Investment options for advance refunding escrow

Introduction

Traditionally, the proceeds from advance refunding bonds are used to purchase State and Local Government Series (SLGS) securities and placed in an escrow with a third-party agent. Open Market Securities (OMS) or cash may also be used. OMS are U.S. Department of the Treasury (Treasury) and (sometimes) Agency securities purchased in the open market. OMS may generate additional savings for the issuer. The use of a bidding agent may be helpful.

SLGS

SLGS are special-purpose non-marketable securities that the Treasury created for the exclusive use of state and local governments to assist them in complying with federal tax laws and Internal Revenue Service (IRS) arbitrage regulations. In 1969, legislation was passed to end the practice of earning arbitrage profits by investing bond proceeds in higher-yielding investments.

SLGS rates are set daily and based on yesterday’s closing Treasury rates. Like Treasuries, SLGS maturities range from one month to thirty years. Unlike Treasuries, SLGS rates do not fluctuate intraday; SLGS are priced at par. Also, unlike Treasuries, SLGS can be tailored to mature on the exact dates needed for escrow disbursements. SLGS are subscribed for directly through the Federal Reserve on the day refunding bonds are sold. SLGS and the refunding bonds settle on the same day.

No SLGS

The Treasury can close the SLGS “window” at its discretion. The window was closed on Mar. 1, 2019, when federal debt reached its ceiling. It reopened on Aug. 5, 2019, after the Bipartisan Budget Act of 2019 suspended the federal debt limit through July 31, 2021.

Taxable municipal bonds can only be refunded with OMS.

OMS

As the name implies, OMS are purchased in the open market to fund an escrow. The indenture of the refunded issue(s) will determine eligible investments. Treasuries trade 24 hours per day. Bond prices fluctuate like stock prices. If today’s bond prices trade lower and yields move higher, then OMS may cost less and yield more than SLGS. Recall that SLGS rates are fixed and based on yesterday’s Treasury rates.

If there is a sell-off in the bond market on pricing day, OMS should cost less than SLGS. Conversely, if there is a rally in the bond market on pricing day, SLGS may cost less than OMS.

One very powerful argument for the use of OMS is zero-coupon Treasuries, known as STRIPS (Separate Trading of Registered Interest and Principal of Securities). STRIPS trade at a discount to their face value and mature at par. The difference between the purchase price and par is the investor’s profit, or investment yield.

Anytime a discounted OMS fits into an escrow, OMS should cost less than SLGS. Recall that SLGS are priced at par.

Agency issuers include the Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC), Federal Home Loan Bank (FHLB) and Federal Farm Credit Bank (FFCB). These issuers are referred to as “government sponsored entities” but are not government guaranteed. As a result, agency securities trade “cheap” to Treasuries. Currently, they offer a couple of basis points more yield than comparable Treasuries.

The agencies can issue “SLGS-like” securities. They are issued at par on the day refunding bonds are sold and settle on the same day as the refunding bonds. Coupon-payment dates are customized to match escrow-disbursement dates.

If agencies are an eligible investment, OMS may cost less than SLGS.

Bidding agent services

A bidding agent performs several useful services and becomes part of the refunding bond financing team. Baker Tilly Investment Services, LLC (BTIS) provides bidding agent services in exchange for a fee. It is important to note that the bidding agent only earns their fee if OMS are used to fund the escrow. Further, the fee is paid directly by the OMS provider, not the issuer. There is no fee for a SLGS subscription. Regardless of the issuer’s choice between SLGS and OMS, there are no out-of-pocket expenses to the issuer.

Steps in the process

- Calculate escrow disbursement dates and amounts

- Determine eligible investments allowed by indenture and statute

- Determine bidding agent fee. The fee is based on the amount of the escrow and the weighted time to disbursement. The result gives the dollar value of 0.01% (one Basis Point [BP]) on the escrow (DV01). If the DV01 is less than $2,500, we recommend SLGS. Our fee is generally less than 0.01% and typically capped at $12,500

- Suppose the value of one BP is $25,000.00. If OMS portfolio yield is two BPs more than SLGS, then the advantage of OMS over SLGS is $50,000.00 ($25,000.00 * 2)

Pre-sale

- If the issuer is interested in comparing the cost of SLGS to OMS, an engagement letter between BTIS and the issuer is drawn up and executed by both parties

- Draft a Request for Offers (RFO) that specifies eligible investments, escrow requirements, fee, deadline for offers, firm time, settlement date, right to reject and compliance with federal safe harbor regulations

- Distribute draft to the working group (issuer, bond counsel, municipal advisor, underwriter, escrow agent and verification agent) for comment

- The RFO specifies that the bidding agent fee be included in the cost of the OMS portfolio

- Forward the final document to a select group of broker-dealers that specialize in the OMS escrow market

- Note that the broker-dealer has also included a profit in the cost of the OMS portfolio

Sale date

- Determine the escrow cost of SLGS

- Accept OMS offers submitted by the deadline and tally the results

- Hold a conference call with the issuer to discuss results, make a recommendation and get a verbal decision in favor of SLGS or OMS

- The firm time for OMS is typically 15 minutes. The deadline for offers and the conference call with the issuer are simultaneous. It is imperative that the issuer commit to the conference call invitation

The following bullet points assume OMS are chosen:

- Receive trade confirmations from broker-dealer

- Forward trade confirmations to verification and escrow agent

- Provide delivery instructions for the broker-dealer to the escrow agent

- Provide escrow-account settlement information to the broker-dealer

Post-sale

- Monitor delivery of securities to escrow agent and receipt of payment to broker-dealer on settlement date

- Prepare Certificate of Bidding Agent, which documents all the offers and the cost of SLGS

The BTIS fee for performing bidding agent services is fully disclosed in the engagement letter with the issuer. The fee is paid by the broker-dealer, not the issuer, and is contingent upon the use of OMS.

No obligation

The choice between OMS and SLGS is typically whichever costs less and generates more savings. The decision is made on the refunding bond sale date under current market conditions. If SLGS are chosen, all broker-dealer offers are rejected. The bidding agent earns no fee.

Negative arbitrage

Negative arbitrage exists when the yield on the escrow investments is less than the yield on the refunding bonds, which creates negative cash flow.

IRS regulation

IRS regulations require that a “fair market value” be obtained for the OMS. The safe harbor for establishing the fair market value requires an entity to conduct a bona fide solicitation for the purchase of the investments and to certify that the lowest cost portfolio (including any broker’s fees) of OMS is not greater than the cost of the most efficient portfolio comprised exclusively of SLGS.

The issuer and bond counsel rely on the Certificate of Bidding Agent to satisfy IRS safe-harbor regulation.

Example

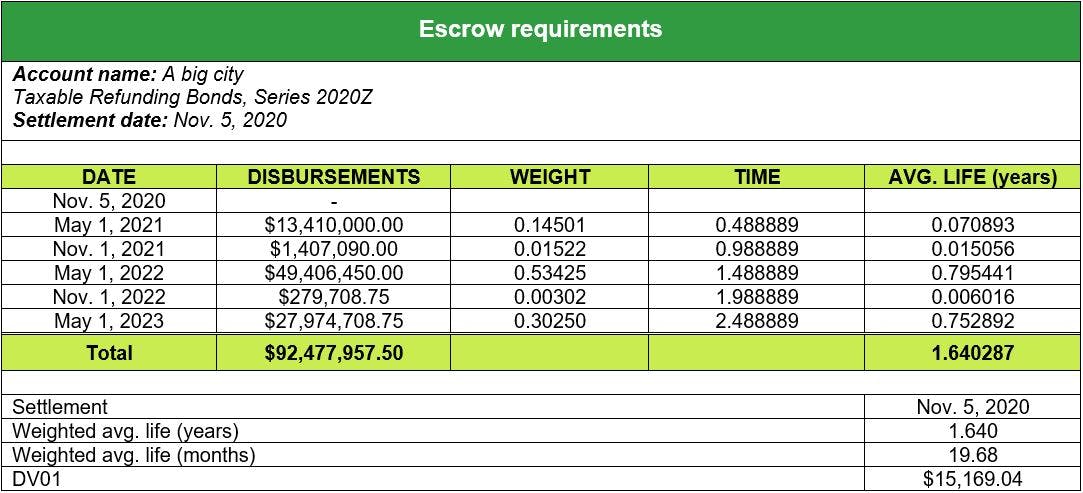

BTIS recently acted as the bidding agent for a big city. The size of the escrow was over $92 million, and the average life of the escrow was 1.64 years. The average life weighs the disbursements by their time to receipt. Every BP represents savings of $15,000. (See Escrow requirements table below.)

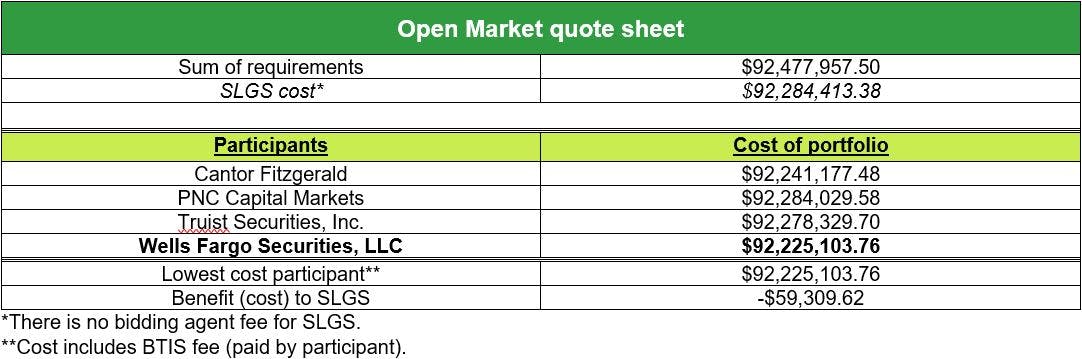

On sale date, we received offers from four broker-dealers. Treasuries and agencies were eligible securities. The winning provider asked the FHLB to issue two SLGS-like securities to fund the May 1, 2022, and May 1, 2023 disbursements: par price, match settle, etc. The advantage of the OMS portfolio over SLGS was almost $60,000, or approximately four BPs. (See Open Market quote sheet below.)

Conclusion

An OMS escrow may generate additional savings over SLGS in a refunding transaction. The combination of market timing, zeroes and (permitted) agencies may favor OMS over long-established SLGS. In addition, there may be times when the SLGS are not available or eligible.

Working with a bidding agent ensures safe harbor for establishing fair market value via a bona fide solicitation process. The issuer and bond counsel rely on the Certificate of the Bidding Agent. The bidding agent fee is disclosed to the issuer, paid to the bidding agent by the broker-dealer only if OMS are chosen by the issuer.

For more information, or to learn how Baker Tilly Investment Services can help, contact our team.

Treasury Direct, State and Local Government Series Securities Overview

GFOA, Refunding Municipal Bonds

JD Supra, SLGS Window Reopening; Sequestration Extended through FY 2029

The information provided here is of general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances a professional should be sought. Baker Tilly Wealth Management, LLC (BTWM) is a registered investment advisor. BTWM does not provide tax or legal advice. BTWM is not an attorney. Estate planning can involve a complex web of tax rules and regulations. Consider consulting a tax or legal professional about your particular circumstances before implementing any tax or legal strategy. Securities, when offered and transaction advisory services are offered through Baker Tilly Capital, LLC (BTC), Member FINRA and SIPC. BTWM and BTC are affiliated entities controlled by Baker Tilly Advisory Group, LP, a tax and advisory firm, trading as Baker Tilly. Baker Tilly is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities.

Investment advisory services are offered through Baker Tilly Investment Services, as a Division of Baker Tilly Wealth Management, LLC, a registered investment adviser. Baker Tilly Wealth Management, LLC is controlled by Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm that provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Wealth Management, LLC