Venture capital and private equity’s growing partnership in software and technology

Software and technology appear to be creating create deal opportunities between venture capital and private equity groups. As the traditional lines continue to blur and evolve, private equity is increasingly providing unique partnership alternatives for venture capital-backed business and continues to strengthen its position as an attractive exit option for late-stage businesses.

U.S. venture capital deal flow insights and trends

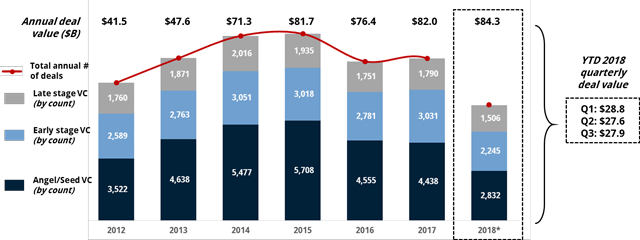

Throughout the first three quarters of 2018, the U.S. private market continues to witness robust deal activity. A major trend that continues to be present amidst U.S.-based venture capital (VC) transactions has been an increased amount of capital allocated to fewer deals. As of Sept. 30, approximately $84.3 billion has been invested across 6,583 transactions. Deal value has increased 37 percent over the same period in 2017 and all three quarters now represent the three highest quarterly totals throughout the last decade. Although there has been an uptick in deal value, deal count continued its downward trajectory with Q3 registering the lowest number of deals completed in the in last five years. Some of the primary elements encouraging a concentration of capital include, an increase in non-traditional VC and tech investors committing capital at later stages, growing levels of dry powder following multiple periods of elevated fundraising activity and inflated valuations.

Annual U.S. venture capital deal flow (count and value)*

(Source: PitchBook)

*Data as of Sept. 30, 2018

Additional trends impacting the evolving VC landscape include (but are not limited to):

- Companies are electing to stay private for longer periods of time

- Although capital concentration has been more apparent amidst larger, late-stage deals, median deal sizes across seed/angel and early-stage transactions continue to grow (which has also resulted in an uptick in equity consideration being returned to investors).

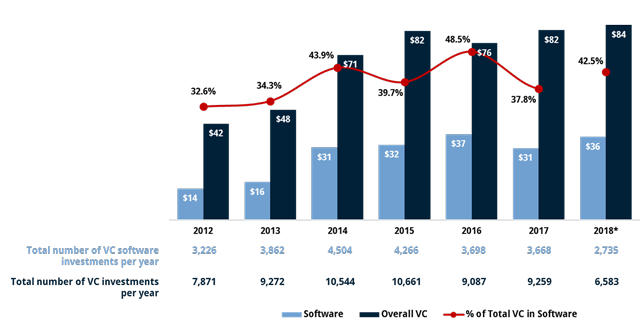

- Software continues to drive VC deal activity

- Businesses are delaying capital raise efforts and the average time to exit has increased to approximately 6.4 years (10.6 years for companies seeking to exit via an IPO)

- Access to late-stage financing at elevated multiples continues to promote delayed exit decisions

- The coveted IPO market continues to be less than robust and alternative exits (i.e., acquisitions and buyouts) are increasing as a percentage of total exits

- Through the first three quarters of 2018, 42.3 percent of VC deals have had a focus on software assets

VC software deal insights*

(Source: PitchBook)

*Data as of Sept. 30, 2018

Spotlight: Private equity interest in VC-backed software companies

Capital superabundance, elevated valuations and fierce competition for attractive assets are a few of the many trends impacting the way private equity groups navigate today’s marketplace. The need to source quality deals has forced financial sponsors to pivot strategies and explore different ways to establish a competitive edge. In doing so, some of the enduring and emerging trends include:

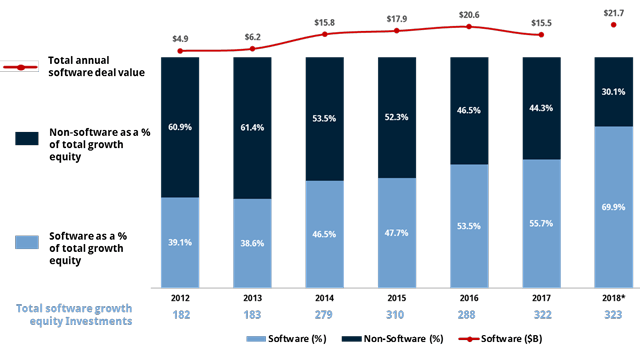

- The value of U.S. growth equity investments continue to grow

- As of Sept. 30, there have been a total of 785 growth equity investments valued at $47.2B and 69.9 percent of those investments were software focused

- By count, 54.6 percent of the YTD 2018 transactions were valued at less than $100M, but approximately 62 percent of deal value ($30B) came from investments greater than $100M

U.S. software growth equity investments*

(Source: PitchBook)

*Data as of Sept. 30, 2018

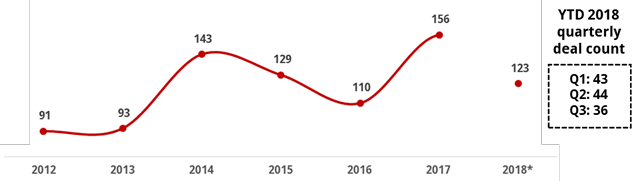

- Moving downstream to source add-on acquisitions opportunities continues to be a focus for many (currently 51 percent of U.S. PE deals are add-ons), but the proliferation of technology and its influence on day-to-day operations has influenced some private equity groups to move further downstream to explore VC-backed software and technology acquisitions/buyouts

- Vertical specific, technology-focused buyout funds are being raised

- This strategy can be attributed to a various theses, including (but not limited to):

- Software and technology assets with recurring revenues and sticky customer relationships align particularly well with private equity models

- As the average time to exit continues to grow for software and technology focused start-ups, the business’ are naturally maturing from an operating perspective while also growing in size. The additional operational growth captured during the extended time period allows the business to organically grow into an attractive buyout target.

- In addition to the above, buyouts at this stage may provide an opportunity for private equity firms to acquire innovative technology earlier in a company’s operating lifecycle before they grow into mature companies which are typically the focus of private equity buyouts. Contingent upon each underlying transaction, acquiring a business at this stage can equate to lower transaction multiples and / or be justified by its high growth value proposition.

- Private equity firms have amassed large amounts of dry powder needing to be deployed, so the idea of buying an earlier-stage tech business and investing in its growth can also be accretive from a platform and add-on perspective. Technology continues to solidify its value proposition and is being viewed by most as a key value driver for businesses across all industries so adding on a tech platform not only offers operational benefits but can also enhance exit multiples (which at times is needed for platform investments bought at elevated multiples).

- Historically, there have been tech focused financial sponsors, but more firms not traditionally focused on software and technology are raising capital for tech-focused buyout funds.

U.S. VC-backed buyouts (count)*

(Source: PitchBook)

*Data as of Sept. 30, 2018

From both an operating and investment perspective, the value proposition software and technology provides is evident and it is believed that many private equity firms are willing to pivot their investment theses to accommodate attractive growth assets. Based on by some of the existing and emerging trends highlighted above, private equity will continue to monitor VC-backed technology and software business closely throughout the foreseeable future.

For more information on this topic, or to learn how Baker Tilly Capital specialists can help, contact our team.

Sources:

PitchBook 3Q 2018 US PE Breakdown

PitchBook 3Q 2018 NVCA Venture Monitor

Baker Tilly Capital, LLC industry research