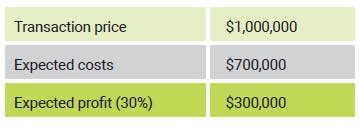

At contract inception, the general contractor expects the following:

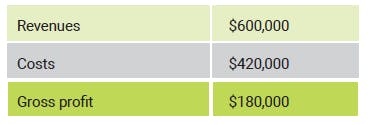

At the end of year one, the general contractor has satisfied 60 percent of its performance obligation on the basis of costs incurred to date relative to total expected costs. The general contractor has reassessed the variable consideration and concludes that the amount is still constrained. Consequently, the cumulative revenues and costs recognized for the first year are as follows:

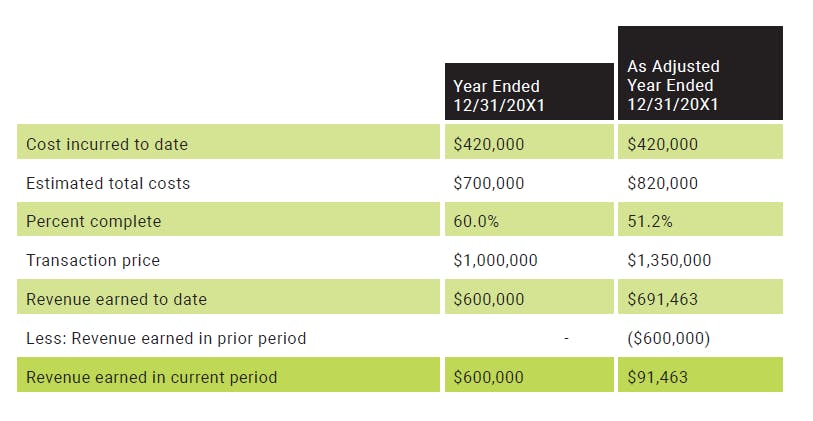

In the first quarter of the second year, the parties to the contract agree to modify the contract by changing the floor plan of the building. The contractor determined that the goods and services included in the modification are not distinct. As a result, the fixed consideration and expected costs increase by $150,000 and $120,000, respectively. In addition, the allowable time for achieving the $200,000 bonus is extended by six months to 30 months from the original contract inception date. At the date of the modification, on the basis of the contractor’s experience and the remaining work to be performed, the contractor concludes that it is probable that including the bonus in the transaction price will not result in a significant reversal in the amount of cumulative revenue recognized.

Conclusion

The contractor determined that the change order for the modified floor plan is not distinct from the original contract, so the original contract remains a single performance obligation. Additionally, the contractor now believes it is probable it will complete the project within the 30-month bonus period. Accordingly, the contractor includes the full $200,000 bonus in the contract amount and recognizes a catch-up adjustment (accounted for as a change in estimate) in year two.

The calculation below illustrates the amount of the catch-up adjustment recognized in year two:

For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team.