Delight stakeholders and impress investors with your SaaS Intelligence

Finance teams’ shifting role toward advanced analytics

In recent years, there has been a significant shift in the role that finance departments typically play in leading their company’s digital transformation and spearheading the organization’s use of advanced analytics.

The expectations used to be to report on how the organization has done (over the last quarter, year, etc.) and in most cases, it was a matter of simple data and basic financial reporting. Now the role is about helping the company grow from a financial perspective, utilizing all available metrics and taking full advantage of real-time data analytics.

While the concept of data analytics is nothing new, the focus on advanced analytics has created a need for new approaches, innovative organizational strategies and modern technology platforms to support SaaS finance teams within growing companies and their evolving analytics needs.

There are many stakeholders around an organization impacted by the SaaS reporting needs of the business. Whether that’s the finance team charged with the collating, parsing and analyzing of financial and operational data, or the consumers of that business intelligence such as revenue operations, executive leadership, board of directors or other external investors. These stakeholders all have a vested interest in the efficiency, availability, analytical depth and reliability of reporting tools employed by the organization to support strategic data-driven decision-making.

In today’s market, business intelligence platforms are as critical as ever in ensuring that organizational growth initiatives are generating success and that capital is being employed efficiently. Consequently, the risk of not having a sufficiently advanced analytics platform has never been more significant – and that is not going to change anytime soon.

Examining common data analytics challenges for SaaS finance teams

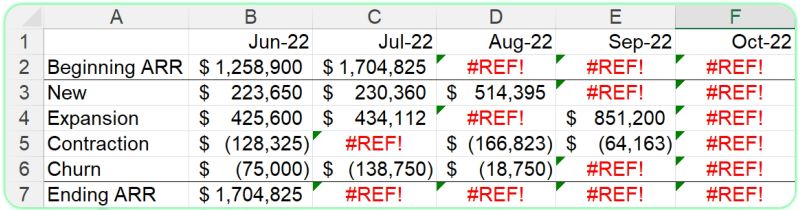

The adjacent graphic might look all too familiar to you. Perhaps you recall a time when you (or someone on your team) made a change to an Excel formula or moved a reference cell, and suddenly your entire reporting model was broken with no obvious unwinding mechanism in sight.

While Excel and Google Sheets can be useful tools, they are manual, error-prone and backward-looking solutions that obstruct a user’s ability to perform high-quality analytics – as they only offer surface-level metrics and limited segmentation. Furthermore, those solutions don’t scale – only increasing in complexity and instability as data volumes expand – leaving growing companies absorbing enterprise technical debt and scrambling for a more comprehensive and reliable tool to meet ever-growing reporting demands from stakeholders.

Meanwhile, there are clear benefits to automating and systematizing the data analytics process earlier in a company’s lifecycle to avoid that technical debt and be positioned to meet stakeholder reporting demands now and into the future. After spending hundreds of hours talking with finance organizations over the years, it’s evident that there are certain attributes of analytical tools that tend to delight SaaS finance teams and stakeholders alike. They want an analytics platform that is:

- Automated: Enables finance teams to focus on data analytics instead of data preparation

- Reliable: Instills high confidence in SaaS metrics delivered to leaders and investors

- Real-time: Provides immediate insights that support rapid data-driven decision making

- Scalable: Built to scale and deliver continual value as the organization grows

- Configurable: Provides insights that can be tuned to fit the business’s specific needs

- Insightful: Offers deeper, more insightful business intelligence to identify crucial trends

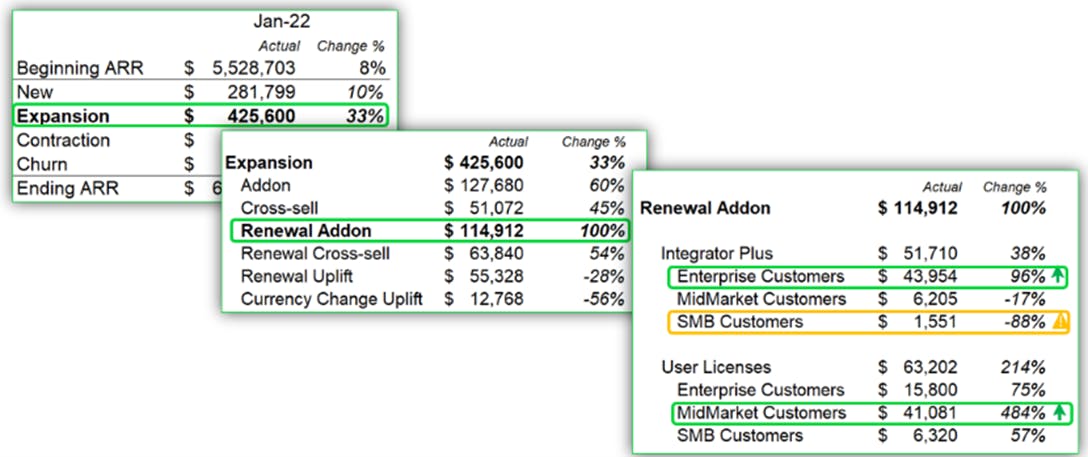

Continuing the topic of insightful analytics, stakeholders do not want to be limited by reporting solutions that provide an incomplete view of the subscription activities driving recurring revenue. Oftentimes, recurring revenue activity categorization options are constricted to four segments – new, expansion, contraction and churn – and while those are fine if you only need a general directional understanding of your organization, they simply are not sufficient for many businesses in today’s marketplace.

Stakeholders want to understand what’s driving the recurring revenue growth of their business, directing questions to SaaS finance teams such as “how much of our expansion this quarter was generated from add-ons and cross-sells versus uplift (i.e. price increases)? Which products are experiencing the most contraction or churn and why?” Unfortunately, far too many SaaS finance teams either can’t provide those answers, or spend an inordinate amount of time attempting to dissect their data on an ad-hoc basis to respond to such requests only to go back to the drawing board when the inevitable follow-up questions like “…across which customer segments? in which industries? which CSMs?” are presented.

These days, most sophisticated stakeholders require the depth of business intelligence, including the option to segment their data by customer, cohorts of customers or specific products among other options.

You can see in the adjacent graphic how valuable detailed category, customer and product segmentation can be to a business. In this case, the broad ‘Expansion ARR’ activity is broken down into different granular recurring revenue categories of ‘Add-on’, ‘Cross-Sell’, ‘Renewal Add-on’, etc. to bring clarity to the specific subscription events driving expansion within the customer base. This elucidates some interesting trends – including uncovering that add-ons occurring at the time of renewal doubled in January compared to the prior month. When explored further by product and customer segmentation, valuable insights emerge indicating substantial growth in user license purchases within the midmarket customer segment, while indications of challenges in the slowing expansion of SMB Customers adding the Integrator Plus product are evolving. Armed with detailed information such as this, business leaders can make better-informed decisions to capitalize on momentum or mitigate issues based on real-time emerging trends.

Standing out from the crowd

From an investor’s standpoint, there are typically eight key SaaS metrics that garner their focus:

- CARR Growth

- CAC Payback

- CLTV/CAC

- Churn Rate

- Cash Flow Margin

- Cash Conversion Score

- Net Dollar Retention

- Rule of 40

In a competitive investment environment, first impressions matter. Those organizations operating with a sophisticated, real-time analytics platform delivering these metrics (and others) can stand out in the crowd by showcasing their financial operations – and overall organizational – maturity to potential investors. They can articulate their company story using quantifiable, investor-grade metrics and be prepared to explore and explain growth trends on a moment’s notice. Leaders can demonstrate the depth of their business intelligence backed up by auditable systems, which not only can attract and impress investors but also can expedite the due diligence process and the deal velocity once a transaction is in the works.

Introducing SaaS Intelligence

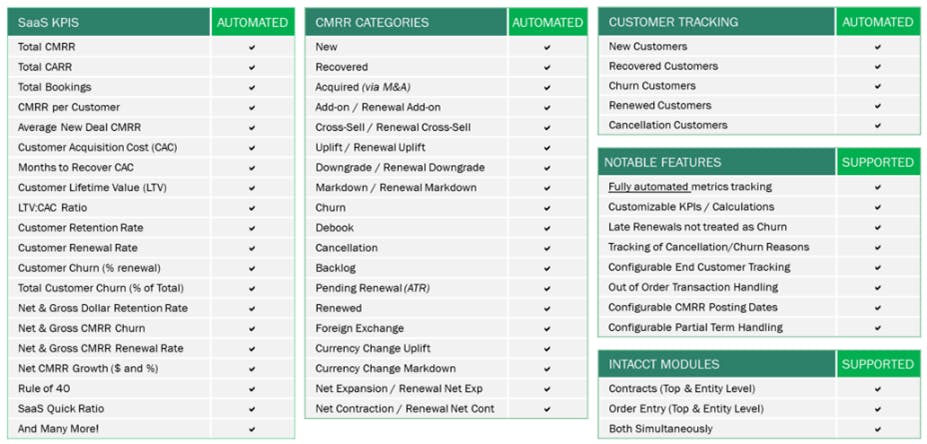

SaaS Intelligence is an investor-grade, fully automated B2B/B2B2C SaaS financial metrics tracking application built on the Sage Intacct platform. Its intelligence engine automatically analyses and categorizes customer subscription activity in real time, blending customer subscription activity with Sage Intacct’s GAAP financial data to produce the most robust and accurate set of SaaS metrics.

Its data contextualization capabilities include 35 categories of recurring revenue activity – immensely more detail than the typical 4 categories of “New ARR”, “Expansion ARR”, “Contraction ARR”, and “Churn ARR” – more than 60 KPIs, and over 40 out-of-the-box graphs and reports.

Paired with capabilities of segmenting its detailed recurring revenue activity by entity, customer and product (at a minimum) to identify crucial trends, SaaS Intelligence supports a vast array of SaaS reporting complexities such as committed vs active (live) recurring revenue, multi-entity, multi-currency, consolidated reporting and even channel or parent/child customer models. SaaS Intelligence’s configurability and deep insights deliver the most detailed and comprehensive view into your SaaS business, providing stakeholders with immediate, self-service answers to their most pressing questions and revelatory insights to questions they never considered to ask.

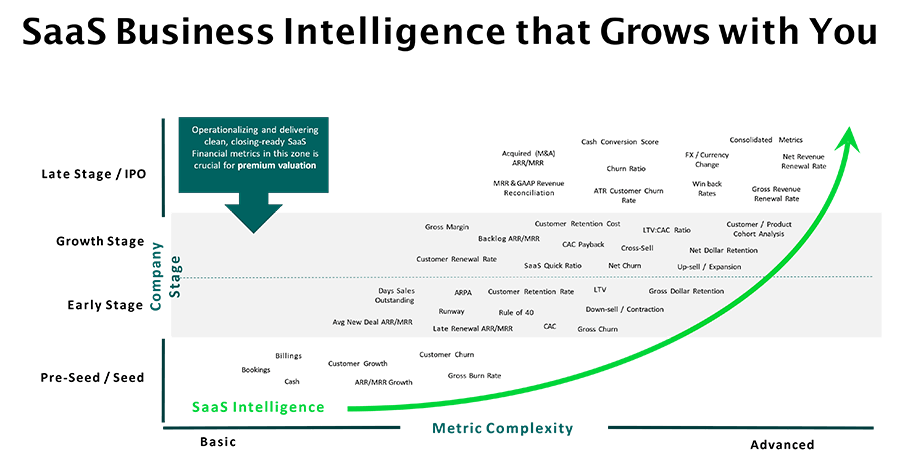

Perhaps the greatest benefit of SaaS Intelligence is its ability to grow alongside your company. The below graphic illustrates the analytics needs that companies tend to require as they go from the pre-seed stage, through early and growth stages and finally to the late stage or IPO. SaaS Intelligence offers more, not fewer, options as the company gets more mature and its business reporting needs become more complex – future-proofing from having to switch reporting platforms as an organization grows and allowing look-back at metrics trends that may not have previously been a focal point of analysis for the business to uncover keen insights.

The bottom line is that the time your SaaS finance team spends managing and organizing data in Excel – or other outdated platforms – is time that should be spent analyzing and exploring data trends to provide strategic insights to the business. Managing data used to be considered a valuable use of time, but in today’s world, there is sufficient business intelligence technology available that makes manually collecting and manipulating data not only a waste of your SaaS finance team’s time but an inherently risky endeavor fraught with unreliable results. You need to spend your time leveraging system-driven business intelligence to evolve your organization, delight stakeholders and impress potential investors.

To learn more about how SaaS Intelligence can benefit your business and how Baker Tilly can help, connect with us.