2024 Tax Strategy Playbook

Download the Tax Strategy Playbook for tax insights and opportunities that could impact your organization in 2024.

Baker Tilly’s inaugural Tax Strategy Playbook discusses the outlook for the new year’s tax policy landscape, outlines how current tax policy impacts your business and discusses opportunities for tax planning and mitigating inherent risks. We delve into various areas within federal, global and state and local tax.

Explore our Tax Strategy Playbook’s Washington update covering a 2024 Outlook, the potential for bipartisan tax legislation, the 2024 election and interest rates.

As we enter 2024 and the second session of the 118th Congress, the federal government will remain divided, with Democrats in control of the White House and Senate, while Republicans control the House of Representatives. Enactment of new legislation under this configuration necessitates bipartisan, bicameral agreement, something Congress struggled to achieve in 2023.

One of the major hurdles to achieving compromise in 2023 was small majorities in both chambers, which proved to be particularly troublesome for House Republicans, who were often divided among themselves.

While 2023 brought key bipartisan compromises, including two short-term funding packages and raising the U.S. debt limit, only 27 bills passed through both the House and the Senate, making the first session of the 118th Congress historically unproductive.

The tax policy outlook, and whether Congress will generally operate more effectively in 2024, remains unclear. In a divided government, the ability to find bipartisan compromise is essential; however, partisan divides have generally deepened in recent months. The 2024 presidential election cycle could exacerbate disagreements, further hindering the parties’ ability to find common ground.

In October 2023, the House elected Rep. Mike Johnson (R-LA) as speaker as a replacement for Rep. Kevin McCarthy (R-CA), who was voted out by his own party weeks earlier. Whether Republican House members coalesce around Speaker Johnson, or they continue to internally divide will be critical to Johnson’s ability to govern, especially as the speaker enters 2024 with a slim two-seat majority. Speaker Johnson will need to work with the Democratic-led Senate to pass any potential legislation.

We will continue to monitor and report on the tax policy outlook as 2024 progresses.

As Congress returns, the primary focus is on funding the federal government for the remainder of the 2024 fiscal year. Late in 2023, Congress passed an unprecedented multitiered, or “laddered,” continuing resolution (CR) with funding for four appropriations bills expiring on Jan. 19 and another eight expiring on Feb. 2. With time expiring, Congress will attempt to pass a stopgap funding bill that will extend government funding through March 1 and March 8, continuing the laddered approach. The new CR would give lawmakers more time to allocate funds between and write the appropriations bills in accordance with the top-line FY24 spending deal negotiated by Speaker Johnson and Senate Majority Leader Chuck Schumer (D-NY).

There are several modifications to the tax code that have garnered significant bipartisan support heading into this Congressional session. We discuss these in more detail in “The potential for bipartisan tax legislation.”

There are several provisions from the Tax Cuts and Jobs Act (TCJA) of 2017 that are currently scheduled to sunset after the 2025 tax year. The extension, modification or lapse of many of these provisions will largely depend on the outcome of the 2024 elections. We expect tax policy to be in the forefront of 2025 political negotiations, and candidate and party platforms to play a role in upcoming elections.

As we head into 2024, there are a handful of significant tax provisions that have wide-ranging bipartisan support. There has been meaningful consensus regarding the following tax provisions:

While this list at first pass seems promising, where the disconnect looms large is how to pay for these tax breaks. Republicans, not wanting to add to the deficit, would propose further cuts to IRS funding and clean energy provisions provided by the Inflation Reduction Act (IRA). These are both nonstarters for Democrats, who would counter with a number of tax hikes on corporations and wealthy taxpayers as outlined in President Joe Biden’s budget proposal, which are equal nonstarters for Republicans.

The items noted above are all tax provisions that have a chance of passing in the current 118th U.S. Congress. We’d be remiss if we didn’t mention that several impactful tax provisions enacted by the Tax Cuts and Jobs Act (TCJA) of 2017 are scheduled to sunset after the 2025 tax year, absent any legislative extensions or changes. At this time, it seems unlikely these provisions will be addressed in the current year; rather, we expect they’ll be addressed in the 119th Congress as the sunset date draws nearer.

The outcome of the upcoming 2024 election is sure to have a significant impact on the future of tax policy, particularly as we approach the 2026 expiration of numerous provisions contained Tax Cuts and Jobs Act (TCJA). On Nov. 5, control of the House, Senate and presidency will all be up for grabs.

Presidential candidates will be decided over the next several months, as each state conducts its primary elections or caucuses. As the time of publication, the leading candidates are incumbent President Joe Biden and former President Donald Trump.

Early in his presidency, Trump signed the sweeping TCJA, the largest overhaul of the tax code in three decades, into law. Early discussions of Trump’s campaign tax plan include extending the TCJA provisions set to expire in 2026, and further reducing tax rates for both businesses and individuals. In contrast, the Biden tax plan is in favor of maintaining many TJCA provisions but increasing taxes on corporations and certain high-net-worth individuals. Look for more in-depth analysis of presidential tax plans as the 2024 election progresses.

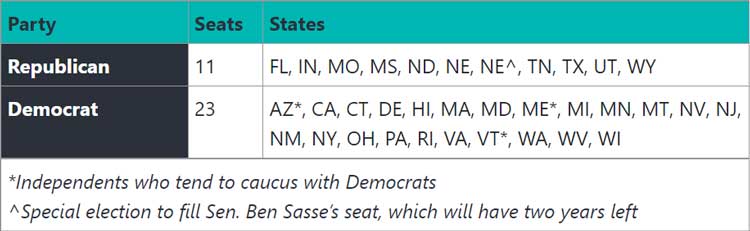

Currently, Democrats lead the Senate with a very slim majority of 51 to 49. This includes three independent Senators who caucus with the Democrats. Holding on to the majority is likely to be an uphill battle. Every two years, approximately one-third of Senate seats are up for election; in 2024, there are 34 seats up for grabs, 33 regular and one special election to fill a recently vacated seat. Of these, more than two-thirds are held by Democrats, several of which represent states who voted for Trump in the last presidential election.

The entire House of Representatives is up for election every two years. While the House has 435 seats, less than 10% of the seats are considered to be considered a “toss up,” meaning either party stands a chance of winning.

We’ll continue to watch and report on relevant insights on the future of tax policy through the 2024 election cycle.

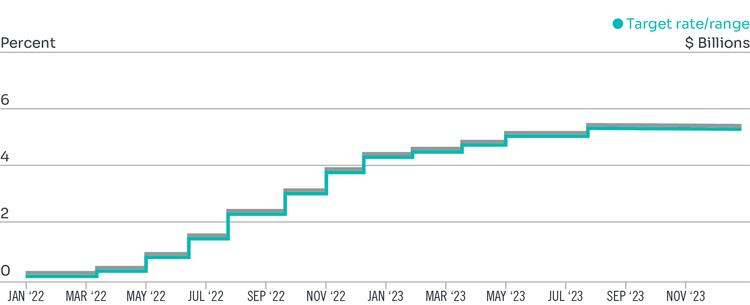

The Federal Reserve (the Fed), whose mandate is to manage U.S. monetary policy, has spent the last two years battling runaway inflation. Their primary tool in this campaign has been increases to the federal funds rate, a target interest rate for commercial banks’ overnight loans. The federal funds rate impacts other interest rates throughout the economy.

In their attempt to curb inflation, the Fed raised the federal funds rate 11 times over the last two years. While this tightening monetary policy has had a positive impact on inflation, it has increased the cost of borrowing, which puts additional pressure on businesses, sometimes delaying additional investments or expansion efforts. In addition, recent tax changes have made interest expense more difficult to deduct, something we discuss in more detail in Rising interest rates and the business interest expense deduction limitation.

The Fed’s most recent meeting, which concluded on Dec. 13, 2023, brought welcome news as the Fed opted to hold rates steady for the third consecutive meeting. Meeting notes, released in early January 2024, indicated most Fed officials believe the Fed is at or near its peak in the current monetary tightening cycle. Furthermore, the notes indicated cuts to the federal funds rate are likely to occur in 2024.

We’ll continue to bring you insights on the Fed’s interest rate policies, challenges associated with the deductibility of interest expense and the impact on taxpayers as new developments arise.

Download the Tax Strategy Playbook for tax insights and opportunities that could impact your organization in 2024.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments. Baker Tilly US, LLP does not practice law, nor does it give legal advice, and makes no representations regarding questions of legal interpretation. Baker Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. © 2024 Baker Tilly US, LLP