The ASC 606 transition for construction contractors: Determining the transaction price – Variable consideration

After identifying the contract and the performance obligations within the contract, the next step for a construction contractor under ASC 606 is to determine the transaction price. The transaction price is the amount of consideration to which the contractor expects to be entitled in exchange for satisfying its performance obligations, excluding amounts collected on behalf of third parties (i.e., sales tax).

In the construction industry, the transaction price is generally the contract price under the terms of the contract and may include fixed amounts, variable amounts or both. Determining the transaction price under the new standard requires contractors apply judgment and document processes and controls related to variable consideration, noncash consideration and the existence of a significant financing component.

Variable consideration

When the consideration promised in a contract includes a variable amount, a contractor is required to estimate the amount of consideration to which it will be entitled. Variable consideration may include items such as discounts, rebates, credits, incentives, performance bonuses, penalties or other incentives that are unknown at contract inception. Amounts are only included in the transaction price if it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur in the future.

To the extent that variable consideration is probable (generally at least a 75 percent chance of occurring) that a significant reversal in the amount of cumulative revenue recognized will not occur in the future, a contractor should estimate the amount of variable consideration using either the expected value or most likely amount methods to determine the amount of variable consideration to include in the transaction price. The method a contractor selects is not a policy choice; the estimation is driven by the facts and circumstances of each contract. The chosen method should be applied consistently throughout the contract and throughout contracts with similar terms and requires documentation of management’s conclusions. The estimate used at contract inception should be revisited each reporting period for changes in the probability assessment.

The expected value method should be utilized when there are multiple possible outcomes where a contractor would assess the sum of the probability-weighted estimates over a range of possible outcomes. Alternatively, the most likely amount method should be utilized when a contractor expects to be entitled to one of only two possible outcomes.

To include variable consideration in the estimated transaction price, a contractor has to evaluate the constraints of that estimate before concluding on the probability. The new accounting standard provides indicators for when a revenue reversal may be probable:

- The amount of the consideration is highly susceptible to factors beyond a contractor’s influence. Those factors may include volatility in a market, the judgment or actions of third parties, weather conditions and a high risk of obsolescence of the promised good or service.

- The uncertainty about the amount of consideration is not expected to be resolved for a long period of time.

- A contractor’s experience (or other evidence) with similar types of contracts is limited, or that experience (or other evidence) has limited predictive value.

- A contractor has a practice of either offering a broad range of price concessions or changing the payment terms and conditions of similar contracts in similar circumstances.

- The contract has a large number and broad range of possible consideration amounts.

The indicators are not meant to be all-inclusive and a contractor may note additional factors that are relevant in their evaluations. In addition, the presence of any one of these indicators does not require a contractor to conclude it is probable that a change in the estimated variable consideration will result in a significant revenue reversal. The new accounting standard permits a contractor to recognize some of the variable consideration when applying the constraints.

A scenario in construction

A contractor enters into a contract with a customer to build student housing on customer-owned land. The contract terms include promised consideration in a fixed amount of $10 million. The customer has included a contract provision to help ensure the student housing building is placed in service prior to the school year. The contract terms include a $10,000 per week liquidated damage clause for delivering the certificates of occupancy after the target date and a $10,000 per week incentive for delivering the certificates of occupancy before the target date. The building is being designed to meet or exceed a certain energy efficiency rating. The contract terms provide a $200,000 incentive should the building receive the energy efficiency designation; however, the contractor has limited experience on energy efficient projects and has assigned a new project manager to the project.

Conclusion

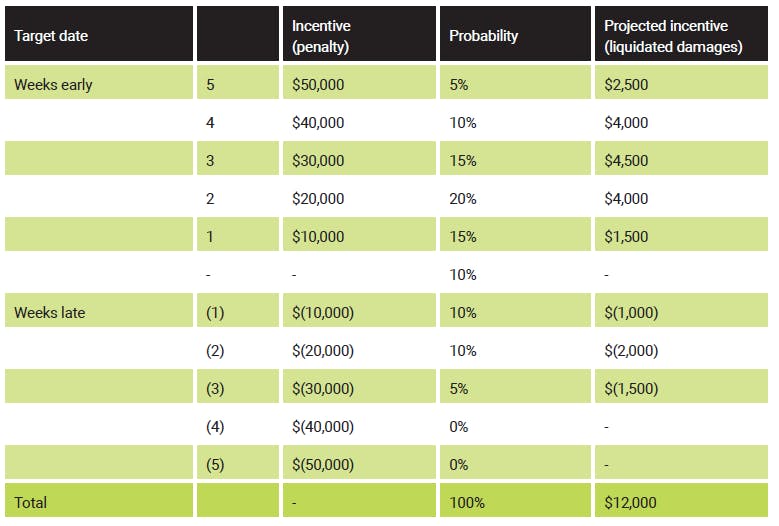

The contractor concludes that the contract contains two types of variable consideration (liquidated damage/incentive for delivering the certificates of occupancy and the energy efficiency incentive). Based on the contract terms and the specific circumstances, the contractor concludes that the variable consideration for the liquidated damage/incentive should be evaluated based on the expected value method due to the numerous possible outcomes. The contractor performed the following evaluation of the liquidated damage/incentive variable consideration:

Expected value calculation for incentive (liquidated damages):

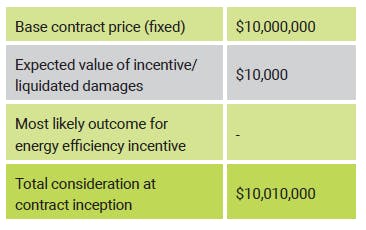

The result of the contractor’s expected value calculation for the incentive or liquidated damages indicates that it is probable that the certificates of occupancy will be delivered one week early based on the calculated outcome of $12,000. As a result, the contractor will include $10,000 of expected liquidated incentive in the transaction price.

The variable consideration for the energy efficiency incentive should be evaluated based on the most likely amount method since there are only two possible outcomes. The contractor determines the energy efficiency incentive should be excluded from its initial assessment of the variable consideration because of the contractor’s lack of experience on energy efficient projects and because the project manager is new to the company.

Contract consideration at initial assessment:

At each reporting period, the contractor should reassess its estimate of variable consideration and account for any changes in the amount of variable consideration in the period that determination is made as a change in accounting estimate.

For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team.