The primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management.”“It is important that management, with the oversight of those charged with governance, places a strong emphasis on fraud prevention, which may reduce opportunities for fraud to take place, and fraud deterrence, which could persuade individuals not to commit fraud because of the likelihood of detection and punishment. This involves a commitment to creating a culture of honesty and ethical behavior, which can be reinforced by active oversight by those charged with governance.AICPA, AU-C Section 240 - .04, Consideration of Fraud in a Financial Statement Audit

All the Queen’s Horses, an illuminating look at government fraud

One of the most famous stories in all of literature — the tale of Humpty Dumpty — has become a metaphor for the fragile nature of power, a reminder of the catastrophic collapse and irreparable damage that greed can cause. Kelly Richmond Pope’s riveting documentary, fittingly titled All the Queen’s Horses (Horses), tells another such story.

Pope’s film is a story of how one person’s fraud — enabled by poor internal controls — left a humble Midwest city struggling to put itself together again.

How does $53 million disappear?

An award-winning film now available on streaming platforms, Horses documents the largest municipal fraud in U.S. history. The victim: Dixon, Illinois, a modest municipality with a population of around 15,800. The perpetrator: Rita A. Crundwell, the city’s controller and treasurer for close to 30 years. In 2012, Crundwell confessed to embezzling more than $53 million, used to support her championship quarter horse breeding operations and a lavish lifestyle.

To watch this illuminating, sobering film is to witness a shocking institutional collapse. Horses leaves many viewers bewildered that theft of such a magnitude could happen for so long without being detected — especially in a community with a general fund budget of only $8 to $9 million per year. But as the film makes clear, the crime was made possible by basic failures of governance, controls and operations. Specifically, the film demonstrates the following truths:

1. Basic internal controls are an absolute necessity; no matter how trustworthy people seem.

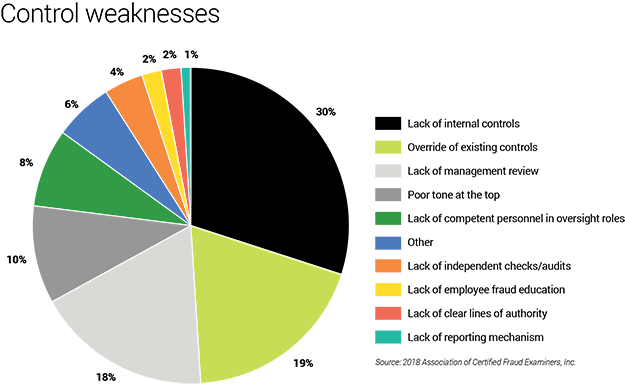

Crundwell was a long-time and trusted employee. She did it all —opening the mail, preparing and signing the checks, and reconciling the bank accounts. As the film shows, entrusting all of these responsibilities to one person was a crucial mistake, a major control deficiency that enabled Crundwell to steal money undetected. Failure to enact basic internal controls like these contributes to 30 percent of the frauds that occur. Below are other control weaknesses governments need to consider.

2. Tips are essential in fraud detection.

According to “Report to the Nations: 2018 Global Study on Occupational Fraud and Abuse" from the Association of Certified Fraud Examiners, Inc. (ACFE), a tip is the number-one fraud detection method. As was the case in Dixon, the tip is typically reported by an employee. In addition to the employee tip, the city received a letter from a neighboring community that something was amiss with the City of Dixon’s financial statements based on their similar size and proximity.

3. Often, there is more than one red flag.

Crundwell lived a lavish lifestyle, far beyond the means of your average municipal controller. She portrayed an image to some that her quarter horses and the many awards that she won were the source of her wealth. Others thought she inherited her wealth.

Donald R. Cressey pioneered a concept called the “fraud triangle,” which details the motivations behind workplace fraud. Crundwell’s story hits all three:

- Pressure or the incentive to commit fraud. In this case, Crundwell’s need to care for 400 beloved quarter horses and to maintain her lavish lifestyle (motor coach, multiple homes, jewelry, etc.)

- Rationalization or justification. Crundwell kept very good records of the money she embezzled and was quite skilled at explaining away accounting inconsistencies.

- Opportunity. Crundwell had total control and knowledge of Dixon’s financials, and this power enabled her to carry out the fraud.

4. The governing body and management have the primary responsibility to prevent and detect fraud.

The citizens of Dixon were shocked by the scandal and felt the city council should have known what was going on. The media blamed the city’s commission form of government. Subsequent to the fraud, the city changed its form of government and had significant turnover on the city council including the election of a new mayor.

Constituent concern was justified. Audit standards make clear that the governing bodies and management have the primary responsibility to prevent and detect fraud:

Morals of the story

At a crisp 70 minutes, Horses is well worth the time of those serving on a governing body as well as those in management. Beyond the entertainment value, the film provides clear takeaways for every government entity to consider.

- Develop or update your tip or whistleblower policy so people know what to do if they see something suspicious. It protects the person reporting the activity as well as the accused. Governments should have a communication plan ready if something goes wrong and know who to call (general counsel, labor attorney and possibly the district attorney) when action becomes necessary.

- Regularly examine and update your system of internal controls, especially segregation of duties over key transaction cycles – disbursements (including electronic and ACH payments), payroll, utility billing, receipting and taxes. In small communities that must consider the cost-benefit of a system of internal control, there are usually a few key controls will go a long way. Crundwell did all of the “important things.” There was too much control with one person and no compensating controls in place.

- Provide capital project oversight and monitoring the spend down of bond proceeds. Many of Crundwell’s fictitious invoices were for capital projects presumably to be paid for with bond proceeds.

- Ask whether any of your employees exhibit red flags or fit the characteristics of the fraud triangle.

- Ensure your governing body sets the appropriate tone at the top in preventing fraud. Crundwell was able to commit her crimes undetected because she quickly realized no one was watching.

- Read your insurance policy to ensure it covers fraud and the investigation of fraud.

- Conduct a fraud risk assessment. If it’s been a while since the last time your government had a fraud risk assessment, let this film be a reminder of how important this process is.

Dixon, Illinois is the hometown of former president Ronald Reagan. When describing his approach to Soviet diplomacy, Reagan frequently used the line “Trust but verify.” This philosophy is also a good approach to government operations. Dixon trusted Crundwell, but they did not verify — and by doing so, they missed an outrageous financial crime happening in plain sight.

For more information on this topic, or to learn how Baker Tilly state and local government specialists can help, contact our team.