Article

How AI will transform not-for-profit financial management

Frequently changing societal and financial trends are causing not-for-profit organizations to constantly adjust their priorities and goals. Organizations working with lean staffing and small budgets rarely have the resources to truly innovate through technology. Artificial intelligence (AI) has the potential to enhance not-for-profit operations, such as financial management. Computing has become more cost-effective and efficient recently, and technology solutions like AI-powered, not-for-profit financial management are no longer constrained by power or computing capacity.

According to the Brookings Institute, not-for-profits are becoming increasingly interested in the capabilities of machine learning, AI and data analytics. In terms of financial management, these technologies analyze massive data sets in real-time, provide the power to audit every transaction, and meet processing requirements during periods of uneven demand.

This is no longer just about process automation; AI can revolutionize not-for-profit finance. AI can eliminate the close, continuously monitor performance and security, and detect anomalies or irregular transactions in real-time. Learn more about how AI is helping speed time to revenue and actionable insights.

Digital AI assistants

Working with a digital AI assistant is different from using an AI chat bot. Digital assistants help provide continuous assistance and monitoring to humans and chat bots are typically used as an interface to exchange basic information. For example, digital assistants take notes and provide meeting reminders. In financial management software, digital assistants can apply trend lines to your financial data to drive forecasts.

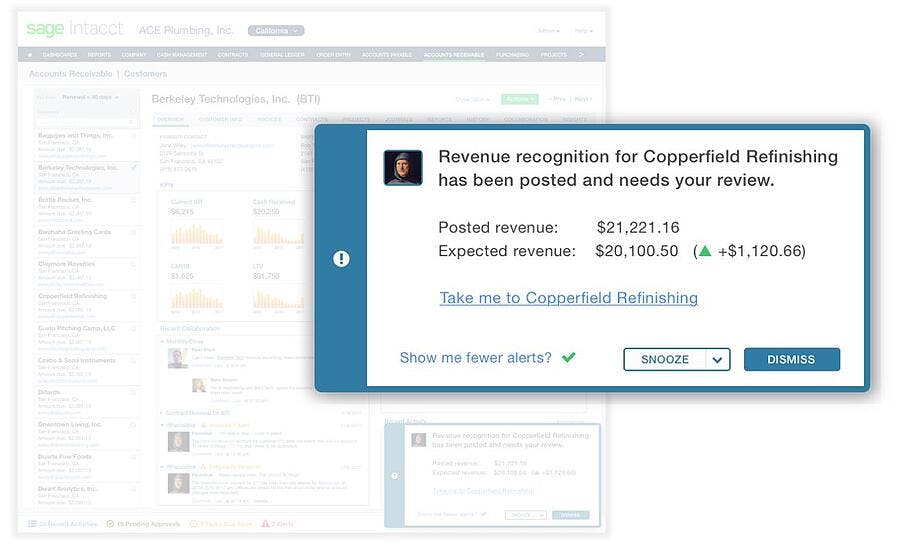

Sage Intacct’s digital assistant provides a conversational interface and acts as an extension of the not-for-profit finance team. It works in the background to monitor performance, watch for unusual activity or unauthorized access, and detect irregular transactions. The digital assistant notifies the appropriate user via alert message when it finds something abnormal so the item can be reviewed. The digital assistant can also be used in corporate communication tools to assist employees who do not work directly in Sage Intacct to speed up processes like expense report submissions and purchase order approvals.

If revenue is recorded in an unusual way, a digital assistant can alert you to take a closer look. In some cases, the assistant may also provide you with a list of recommended action.

Eliminate the financial close

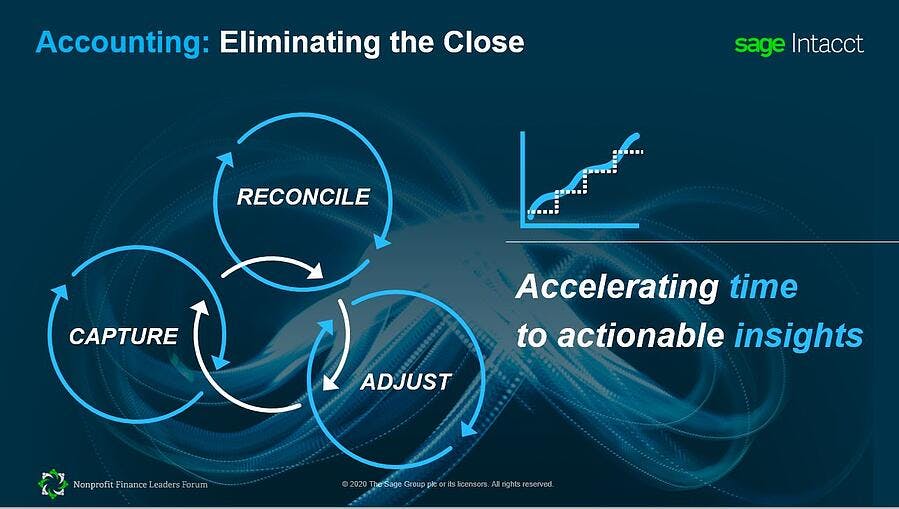

Financial management and accounting vendors have the goal of eliminating the financial close for several years. To do this, financial management software must be able to capture transactions continuously in real-time, reconcile what’s captured in accounting versus external sources, and make adjustments or apply accounting treatments to transactions as information changes.

Less delay to actionable insights

Automating data entry is one way to minimize delays in financial processes. AI helps ensure the quick and easy capture of physical documents, like bills and receipts, needed for Accounts Payable and Account Receivable to take action. AI extracts the relevant data from a picture, scan, or PDF file then categorizes, posts, and reconciles the information in the accounting software.

Speed up time to revenue by leveraging AI

Good time capture is vital to invoicing customers in an accurate and timely manner. Poor time capture has the potential to negatively affect customer satisfaction, cash flow, and overall revenue. AI technology like Sage Intelligent Time allows you to automatically create timesheets for employees as they work. The AI looks at your calendar and uses productivity applications then groups work into blocks of time. AI can also automatically allocate time blocks to specific projects, specific tasks, or clients. Alternatively, employees can manage their own time by manually dragging and dropping blocks of time to the appropriate allocations.

Remote employees can use any device to record time and submit timesheets in one click to the accounting system for billing. AI provides suggestions for time allocation, reducing the need for manual data entry, and encourages employees to review the entries for accuracy before submitting a final timesheet.

AI enables continuous accounting by ensuring all types of transactions are captured continuously . Your books will always be up-to-date with real-time adjustments, reconciliation, and transaction recording. Along the way, potential issues are flagged for action and correction. The system provides a way to analyze and monitor performance throughout the financial period - rather than finding out the truth at the end of the period.

To summarize

AI can help your not-for-profit reduce the amount of time spent looking over the past and spend more time on strategic activities like forecasting. Financial management systems enabled with AI empowers not-for-profits to perform continuous accounting, including quick capture of time and transactions, and store all the details necessary for accurate time tracking. AI is ready to power the future of financial leadership with its ability to drive continuous accounting, assurance, and deeper insights.