The ASC 606 transition for construction contractors: Allocating the transaction price – Standalone selling price

Once the performance obligations have been identified and the transaction price has been determined, the next step is to allocate the transaction price to the performance obligations based on the standalone selling price. The standalone selling price is defined as the price at which a contractor would sell a promised good or service separately to a customer. Once the selling prices have been determined, a contractor will apply the relative values to the total contract consideration and estimate the amount of the transaction price to be recognized as each promise is fulfilled.

The new accounting standard requires additional consideration and documentation of the standalone selling price or when the standalone selling price is not observable, when variable consideration is part of the transaction price, and when there are changes in the transaction price after contract inception.

Standalone selling price

A construction contractor will determine the standalone selling price for each of the performance obligations at the inception of the contract and will not adjust the initial allocation for future changes in any selling prices. A contractor should maximize the use of observable inputs when estimating the selling price. The best use of observable inputs is a contractor’s actual selling price for the same good or service. The standard provides three methods for determining the standalone selling price when a contractor’s actual selling price for the same good or service is unavailable, but does not require their use if a more suitable method is available with more observable inputs. The three suggested alternative methods are:

- Adjusted market assessment – The price is based on what a customer would be willing to pay in the market in which the goods or services are being sold, such as a competitor’s pricing that is adjusted for the contractor’s own costs and margins.

- Expected cost plus margin – The price is determined by forecasting the expected costs of satisfying a performance obligation and then adding an appropriate margin for the good or service.

- Residual – An estimate of the standalone selling price by reference to the total transaction price less the sum of observable standalone selling prices for other goods or services promised in the contract. The residual method may be used only if the selling price is highly variable because a standalone selling price is not discernible or a price for the good or service has not yet been established.

Depending on the nature of the performance obligations, a contractor may need to use a combination of methods if certain performance obligations have highly variable or uncertain standalone selling prices. If a standalone selling price is not directly observable for any of the identified performance obligations, a contractor should utilize estimates.

Once the selling prices have been determined, a contractor will apply the relative values to the total contract consideration and estimate the amount of the transaction price to be recognized as each promise is fulfilled.

A scenario in construction

A contractor enters into a contract with a customer to install an HVAC system for $1.5 million. The contractor manufactures the ductwork for the system and purchases additional HVAC equipment from other vendors. The contractor does not design or manufacture the purchased HVAC equipment, but it does install the equipment in the customer’s facility. The construction contract includes a one-year preventive maintenance agreement at no additional charge to the customer. The contractor regularly contracts with other customers to provide preventive maintenance services. The contractor has determined the standalone selling prices for the performance obligations based on its current bid rates and other observable inputs. The standalone selling price for the installation services, manufactured ductwork and purchased HVAC equipment was determined to be $1.49 million and the standalone selling price for the one-year preventative maintenance service agreement was determined to be $25,000.

Conclusion

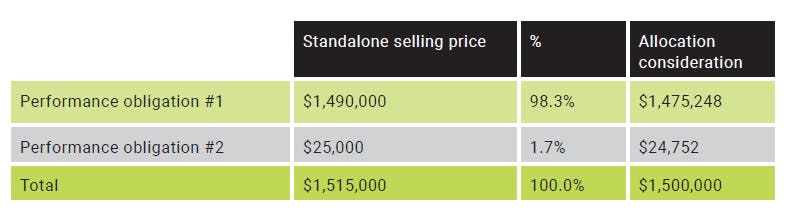

The contractor concludes that the installation services, manufactured ductwork and purchased HVAC equipment should be combined into one performance obligation because the contractor provides significant services of integrating the three items into the customer’s facility (performance obligation No. 1). The contractor would also conclude that the maintenance agreement is a separate performance obligation since the customer can benefit from this service separately and it is not highly integrated with the installation services (performance obligation No. 2). The contractor determines that its current bid rates and other observable inputs provide the best representation of the selling price of the various performance obligations. Accordingly, the contractor calculates the ratio of the standalone selling price of each of the performance obligations and allocates the total contract price using the same ratio:

For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team.