Housing Authority of Elgin secures public/private financing for $33.5 million affordable housing project for seniors under Rental Assistance Demonstration

Our client’s need

The Housing Authority of Elgin, Illinois (HAE), a public housing agency, manages a portfolio of nine family and elderly developments within the city. The 255-unit portfolio includes the aging 11-story Central Park Tower (CPT) apartment building which was in need of capital improvements in excess of $30 million—far beyond their annual capital appropriation from the US Department of Housing and Urban Development (HUD).

To overcome the financial challenge of the project, HAE engaged C. Ray Baker & Associates, Inc. (CRB) to assist in the preparation and submission of a successful competitive application to convert CPT to a Section 8 funding platform under HUD’s Rental Assistance Demonstration (RAD). The authority and its Board of Commissioners knew that the success of the project hinged upon their ability to assemble a deeply experienced development team with not-for-profit specialization and a shared commitment to community stewardship.

Baker Tilly solution

CRB helped the authority establish the criteria for development team members, review candidates, negotiate contracts, and establish performance benchmarks. The assembled team then worked with the authority to lay out a vision for redeveloping the existing elderly high-rise building. The team needed to:

- Build consensus among project stakeholders

- Establish ownership structure

- Determine project delivery method

- Establish the project objectives

- Frame the project vision

- Quantify market demand

- Finalize the land, building, and infrastructure program

- Complete master plan and architectural design

- Formulate development budget and project schedule

- Finalize development phasing plan

- Prepare the public/private partnership financing structure

Financing

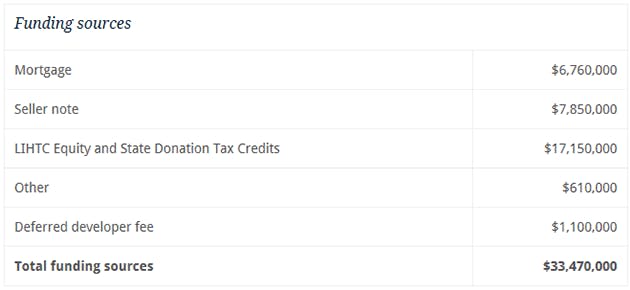

In deciding the financial advisor for the project, CRB chose Baker Tilly for their deep knowledge of various sources, experience serving not-for-profits, and demonstrated ability to work with multifaceted projects. The magnitude and intricacy of the project’s rehabilitation and new construction demanded a very complex structure of layered financing from many public and private sources, each governed by various regulatory requirements and constraints. Together, CRB and Baker Tilly helped the authority source and secure a total of $33 million in funding to move the project forward.

- Low-Income Housing Tax Credits (LIHTCs) – HAE was one of nine awardees out of 43 applicants for 9% competitive LIHTCs. Of the nine awardees, CPT was one of only two who received the $15 million maximum award allowed under the Qualified Allocation Plan, and was the only housing authority sponsored applicant to receive LITHCs during the round.

- Predevelopment Loan – A predevelopment loan that leveraged HAE’s upfront capital investment in the project allowed them to fully guide the predevelopment process. By controlling the process and thoroughly understanding the project and community needs, the authority was better positioned to negotiate with its development partners. Projects with this type of financing arrangement rely on strong relationships and a genuine shared interest among the stakeholders. A unique predevelopment loan structure allowed HAE to demonstrate to the development team that it had the funding capacity to the stay the course through financial closing.

- Permanent Mortgage – FHA 221(d)(4) insures mortgage loans to facilitate the new construction or substantial rehabilitation of multifamily rental for moderate-income families, elderly, and the handicapped. The program allows for long-term mortgages (up to 40 years) that can be financed with Government National Mortgage Association (GNMA) Mortgage Backed Securities. CPT applied for and received an FHA 221(d) mortgage loan.

- State Donation Tax Credits – In Illinois, corporations and individuals can apply to receive tax credits for their state income tax for cash, securities, or properties donated for approved affordable housing creation. A charitable not-for-profit organization that creates and preserves high-quality affordable housing for family and senior residents of low and moderate income partnered with HAE to apply for and structure the sale of the state donation tax credits.

- Energy Conservation – The county provided funding to offset the costs of energy conservation features designed into the project.

Results achieved

Central Park Towers is one of the largest and most complex RAD transactions closed to date, and ensures quality affordable housing for Elgin residents for years to come. The authority purchased and demolished property adjacent to the building, allowing the plan to include substantial rehabilitation and new construction with an expanded site footprint. The authority was able to increase living space for the elderly residents and reduce the density of the tower by converting existing efficiency units into one-bedroom units. The units lost through the tower reconfiguration will be constructed in a new mid-rise tower immediately adjacent to the rehabilitated building. The project also includes a new courtyard between the two buildings and will incorporate sustainable features consistent with Enterprise Green Communities criteria.

Funding sources

For more information on this topic, or to learn how Baker Tilly real estate specialists can help, contact our team.