Preventing and detecting fraud

The board's role related to fraud prevention and detection

Governing boards, usually via an audit committee, should take an active role in monitoring the risk and mitigation of fraud, as well as in overseeing an effective ethics and compliance program. Regular dialogue with organization leaders can help to ensure that the organization has appropriate anti-fraud programs and controls in place. Additionally, audit committees should take an interest in ensuring that appropriate action is taken against known perpetrators of fraud.[1]

The impact of fraud

- The cost of investigating fraud can be high

- Fraud can have a negative impact on staff morale

- Fraud creates a distraction from the organization’s core mission

- Reputation risk associated with fraud can be more impactful than the actual financial loss, including loss of public confidence, and potential damage to existing relationships

- Approximately half of fraud victims do not recover any of their financial losses

According to the ACFE, the typical loss to an organization due to occupational fraud is 5% of its annual revenue.[2]

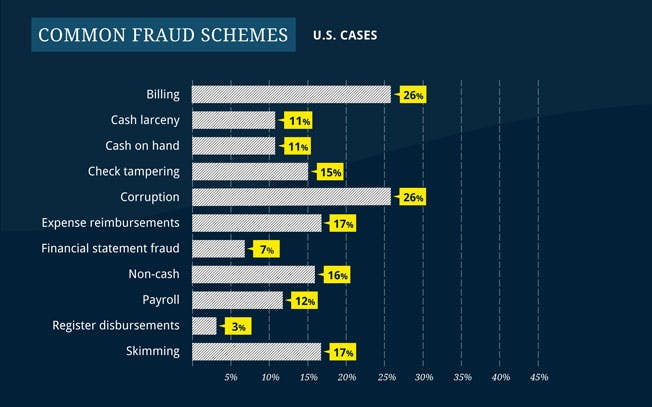

Common fraud schemes in the US[3]

What are the most common fraud schemes by industry?[4]

- Banking and financial services >

- Construction >

- Education >

- Government and public administration >

- Healthcare >

- Insurance >

- Manufacturing >

- Oil and gas >

- Professional services >

- Religious, charitable, or social services >

- Retail >

What can be done to address fraud?

Perform an assessment of fraud risk

- Gain an understanding of the types of fraud that most likely could affect the organization

- Evaluate the control environment/processes put into place by management

- Ensure that a whistleblower hotline has been established and publicized

- Provide guidance in regards to significance of risks and prioritization for eliminating or mitigating those risks

- Reassess fraud risks often; avoid complacency

Provide effective monitoring

- Create a culture of accountability and integrity

- Monitor whether whistleblower complaints have been properly investigated and reviewed

- Consider corruption and regulatory issues, as well as typical fraud related to financial reporting and misappropriation of assets

Communicate with the external and/or internal auditors

- Meet with the auditors before the start of an audit and at its conclusion

- Determine appropriate questions to ask of the auditors prior to the commencement of an audit

- Follow up on those questions/responses at the conclusion of an audit

- Hold a closed session with the auditors as part of both meetings

For more information on this topic, or to learn how Baker Tilly risk and mitigation specialists can help, contact our team.

--

[1] American Institute for Certified Public Accountants, 2010 Fraud and Responsibilities of the Audit Committee: An Overview, New York, NY

[2] ACFE's Report to the Nationals on Occupational Fraud Abuse, page 4, 2012

[3] ACFE's Report to the Nationals on Occupational Fraud Abuse, page 21, 2012

[4] ACFE's Report to the Nationals on Occupational Fraud Abuse, page 29, 2012