The ASC 606 transition for construction contractors: Allocating the transaction price – Allocating variable consideration

When a contract includes variable consideration, a contractor shall allocate the variable consideration it has determined can be recognized. The variable consideration can be allocated to all of the performance obligations based on the relative standalone selling price or only to specific performance obligations depending on its relevance to a specific performance obligation.

Allocations to specific performance obligations must meet both of the following criteria:

- The terms of the variable payment relates specifically to a contractor’s efforts to satisfy the performance obligation or transfer the distinct good or service (or to a specific outcome from satisfying the performance obligation or transferring the distinct good or service).

- Allocating the variable amount of consideration entirely to the performance obligation or the distinct good or service is consistent with the new accounting standard’s objective to allocate in an amount that depicts the amount of consideration which a contractor expects to be entitled in exchange for transferring the promised goods or services to the customer when considering all of the performance obligations and payment terms in the contract.

A scenario in construction

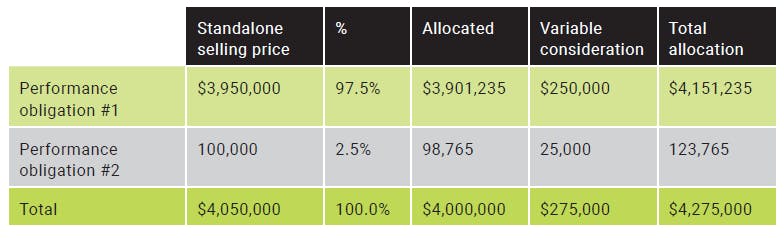

A contractor enters into a contract with a customer to install an elevator for $4 million. The contract includes an incentive bonus for completion by a specified date totaling $250,000. In addition, the contract includes a one-year preventive maintenance agreement at no additional charge and up to 200 hours of maintenance services after the one-year preventive maintenance agreement expires at an agreed upon rate of $250 per hour. Based on the most likely amount approach, the contractor has determined it is probable of attaining the incentive bonus. Based on the expected value approach, the contractor has determined it is probable that 100 of the 200 hours of maintenance services are probable for a total of $25,000. The contractor has determined that the standalone selling price of the elevator installation is $3.95 million and the standalone selling price of the maintenance service agreement is $100,000.

Conclusion

The contractor concludes that the installation of the elevator and the maintenance services agreement are separate performance obligations. The contractor has concluded that the incentive bonus variable consideration is related specifically to the contractor’s efforts to install the elevator prior to the agreed upon completion date (performance obligation No. 1). In addition, the contractor has concluded that the hourly maintenance variable consideration under the maintenance agreement is related specifically to its efforts to provide maintenance services (performance obligation No. 2). Accordingly, the contractor calculates the ratio of the standalone selling price of each of the performance obligations, including the allocation of variable consideration, and allocates the total contract price using the same ratio:

For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team.