The ASC 606 transition for construction contractors: Determining the transaction price – Significant financing component

Construction contractors with contracts exceeding one year should consider whether the pricing of the contract contains an element of financing. The new accounting standard requires a contractor considers whether the pricing of the contract contains an element of financing when, at contract inception, the period between when the contractor transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or more. An element of financing could be provided to the customer or the customer could provide financing to the contractor as determined by the timing of when consideration is received in comparison to the transfer of the promised goods or services.

To reduce the burden of this requirement, the FASB included a practical expedient in the standard that allows a contractor to ignore a significant financing component when the period between a customer’s payment and a contractor’s transfer of the goods or services is expected to be one year or less at contract inception. In most circumstances, costs and earnings in excess of billings (underbillings) and billings in excess of costs and earnings (overbillings) on uncompleted contracts are resolved within one year and would not constitute a significant financing component.

For all other longer-term contracts, a significant financing component can be explicitly stated in the contract or implied by the payment terms agreed to by the parties. When a significant financing component has been identified, a contractor would adjust the transaction price by discounting the amount of promised consideration and recognizing interest income (when customer payments are deferred) or interest expense (when customer payments are accelerated) based on prevailing interest rates in the relevant market. A contractor uses the same discount rate that it would use if it were to enter into a separate financing transaction with a customer. The discount rate should reflect the credit characteristics of the borrower regardless of a rate explicitly stated in the contract when it does not correspond with market terms.

The new accounting standard provides for certain situations which would not indicate a financing component:

- A customer paid for goods or services in advance, and the timing of the transfer of those goods or services is at the discretion of the customer.

- A substantial amount of the consideration promised by a customer is variable, and the amount or timing of that consideration varies based on the occurrence or nonoccurrence of a future event that is not substantially within the control of the customer or the contractor (i.e., royalties, commissions).

- The difference between the promised consideration and the cash selling price of the good or service arises for reasons other than the provision of finance to either the customer or the contractor, and the difference between those amounts is proportional to the reason for the difference (i.e., retainage).

A scenario in construction

A contractor enters into a contract for the construction of a building. The contract terms require customer payment based on scheduled milestones during the three-year term of the project. The performance obligations will be satisfied over time and the milestone payments are scheduled to coincide with the contractor’s expected performance. The contract terms provide that retention of 10 percent be withheld by the customer at each milestone payment. The retention payable will be paid to the contractor when the certificates of occupancy are delivered.

Conclusion

The contractor concludes that the contract does not include a significant financing component. The milestone payments coincide with the contractor’s performance. The contract requires amounts be retained for reasons other than the provision of finance in accordance with the new accounting standard as the withholding of retention is intended to protect the customer from the contractor failing to adequately complete its obligations under the contract.

A scenario in construction

A homebuilder enters into a contract with a customer to build a home on the customer’s land for $1.5 million. The project is expected to take two years to complete. The contractor agrees to perform turn-key construction and finance the project through a construction loan acquired from its own lender at a rate of five percent, which is consistent with prevailing market rates. The terms of the contract require the full amount of consideration be paid when the homebuilder delivers the certificate of occupancy and the homebuilder has determined that it is probable the customer has the ability to obtain the appropriate financing when the consideration becomes due. Had the customer elected to pay the contractor as the performance obligation is satisfied over time, the price would have been $1.35 million.

Conclusion

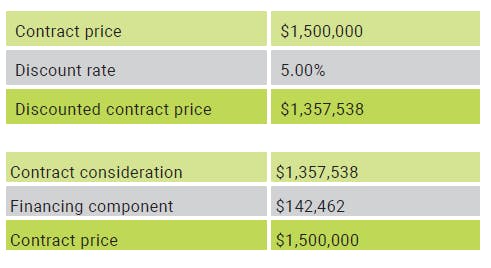

The homebuilder is not allowed to apply the practical expedient (i.e., disregard the significant financing component) because the contractor expects, at contract inception, that the period between when the contractor transfers a promised good or service to the customer and when the customer pays for that good or service will exceed one year. The homebuilder determines there is a significant financing component to the contract since the payments made by the customer do not correlate to the performance of the homebuilder and as a result the transaction price is $1.5 million instead of $1.35 million. The rate of five percent that the homebuilder is incurring through the construction loan is consistent with the prevailing market interest rates for financing transactions with similar risk after considering the credit characteristics and risk of the customer and is consistent with the variation in the transaction price.

As a result, the homebuilder is required to discount the consideration in the contract. The discounted contract price is used as the expected consideration from the contract when calculating performance satisfied over time and the contractor would accrue interest income to be received upon delivering the certificate of occupancy to the customer.

Significant financing component computation:

For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team.