Maintaining gross operating margins when electric utility revenues decline

At the start of the latest fiscal operating year, your electric utility could likely cite any number of favorable areas (e.g,, on-track strategy, a full capital project pipeline, and industrial customers operating at maximum capacity). Now the current environment is different and no one knows how long it will last.

What is certain: Declining power sales will directly impact gross operating margins.

It’s time to place full attention on the impact to your utility’s operating income, which generates the cash flows for operations, debt service and capital expenditures.

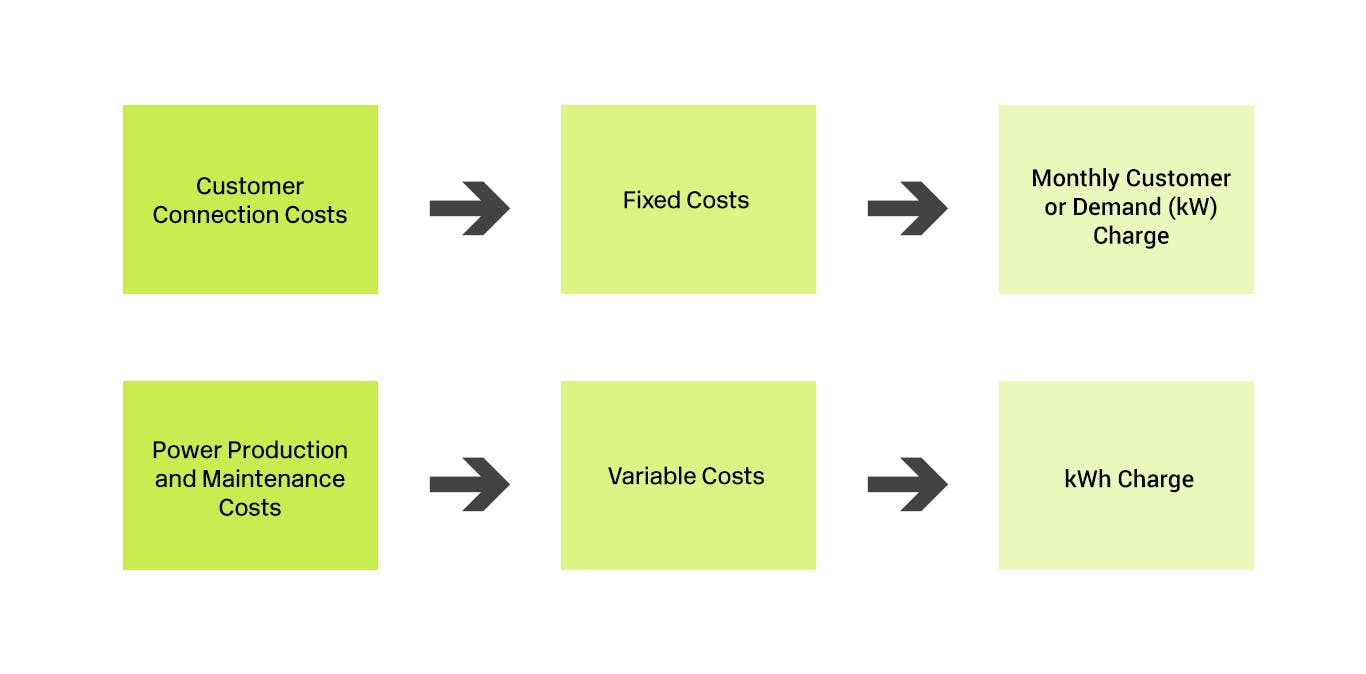

Cost map for electric utilities

Costs for electric utilities, like any business, are a combination of fixed and variable costs. As illustrated in the image below, fixed costs are the infrastructure to size the electric system and connect customers, while variable costs are the cost of fuel or purchased power and system maintenance.

How are these costs recovered from your customers?

Power cost recovery from utility customers

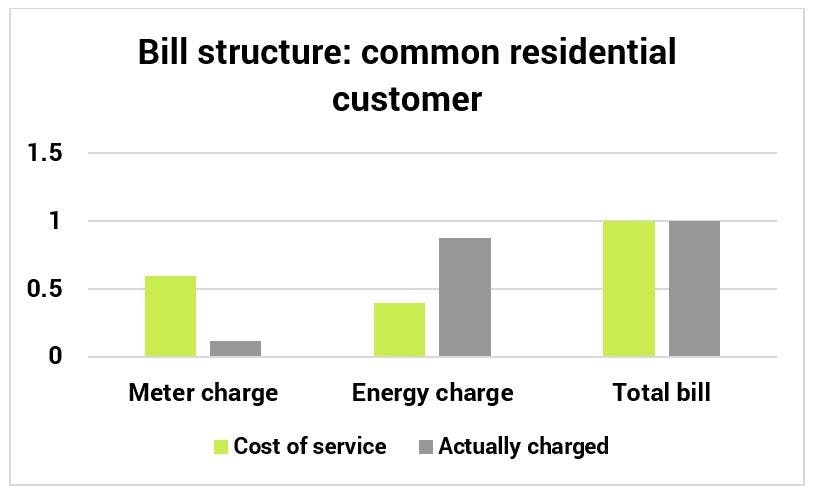

Electric utility customer charges are a combination of fixed customer charges (monthly or kW charges) and variable customer charges (kWh charges). Traditionally, electric utilities have not fully recovered the fixed charge component of power costs in the customer's fixed monthly or kW demand charges. The remaining fixed costs then are allocated to the kWh energy charge. See the graph below depicting the bill structure for a common residential customer:

Although kWh sales are variable revenues generated by variable costs (e.g., fuel, purchased power), a profit margin for fixed cost recovery is built into the rate for each kWh. Declining kWh sales (as in a customer downturn) will erode the utility's gross profit margin. The electric utility must still pay fixed costs to its power supplier (or if the utility generates its power, the fixed costs are depreciation and debt service). Therefore the utility now has a cash flow squeeze as higher fixed charges paid out to suppliers do not match reduced cash flow coming from customers for those fixed charges.

Accounting tools to capture these “lost” margins

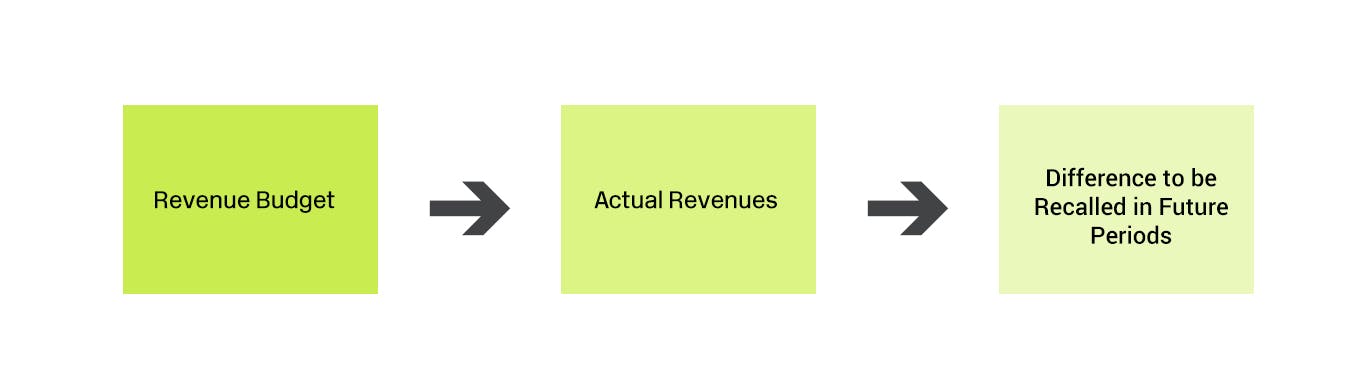

Allowing these lost margins to slip away will inflict a permanent detriment on the electric utility's financial results and cash flows. Accounting methods such as "decoupling" exist to capture these "lost" revenues and collect them in the future.

Decoupling is a form of regulatory accounting used to record these lost margins for recovery in the future. Keep in mind, if your utility is regulated by a state public regulatory commission, this process may or may not be allowable for rate recovery in your rates. For utilities regulated at the local level (i.e., municipal utilities and electric cooperatives), decoupling should be a consideration.

The image below shows the mechanics of decoupling actual revenues from budgeted revenues.

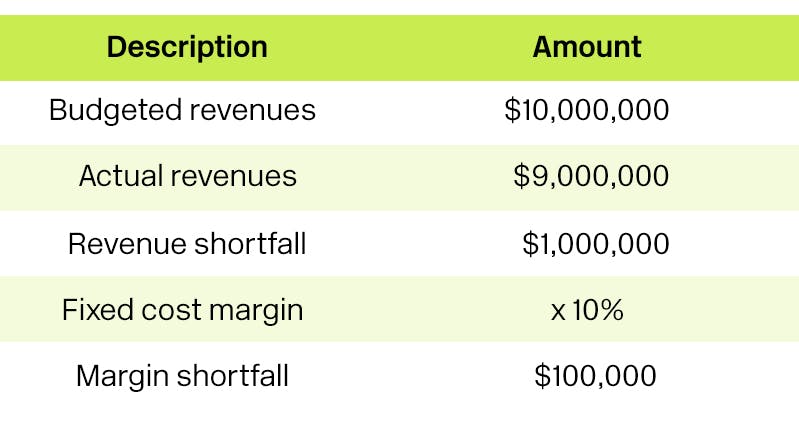

In the example below, a utility has unrecovered $100,000 in fixed margin, which translates to $100,000 less in cash available to pay those fixed margins in power cost.

There are two ways to treat the $100,000 of “lost” margin:

- Accept the “lost” margin. The margin loss will be permanent and will flow as a reduction in operating income. Or

- Defer the amounts as an asset with attempted recovery in the next utility rate adjustment (as a cost adjustment recovery clause or eventually to be written off). Recording the amounts as a deferred asset keeps the lost margin from negatively impacting operating income and the utility’s bond coverage.

Maximize the use of accounting tools to help plan an exit strategy as revenues/margins improve

Even if the final decision is to eventually absorb and write-off “lost” margins, it’s important to track this information. Your utility will need it again when structuring future utility rates (e.g., more fixed charges recovered in rates) and explaining operating income declines to internal and outside parties (i.e., board, management, bond rating agencies). Consider this method as another tool for managing utility company finances in times of uncertainty.

For more information on this topic, or to learn how Baker Tilly power and utilities specialists can help, contact our team.