Embracing a data driven culture: how to transform your finance organization

Over the last 10 years, the movement toward using data and analytics on a greater scale has increased significantly across many industries. Analytics tools have evolved and data technology has become smarter, faster and more user-friendly. Companies, more than ever, are viewing analytics reports as assets. Data isn’t just something an organization has, it’s something an organization needs. And, more than that, data has become something an organization depends on.

Of course, with that mindset, there are significant challenges when it comes to generating economic value from your organization’s data. Primarily, the challenges are:

- Understanding how to leverage new data sources

- Maintaining high quality core data assets

- Overcoming barriers to transition to a data-centric culture

From connected devices to communications and service tools, data sources (both internal and external) are growing at an exponential rate. It can be overwhelming to consider the vast number of sources and how much data is created on the internet every single minute. This bombardment of data presents a technical challenge, but also a business challenge: How do I value this data and how to do I drive value from it?

The final client-facing product may look pretty, but at its essence, data is not clean. Only 3% of participants at a recent Baker Tilly webinar described their organization’s data as “a beautifully integrated single view of our organization.” Meanwhile, nearly one-third of participants described their data as “complete chaos.”

Becoming data literate requires hard work and change. A lot of organizations, as they mature, use data to inform more decisions. But the truth is that many organizational leaders are threatened or overwhelmed by data. Organizations often need to undergo a cultural shift to get business leaders to embrace data, before they can become a more data-driven organization.

Data’s impact on the CFO’s role

As the financial steward of an organization, the CFO is responsible for ensuring funds and capital are used appropriately and efficiently. However, now more than ever, the CFO and their team are becoming the strategic center in charge of overseeing data, in many cases.

The finance executives on the webinar reported that they are often asked to provide more detailed analysis to support strategic decision making and that they are starting to build their own applications to support analytical needs. It is clear that the role of the CFO office in an organization’s data and analytics strategic plan is not going away any time soon.

Developing a strategic approach to analytical maturity

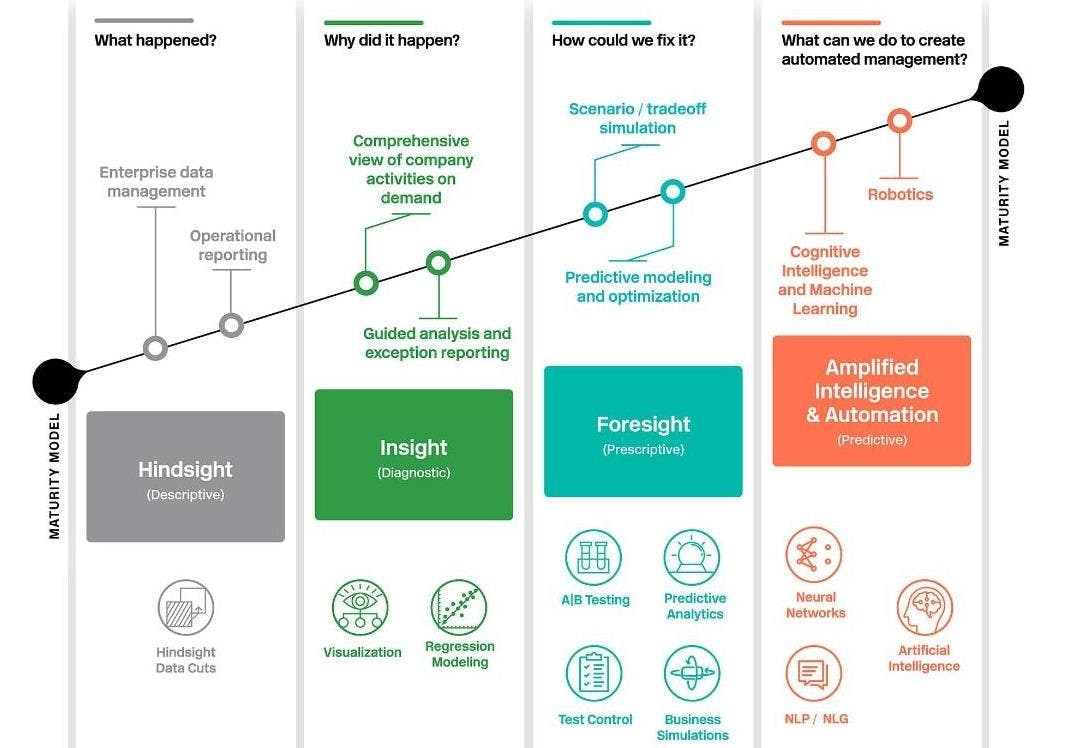

Our analytical maturity model demonstrates that you cannot buy a basic tool or implement a simple solution and jump to a high level of analytical maturity. There are four levels within our maturity model, as highlighted in the graphic below, and these phases often take place over a matter of years – it’s an ever-evolving process.

The four levels of our analytical maturity model are:

- Hindsight: Can we look backwards and see what has happened? Is the data clean, consistent and easy to understand?

- Insight: Now that we know what has happened, we want to know why has it happened?

- Foresight: Now that we know why things have happened, how we can stop it from happening again?

- Amplified intelligence and automation: Now that we can look ahead to hopefully prevent negative outcomes, how do we use automation to simplify this process moving forward?

Data and analytics strategy: What are the key areas to address?

From a data and analytics strategy standpoint, we want to highlight four key areas that organizations must address to create a foundation of long-term success. The emphasis on these areas needs to be collaborative, not independent, as each area is related to the other three.

- People: Employees must understand and properly leverage data to make informed decisions

- Process: Well-established processes must be in place to ensure data is ingested, stored, delivered and consumed properly

- Organization: From the top down, the organization must be aligned, compatible and committed

- Technology: The right tools must be in place to allow data efforts to launch, evolve, mature, and scale with ease

The webinar participants ranked “process” (including planning, governance and quality) as the area that needs the most attention in their organization. Of course, it is not possible to overhaul the entire organization at once so it becomes imperative to prioritize areas of the business as part of your strategic planning.

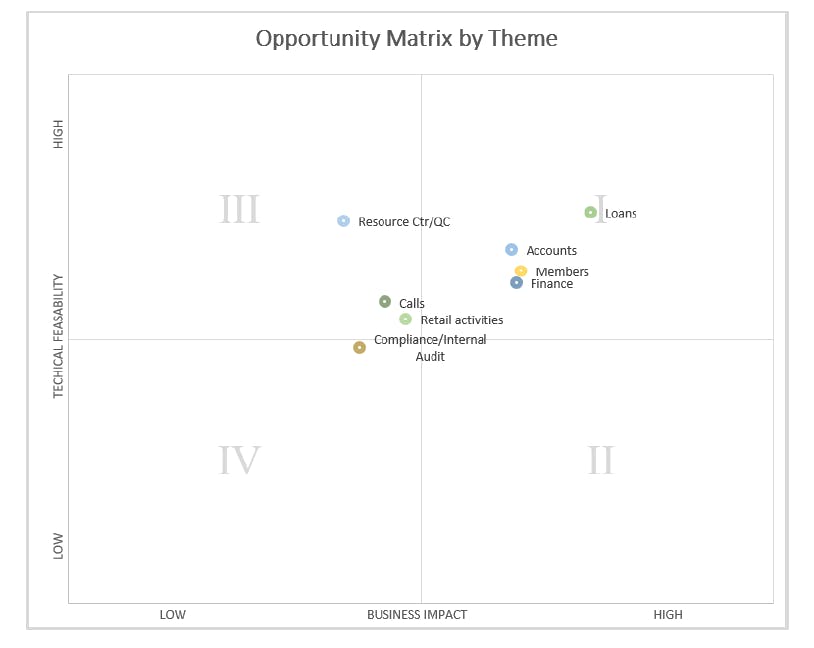

We recommend using an opportunity matrix, like the example below, to rank areas of the business by technical feasibility and business impact. The areas in Quadrant #1 (top-right) with a high technical feasibility and a significant potential impact on the business, are generally the areas you want to prioritize.

Finally, you need to attack these priorities in an agile fashion. What does that mean? Basically, you need to demonstrate value quickly through a series of quick sprints – rolling out new features, analytics, capabilities, features and functions every two weeks. And, you need to be able to adapt to unexpected changes, obstacles and new information gleaned from the data.

Though it can be daunting to get your organization to embrace your data in order to transform your finance function, it is essential to continue to grow your business and set your organization up for future success. If you’re having trouble determining where to start, Baker Tilly can help guide you through this process. We will work to get to know you and your business in order to walk side by side with you through the transformation of your data and analytics capabilities.

Contact us to learn how to transform your finance organization.