House introduces major tax proposals

Introduction

This week, the House Ways and Means Committee began discussing and marking up sweeping draft legislation that substantially modifies many provisions of the Tax Cuts and Jobs Act of 2017 (TCJA).

Changes are expected as the legislation moves through the reconciliation process. It is likely the Senate Finance Committee advances its own version as the Senate works through the budget process. Ultimately, both the House and the Senate will need to combine their respective bills to form one comprehensive package.

In addition to the House legislation, Senate Finance Committee Chair Ron Wyden, D-Ore., proposed a separate bill that would drastically alter partnership taxation, if enacted. Whether any of its provisions will end up in finalized legislation is currently unknown. However, given its potentially seismic effect, its most notable content is discussed below.

Finally, the House bill also includes sweeping international tax changes, which will be covered in an upcoming alert.

Likelihood of passage and timing

In August, Speaker of the House Nancy Pelosi agreed to bring the Senate-passed bipartisan infrastructure bill, outlined in our previous alert, to the floor for a vote by Sept. 27. Ideally, Democratic Party leaders would like to have reconciliation prepared and ready for a vote by that date, but that remains an aggressive timeline. The budget reconciliation process is complex, and many rules in the Senate will likely slow the process. Furthermore, there is little margin for disagreement given the slim majorities the Democrats hold in each chamber.

There are two notable moderate Democratic senators, Joe Manchin (West Virginia) and Kyrsten Sinema (Arizona), who have been vocally opposed to the target price tag of $3.5 trillion, and all 50 Democratic Senate votes will be needed for passage. Given there is not yet a consensus on the various proposals, plus the Senate is still developing its own bill (which will need to be reconciled with the House bill prior to final passage), this process could take until late in the year to be completed.

Actionable items?

You should be aware of these proposals for your own tax planning, but it is important to keep in mind that these are just that, proposals. There is no guarantee any of these will be enacted in their current format, if at all. Recall that the TCJA proposals in September 2017 were quite different, in many cases, to the final legislation that finally passed that December. While the capital gains rate increase would potentially have an effective date of Sept. 13, 2021, that does not mean it may not move to a different date. However, that should not be taken to mean that income should be recognized before the end of 2021 in advance of a potential rate increase. The tax cost should be only one component of an analysis. The ultimate question for an investor should be whether maintaining the investment makes economic sense for them.

Key takeaways: The 12 most impactful provisions

- Individual rate increases

- Expansion of net investment income tax

- Limitations on qualified business income (section 199A) deduction

- Permanent limitation on excess business losses (section 461(l))

- Corporate tax rate increases

- Changes to IRA rules

- Research and experimental expenditures amortization requirement delayed

- Temporary ability for certain S corporations to reorganize as partnerships without tax

- Changes to gain and loss recognition rules

- Changes to gift and estate taxes

- Modification of carried interests rules

- Senate Finance Committee “discussion draft” of partnership legislation

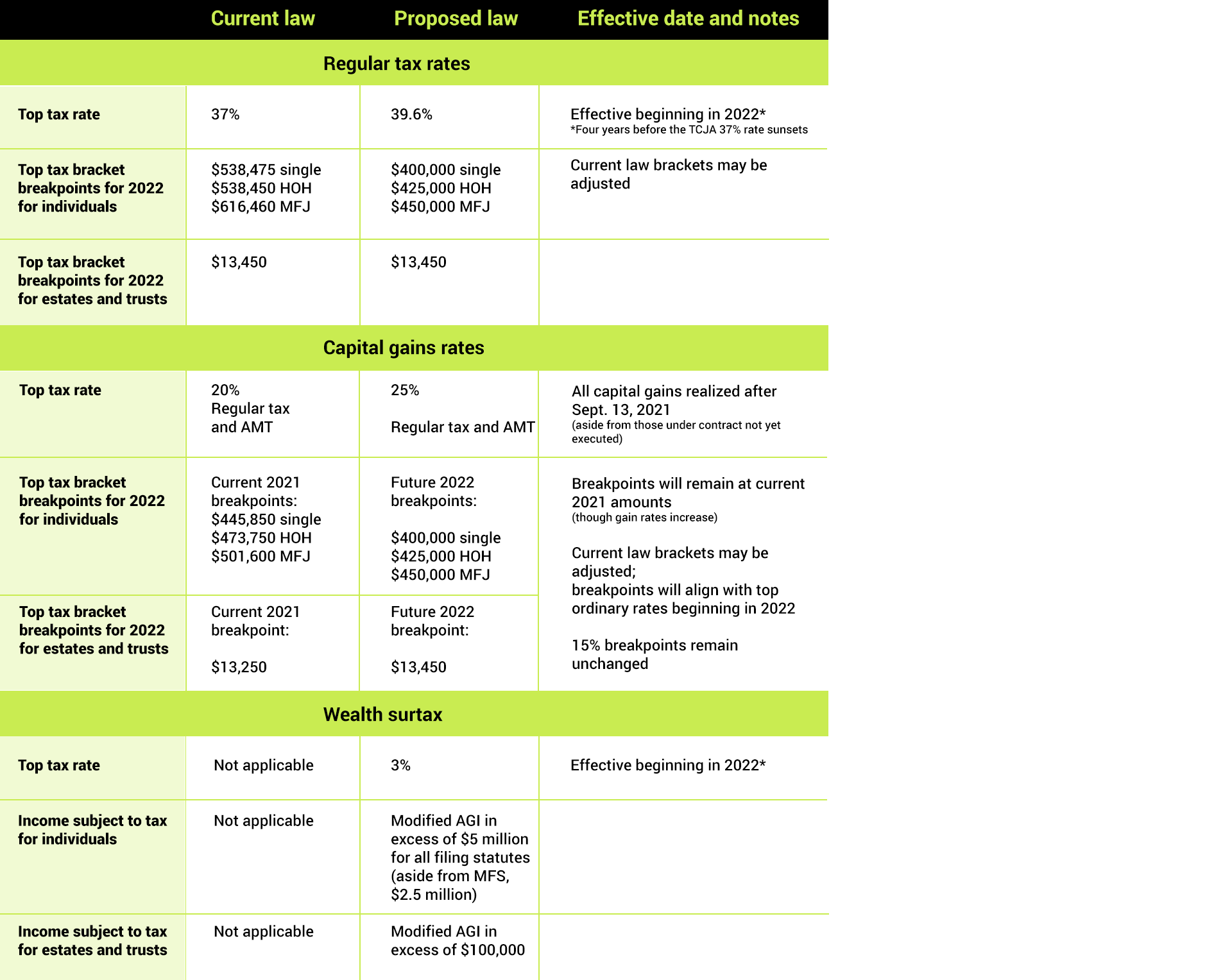

1. Individual and trust and estate rate increases

Top tax rates for individuals, trusts and estates would increase.

2. Expansion of net investment income tax

Net investment income tax would expand to include trade or business income of certain high-income individuals.

- Current law: The net investment income tax only applies to trade or business income to the extent it is passive, generally meaning the taxpayer doesn’t materially participate in the trade or business

- Proposed law: For single taxpayers with taxable income over $400,000 ($500,000 for joint filers), net investment income would include income derived in the ordinary course of a trade or business regardless of whether the taxpayer materially participates

- Effective date: 2022 (tax years after Dec. 31, 2021)

- Notes: Will not apply to any income subject to FICA or self-employment tax

3. Limitations on qualified business income (section 199A) deduction

The qualified business income deduction would be limited to a maximum annual deduction.

- Current law: Section 199A provides a deduction of up to 20% of qualified business income subject to various limitations

- Proposed law: Section 199A deductions would be limited to a total annual deduction of:

- $500,000, married filing jointly

- $400,000, single and head of household

- $250,000, married filing separately

- $10,000, estate and trust - Effective date: 2022 (tax years after Dec. 31, 2021)

4. Permanent limitation on excess business losses (section 461(l))

The excess business loss limitation would become permanent.

- Current law: For tax years 2021-2026, business losses in excess of a threshold amount are disallowed and carried forward as net operating losses (NOLs) under section 461(l)

- Proposed law: The bill would make permanent the excess business loss limitation, and carryforwards would be treated as a deduction attributable to trades or businesses of the taxpayer rather than an NOL, and thus subject to further testing in subsequent years

- Effective date: 2022 (tax years after Dec. 31, 2021)

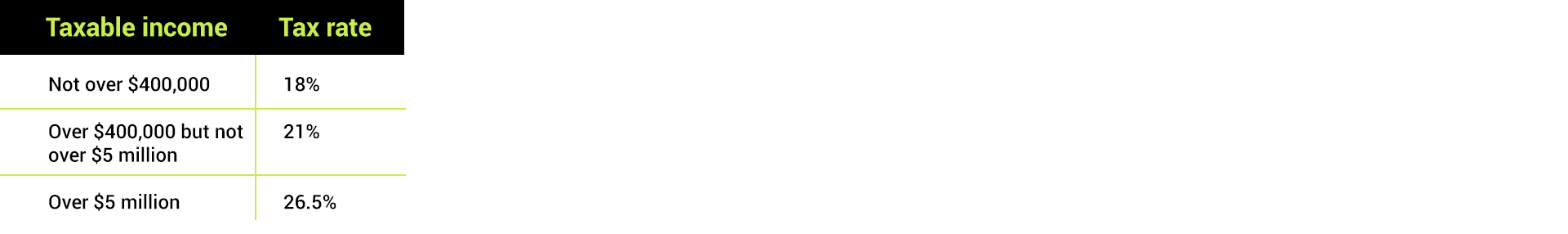

5. Corporate tax rate increases

Corporate rates would return to a graduated rate structure, with an increase in the top rate.

- Current law: The corporate tax rate is currently a flat 21%; corporations are allowed a dividends received deduction of 50% (65% from a corporation that owns 20% or more of a company)

- Proposed law: Tax rates would be graduated:

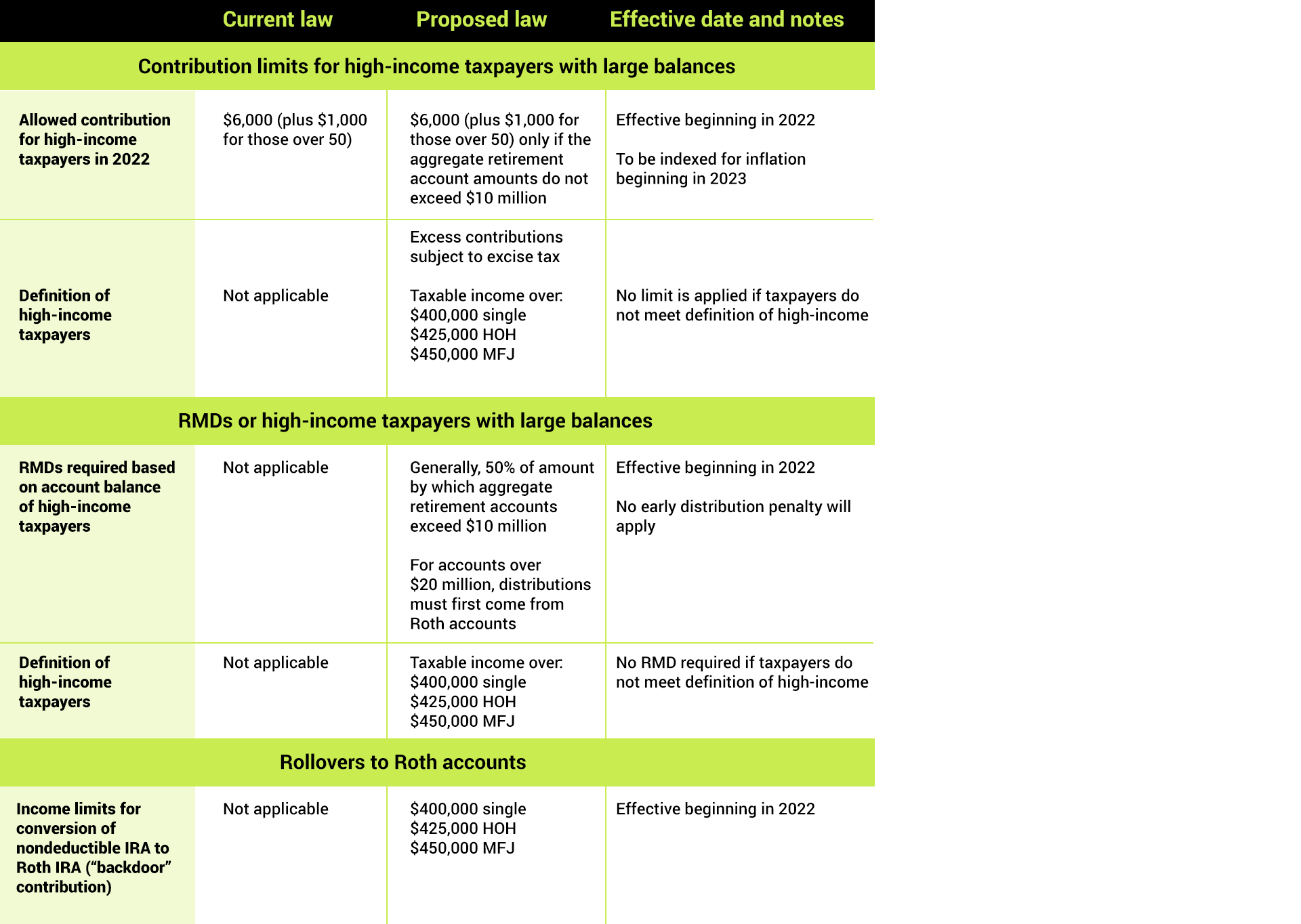

6. Changes to IRA rules

IRAs, particularly those with large balances, would see changes in contribution and distribution rules.

7. Research and experimental expenditures amortization requirement delayed

The requirement to amortize certain expenditures will be further delayed.

- Current law: The TCJA is set to require capitalization and amortization over a five-year period for section 174 research and experimental expenditures beginning in 2022

- Proposed law: The bill would delay the effective date by four years

- Effective date: Capitalization and amortization would be required beginning in 2026

8. Temporary ability for certain S corporations to reorganize as partnerships without tax

- Current law: S corporations reorganizing into partnerships are subject to applicable federal income tax to the S corporation and/or its shareholders

- Proposed law: S corporations that existed as S corporations before May 13, 1996 (prior to “check the box”) would be able to completely liquidate under section 332(b) and transfer substantially all of its assets and liabilities to a domestic partnership, allowing the partnership to be treated as if it were an 80% distributee corporation under section 337(c) and a successor corporation under section 1362(g)

- Effective date: Transactions occurring in 2022 and 2023

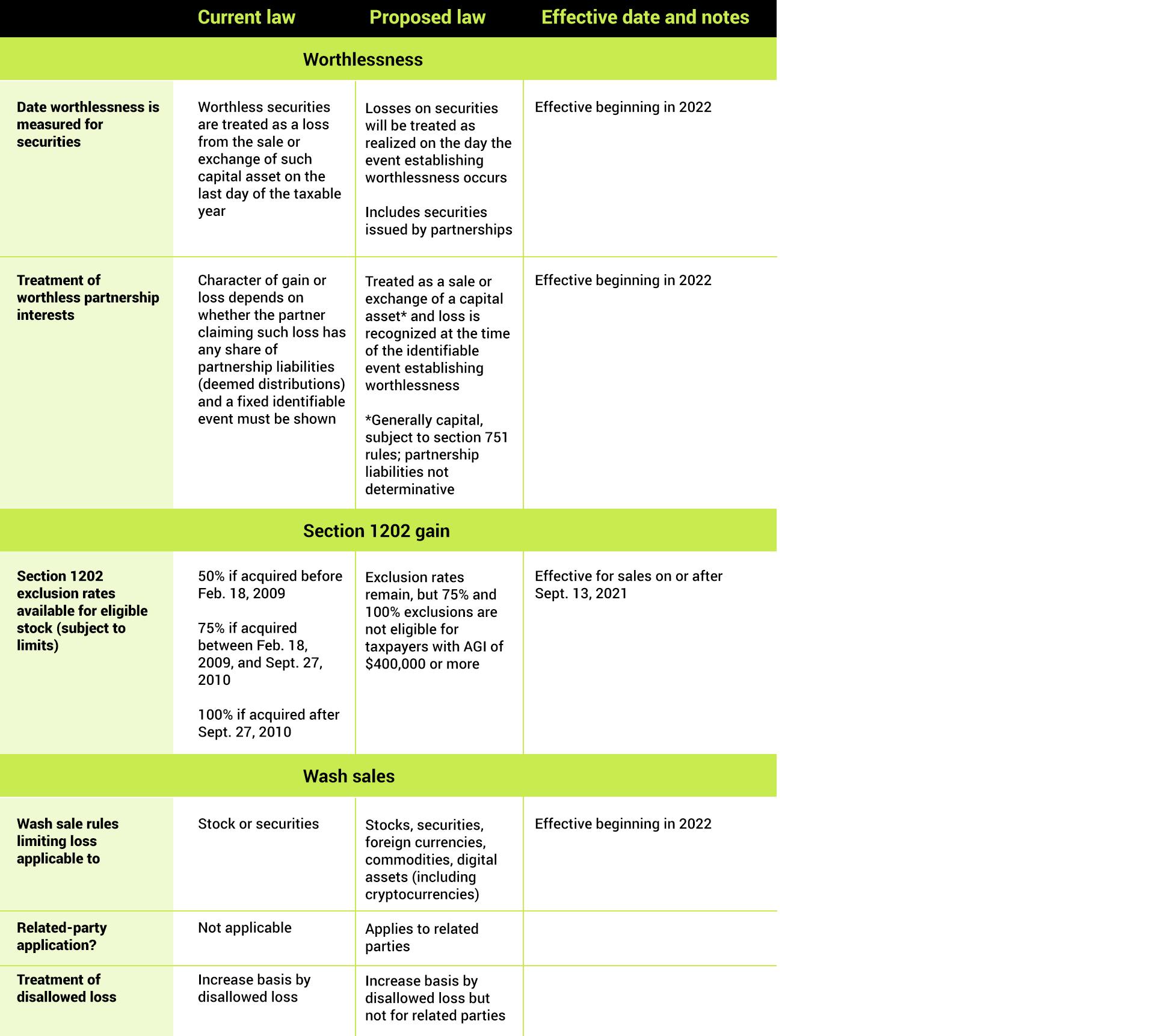

9. Changes to gain and loss recognition

Several changes are proposed related to various gain and loss recognition standards.

10. Changes to gift tax and estates

The unified credit would revert to pre-TCJA levels.

Termination of temporary increase in unified credit

- Current law: The TCJA doubled the unified credit available for transfers by gift and at death to $10 million (indexed for inflation) for transfers made between 2018 and 2025

- Proposed law: The increased credit would expire at the end of 2021, four years early; this would reset the exclusion to $5 million (indexed for inflation), and in 2022, the indexed amount would be $6.05 million

- Effective date: 2022 (tax years after Dec. 31, 2021)

The proposed bill also makes meaningful changes to the treatment of grantor trusts, attempting to align the income tax and transfer tax rules. Of note for estate administration is a provision that would include the grantor trust in a deceased owner’s estate if the grantor was the deemed owner of the trust. Transactions between a grantor trust and the grantor would also become fully taxable.

11. Modification of carried interests rules

Rules for partnership interests held in connection with performance of services would be altered.

- Current law: Currently, long-term capital gain treatment is available for carried interests held by a taxpayer for three or more years

- Proposed law: Carried interest holding periods would generally be extended from three years to five years to obtain long-term capital gain treatment (excluding interests in real property trades or businesses or for taxpayers with AGIs under $400,000); the definition of specified assets is expanded to include some partnership interests themselves, and new, more stringent rules are provided for measuring the start of the holding period

- Effective date: 2022 (tax years after Dec. 31, 2021)

12. Senate Finance Committee “discussion draft” of partnership legislation

In addition to the House bill, as previously mentioned, Sen. Ron Wyden proposed legislation that would drastically alter partnership taxation if enacted. While it is far too early to know if the Senate Finance Committee will approve all or a portion of this proposal, the provisions are far reaching. Among the changes proposed are:

- The remedial method would be required in order to recognize built-in gains more quickly on contributed property.

- Upon a change of ownership interests, revaluation of the partnership’s assets and partners’ capital accounts would be mandatory when appreciated property is contributed, again resulting in faster gain recognition.

- Mandatory basis adjustments arising from partnership distributions and transfers of partnership interests, meaning the elective adjustments to adjust the basis of partnership property in these situations would be repealed.

- Flexibility in the allocation of income and losses would be greatly reduced and, for certain related-party partnerships, the proposal would require all income and losses to be allocated pro rata.

- The recourse debt rules would be significantly modified and a new provision would require all debt be shared between the partners in accordance with partnership profits. An exception to this provision is provided in cases where the partner (or a person related to the partner) is the lender. The provision would be effective for tax years beginning after Dec. 31, 2021. A transition rule is provided allowing taxpayers to pay any tax liability that arises as a result of the enactment of the provision over eight years.

The House bill does not contain similar provisions, but that does not mean this would not move forward.

Notably absent provisions

Several anticipated provisions did not make it into the current House draft of the reconciliation bill. As noted above, we may see these appear in subsequent House versions, a Senate version and/or the final reconciliation bill. The following were notably absent:

- Repeal of the state and local tax (SALT) deduction limitation of $10,000

- Ending step-up in basis of assets to fair market value as of the date of death for estates

- Ending like-kind exchange tax deferrals for real estate gains in excess of $500,000

- Application of a 15% minimum tax on book income for corporations with book income in excess of $2 billion

More on the table

The legislation also contains many more provisions, including President Biden’s priorities such as expansion of the child tax credit, improvements to the child and dependent care tax credit, and dozens of others.

We encourage you to connect with your Baker Tilly advisor regarding how any of the above may affect your tax situation.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.