Webinar

Streamlining Inflation Reduction Act prevailing wage and apprenticeship compliance

Bonus energy tax credit solutions for contractors and project owners

Inflation Reduction Act (IRA) prevailing wage and apprenticeship is not the same as Davis-Bacon regulations previously seen on federally funded projects. To receive an allocation of this tax credit, a project will need to continually evaluate compliance and endure stringent record-keeping requirements for extended periods of time. Baker Tilly and LCPtracker have a end-to-end solution for contractors that offers complete data-set coverage, shielding proprietary payroll data from customers, while mitigating risk for project owners using technology to establish, monitor and document all three pillars of compliance: prevailing wage, apprenticeship and penalties.

Baker Tilly's Inflation Reduction Act advisors recently held two webinars in coordination with LCPtracker exploring the prevailing wage and apprenticeship (PW&A) enhancement credit, stringent regulations and our compliance solution. In today's competitive marketplace, PW&A compliance presents project owners with an opportunity to optimize their tax credit earning potential, while also providing contractors and subcontractors a competitive advantage if they can substantiate compliance. By understanding and adhering to PW&A standards, contractors position themselves to secure contracts and assist project owners in maximizing opportunities under the IRA.

Continue reading or access the on-demand webinar now.

What is the Inflation Reduction Act (IRA)?

The IRA included $270 billion of energy incentives and tax credits. Projects complying with the IRA’s prevailing wage and apprenticeship requirement can significantly enhance credit value, therefore many project owners will be asking contractors to comply.

Under the IRA, funding is allocated across more than 70 distinct tax credits, including section 45 and section 48 credits. Leveraging these incentives can result in a substantial bonus of up to 70% for eligible energy property costs. The scope of eligible energy properties spans a diverse range, encompassing wind, solar, geothermal, combined heat and power, energy storage, electric vehicles, charging stations and renewable fuels. Importantly, eligibility for tax credits extends beyond traditional energy production or manufacturing facilities, encompassing a wide array of projects.

What sets the IRA apart is its inclusivity, extending benefits to both private and public sector projects. Private sector owners can leverage tax credits as a direct offset to federal tax liabilities for eligible energy properties, with the flexibility to utilize credits up to three years retrospectively and 22 years prospectively. Furthermore, the IRA marks a significant departure from past tax credit programs by enabling nontaxable entities, such as local governments and not-for-profit organizations, to receive direct payments from the Internal Revenue Service (IRS). This transformative change has unlocked new opportunities for entities that were previously unable to capitalize on tax credit incentives.

Additionally, the IRA introduces the concept of tax credit transferability, fostering a unique marketplace for the sale of tax credits. Transferability adds flexibility and liquidity and broadens the scope of entities that can benefit from Inflation Reduction Act tax credits. Overall, the IRA represents a pivotal step towards fostering economic growth, promoting sustainable energy initiatives, and driving workforce development across diverse sectors.

Maximizing credit value

There are a few ways projects can maximize the value of Inflation Reduction Act tax credits. By meeting certain criteria credit value can be dramatically increased by as much as 5 times the base value. There are three ways to achieve a 5 times multiplier:

- Meet Inflation Reduction Act prevailing wage and apprenticeship requirements

- Meet one of the two safe harbor criteria:

- Either establish that construction had begun before January 29, 2023 or

- Verify the project generates less than one megawatt (MW) of energy.

This is why defining the eligible energy property up front is important. It is possible that a project is under one MW and does not need to meet prevailing wage and apprenticeship requirements in order to receive the bonus credit.

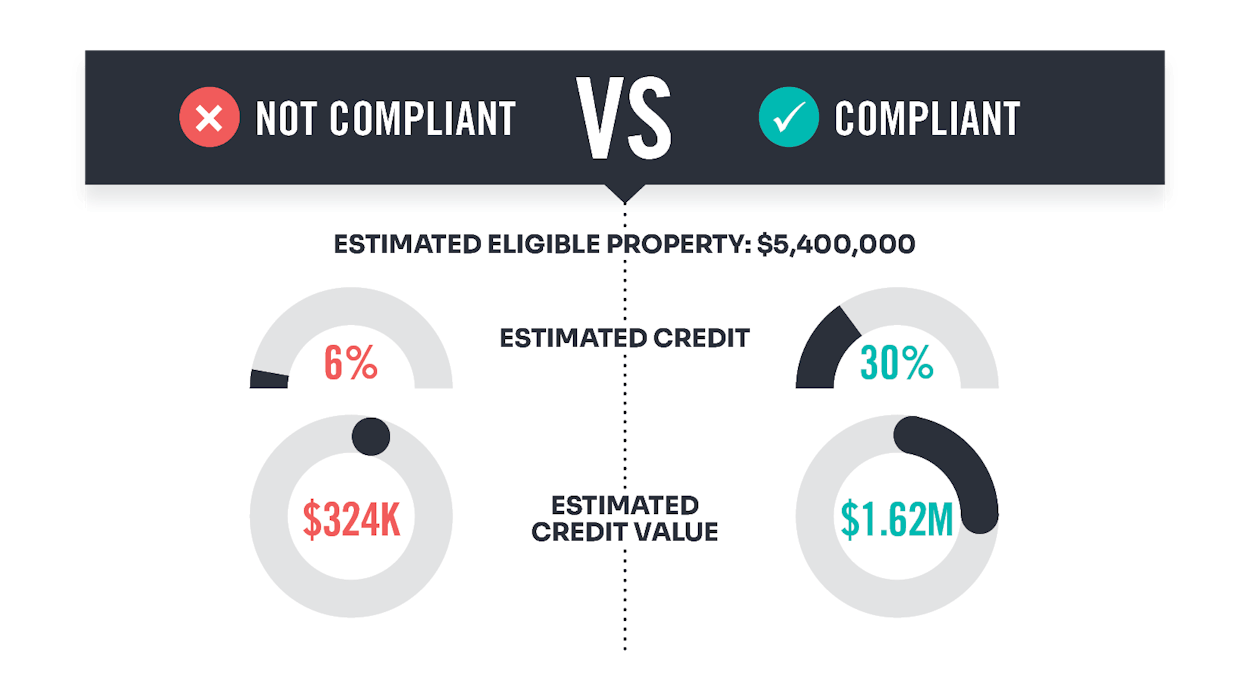

The below illustration demonstrates the impact of the 5 times multiplier. Take for instance a $5.4 million eligible energy property, they could either receive a $324,000 with only the base credit or a $1.62 million credit, the project meets prevailing wage and apprenticeship requirements. Nontaxable entities would receive that amount in the form of direct payment.

PW&A compliance management is critical and must be planned and managed throughout the project lifecycle in order to protect the enhanced credit, minimize and avoid maximum penalties of intentional disregard, all paid by the credit seeker. Regardless of how compliant a project is, strict penalties could be incurred. Proactive management of compliance requires projects have efforts in place prior to construction to establish a plan and educate all contractors. During the construction phase it is important to monitor compliance, cure noncompliance and calculate penalties.

What makes the prevailing wage and apprenticeship retirement so complex?

Prevailing wage and apprenticeship compliance under the IRA is complex and goes beyond Davis-Bacon. While prevailing wage programs have historically aimed to bolster workforce diversity, the IRA introduces a new dimension by embedding these initiatives within tax law.

Unlike its predecessors, the IRA operates independently of labor laws such as Davis-Bacon, albeit with alignment on certain foundational principles. Davis-Bacon provides a framework for definitions of both laborer and mechanic and how wage determinations are established, however, the rules and regulations under the IRA diverge significantly. Notably, taxpayers assume a pivotal role as agents, responsible for establishing wage determinations, initiating construction and maintaining meticulous records which is based on long standing tax guidance.

Within the IRA, prevailing wage and apprenticeship compliance entails navigating three tiers of apprenticeship requirements and facing penalties for noncompliance, including post-construction alterations or repairs. The burden of record-keeping and potential IRS audits further underscores the criticality of taxpayer responsibility.

Dive deeper into the nuances of compliance requirements for contractors and project owners by watching our on-demand webinars and accessing downloadable slides.