SEC issues new pay versus performance disclosure requirement

On Aug. 25, 2022, the Securities and Exchange Commission (SEC) adopted Release No. 34-95607 (Final Rule), amending Item 402 of Regulation S-K to include a pay versus performance disclosure requirement. The amendment was initially proposed in 2015 following a mandate in the Dodd-Frank Act requiring registrants to disclose information on the relationship between their financial performance and amount of executive compensation paid.

Who is affected?

The Final Rule will apply to all reporting companies, except foreign private issuers, registered investment companies, and emerging growth companies. Smaller reporting companies (SRCs) will be permitted to provide scaled disclosures.

When does the rule become effective?

Registrants must begin to comply with these disclosure requirements in any proxy and information statements that are required to include Item 402 executive compensation disclosure for fiscal years ending on or after Dec. 16, 2022. Registrants, other than SRCs, will be required to provide the information for three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the two subsequent annual proxy filings that require this disclosure. SRCs will initially be required to provide the information for two years, adding an additional year of disclosure in the subsequent annual proxy or information statement that requires this disclosure.

What are the disclosure requirements?

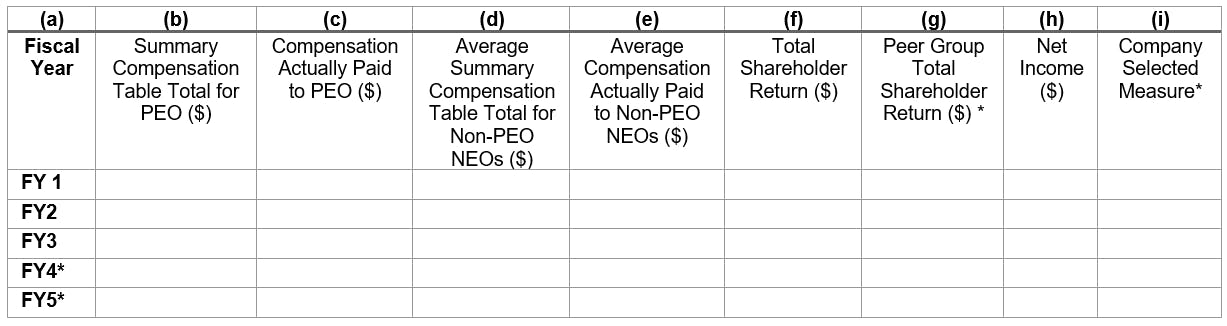

For each of the five most recently completed fiscal years or, for SRCs, the three most recently completed fiscal years, covered reporting companies must disclose the following. Note: SRCs are subject to abridged reporting requirements under the new rule, and as such, are not required to provide some of the disclosures listed below. Disclosures not required of SRCs are denoted below with an asterisk.

Executive compensation data

- Total compensation of the registrant’s Principal Executive Officer (PEO), as reported in the Summary Compensation Table (SCT)

- Compensation “actually paid [1]” to its PEO

- The average of the total compensation, as reported in the SCT, for all named executive officers (NEOs) other than the PEO

- The average of the compensation “actually paid” to all NEOs other than the PEO

Financial performance data

- Total shareholder return [2] (TSR) for the registrant

- TSR for the registrant’s peer group*

- The registrant’s net income

- A financial performance measure chosen by the registrant and specific to the registrant (the Company-Selected Measure) that, in the registrant’s assessment, represents the most important financial performance measure the registrant uses to link compensation actually paid to the registrant’s NEOs to company performance for the most recently completed fiscal year (e.g., total revenue)*

- An unranked list of the financial performance measures used by the registrant to link executive compensation actually paid to the registrant’s NEOs during the last fiscal year that are most important to company performance*

Descriptions of relationships between executive compensation and firm performance

Using the data provided above, for the five most recently completed fiscal years, registrants are required to provide clear descriptions of the relationships between the following. Note: SRCs will only be required to present such descriptions with respect to the measures they are required to include:

- The compensation actually paid to the registrant’s PEO and (1) the cumulative TSR of the registrant, (2) the net income of the registrant, and (3) the registrant’s Company-Selected Measure

- The average of the compensation actually paid to the registrant’s remaining NEOs to (1) the cumulative TSR of the registrant, (2) the net income of the registrant, and (3) the registrant’s Company-Selected Measure

- The relationship between the registrant’s TSR and the peer group TSR

Format requirements

Executive compensation and financial performance data

The Final Rule requires that covered companies provide executive compensation and financial performance data in table format, as depicted below. Note: SRCs are not required to include those items marked with an asterisk. Both company TSR (column f) and peer group TSR (column g) should be calculated based on a fixed investment of $100 at the measurement point.

Relationship descriptions:

Under the Final Rule, covered companies have flexibility as to the format in which to present the descriptions of these relationships, whether graphical, narrative or a combination of the two. Companies also have the flexibility to decide whether to group any of these relationship disclosures together when presenting their clear description disclosure, but any combined description of multiple relationships must be made clear.

Filing requirements

All covered companies, except SRCs, must use Inline XBRL to tag the pay versus performance disclosure in their initial year. SRCs will only be required to provide the required Inline XBRL data beginning in the third filing in which it provides pay versus performance disclosure, instead of the first.

Contact our team for more information on this topic, or to learn more about Baker Tilly's accounting and assurance services, including SEC topics.

[1] Under the Final Rules, compensation “actually paid” is calculated for a given fiscal year by adjusting the officer’s total compensation, as reported in the SCT, for certain amounts relating to defined benefit pension plans and equity awards. Note: SRCs are not required to disclose amounts related to pensions for purposes of disclosing compensation actually paid.

[2] According to the Final Rules and SEC comments, both the company cumulative TSR and peer group cumulative TSR measurements should be calculated for in the same cumulative manner as calculated under Item 201(e) of Regulation S-K for the performance graph. Both company cumulative TSR and peer group cumulative TSR should be calculated based on a fixed investment of $100 at the measurement point.

© 2024 Baker Tilly US, LLP