The growing impact of inflation on not-for-profit organizations

While inflation is often associated with individuals, families and the increased cost of living on a year-over-year basis, the concept certainly has significant relevance to companies and not-for-profit (NFP) organizations.

In particular, NFPs need to be cognizant of inflation – where it is today and where it is likely heading in future years – and the primary areas of their organization that it impacts.

To begin, what is inflation exactly?

The Federal Reserve defines inflation as the measurement of the increase in prices of goods and services over time. Inflation is not measured by any particular good or service cost increase, but rather as a general increase in the overall price level of goods and services in the economy.

Changes to inflation are monitored by several price indexes, including the consumer price index (CPI). The CPI, which is released by the Department of Labor each month, measures the average change over a period of time of prices paid by consumers for a market basket of goods and services.

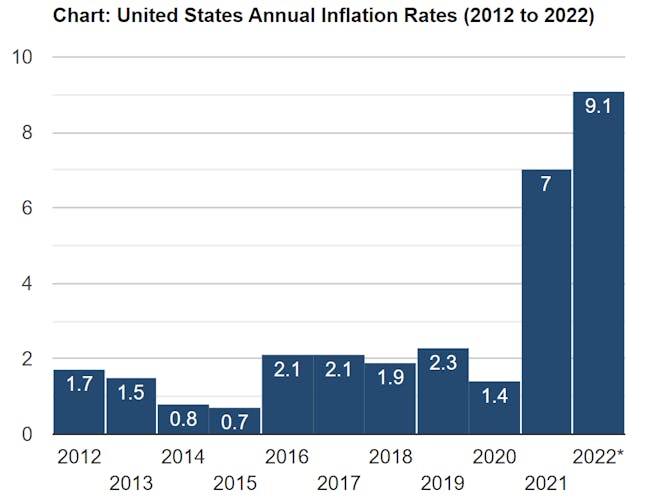

This topic is particularly relevant in 2022, as inflation is at a general 40-year high. Inflation levels peaked in May 2022 at a level not seen since December 1981. Inflation showed a small decrease since March and is currently at 8.6% for the 12 months ended May 2022. And as inflation rises, so too does the demand for not-for-profit goods and services – and so too does its potentially negative impact on organizations of all shapes and sizes.

Source: Current U.S. inflation rates: 2000-2022 | U.S. inflation calculator

With that in mind, what factors should NFPs consider in order to stay ahead during a period of high inflation? We have highlighted four key areas in the following section.

Inflation impact areas to consider

Revenues

Donations and pledges can be a significant source of revenue for many not-for-profit organizations. In a time of rising inflation, multiyear pledges of donations may not be as valuable as they have been previously, nor as attractive as one-time donations. Under SFAS 116 (ASC 958), an unconditional and legally enforceable pledge spanning over multiple years requires the NFP to account for the future cash flows and discount to present value using an appropriate discount rate. This discount rate should be adjusted for inflation and thus may result in less revenue recognized over time in a high inflation environment.

What can NFPs do? Organizations may need to go back to their current donors and request larger donations or higher pledges to help offset the discount factor. They may also want to consider expanding their donor pool to meet their immediate budgetary needs. Investing in a capital campaign or otherwise engaging a fundraising specialist may also be a solution, but it’s one that comes with additional cost.

Some not-for-profit organizations also rely on income earned from investments.

Depending on the type of investment, inflation can have a negative impact on current and future returns on investments. Investments in certain fixed income investments might be unfavorable to NFPs, since the income earned on these are low (lower than inflation rate) or fixed over time.

Stocks have fluctuated in periods of inflation, and so may become less predictable in this environment. As long as these for-profit companies can keep up with rising overall costs, there may not be much of a decline in their overall stock value. But this volatility could be detrimental to public and private foundations and those supporting organizations that rely on their investment earnings to make their required annual distributions. And it may adversely impact organizations that maintain endowment funds, as the returns could be smaller than what they saw during the peak of the pandemic, depending on their investment strategy.

The key for NFPs is to assess and possibly reconsider their investment portfolios – largely dependent on organizational goals and budget – to mitigate their risk and provide for an appropriate return on their investment, based on the needs of the NFP.

Expenses

With potentially decreasing revenues, how can not-for-profit organizations offset their own rising expenses? Will they need to simply absorb these rising costs?

When NFPs provide essential goods or services, they tend to do so at a discount. In these instances, raising the prices charged to their customers or clients may not be an option. In turn, these organizations may be forced to absorb the burden of additional costs and report lower margins. They may also need to invest in other resources to help offset other financial impacts of inflation, like raising additional funds or demonstrating competitive value, so planning becomes particularly crucial.

NFPs should contemplate other areas of their operations where these costs can be passed on. This could mean increasing fundraising event ticket costs, increasing membership dues or initiating special assessments for their members, or increasing prices for other goods sold to the general public that are not directly related to the mission, such as merchandise. It’s important to note that there may be additional income or sales tax costs associated with the latter if the activity is considered unrelated to the overall mission of the NFP.

Of course, one of the largest categories of expenses of a not-for-profit organization is salaries and benefits. And it is no secret that employee retention has become one of the biggest challenges facing employers across all industries, especially in the not-for-profit world.

According to a recent not-for-profit talent survey, the primary reasons for voluntary turnover at NFP organizations were listed as:

- Better opportunity

- Dissatisfaction/disengagement with current organization and culture

- Compensation/benefits

Naturally, this places many organizations in direct competition to provide more opportunities for advancement, higher salaries and better benefits, as well as a heightened focus on culture within the organization.

With this in mind, having a formal talent retention strategy is more important than ever. And with inflation at a four-decade peak, any increases in salaries and benefits layered with other intangible benefits involved in employee retention makes things more complicated than they used to be.

The impact of inflation is everywhere

Simply put, the impact of inflation can be felt across all industries, although NFP organizations are feeling it particularly hard. Smaller organizations, specifically those that are volunteer-run or heavily reliant on donations, may not easily escape the reality of record-setting inflation.

However, by being aware of the impact areas and by taking proactive steps to evaluate the current state and future challenges, organizations can still prepare themselves for success in 2022 – and beyond. Connect with our team for more information on how Baker Tilly can assist not-for-profits with inflation-related planning or to discuss your specific situation.

The investment information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought.