CFO Advisory Services

CFO Advisory Services

Frank J. Walker

CPA, CFF, CVA

Partner

Cary Mailandt

Managing Partner

Jennifer A. Finger

CPA, M.S.A.

Partner

Royce Prude

CPA

Partner

Ken Fleming

CPA

Partner

Dan Martin

CPA

Director

Mike Gayler

CPA

Partner

Zak Everson

CPA

Partner

Jason Winterburn

CPA

Partner

Zaid Sultan

MBA

Director

Jeff Weinberg

CPA

Director

At a glance

The office of the CFO is increasingly complex and equally broad in its mandate. Our CFO advisory services are aligned to support this critical function from strategic finance and decision support to core financial and accounting services.

- Transaction readiness and support

- Financial planning and analysis (FP&A)

- Management reporting

- Cost management

- Treasury and cash flow

- Financial reporting and close

- Technical accounting assistance

- Audit readiness

- Business systems

The role of the CFO has changed, and will continue to evolve.

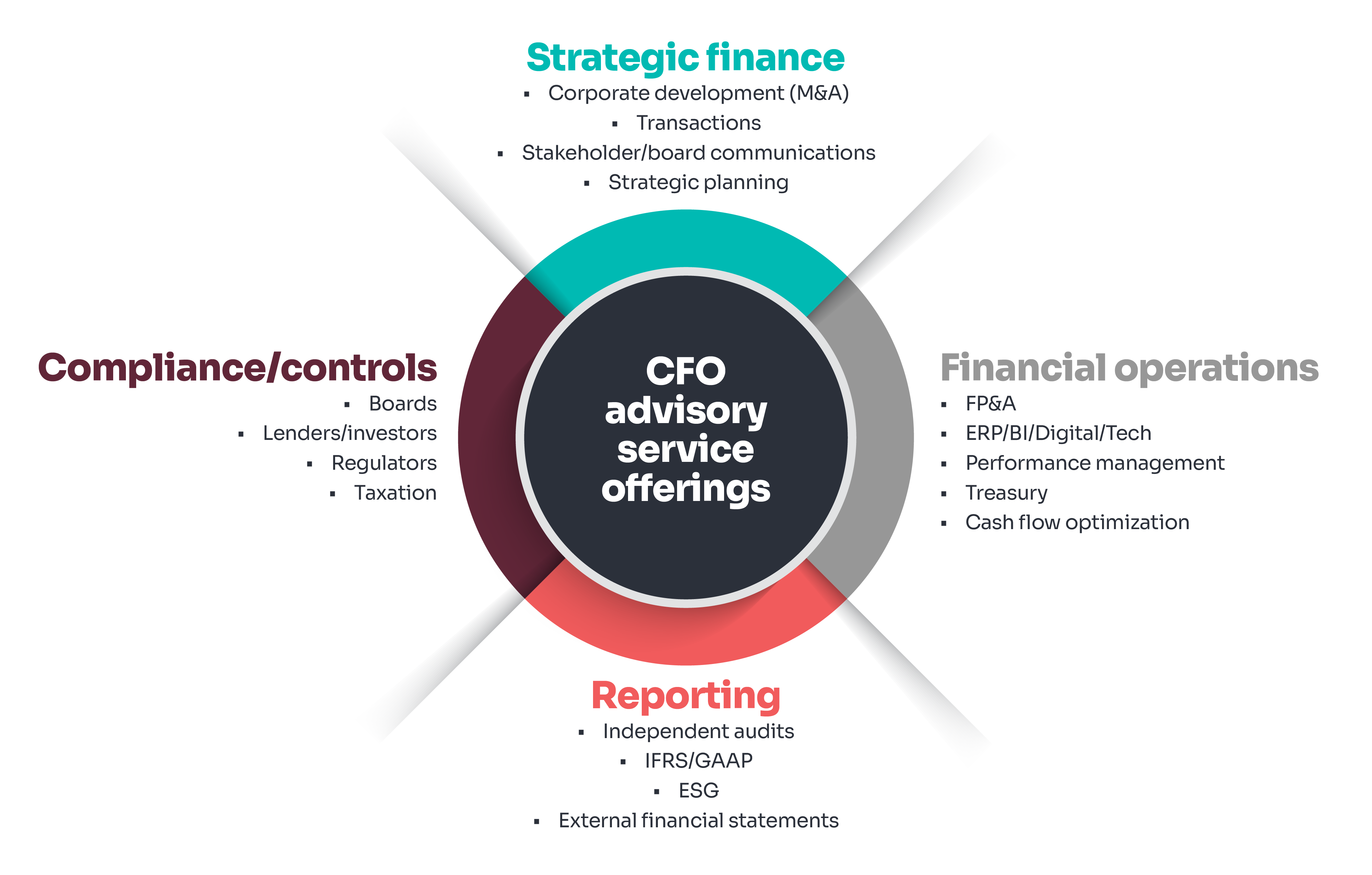

Our CFO advisory team is prepared to face these evolving needs with our four quadrants of CFO value and responsibility: strategic finance, compliance and controls, financial operations and reporting.

CFO – quadrants of value and responsibility

Organizational leadership increasingly expects the finance and accounting team to:

- Improve strategic decision-making

- Manage business risks

- Monitor and improve organization performance

- Explore the adoption of new technologies and tools

- Drive shareholder value

- Ensure accounting and regulatory compliance

The focus on more strategic procedures such as analysis, business partnering, and decision support has led many companies to automate transactional functions and enhance their capabilities. This comes with additional responsibilities and increased scrutiny and regulation in the finance and accounting field, making it challenging to prioritize improvement efforts.

As the role of the CFO evolves and expands, resources within accounting and finance organizations can become stretched to capacity. This can make it difficult for CFOs and their teams to dedicate time to important initiatives, such as the integration of advanced analytics and transformation of financial and accounting functions. In these situations, highly capable external teams may be required to provide support and ensure success when it matters most.

Baker Tilly can help.

Our CFO advisory services practice focuses on helping owners, investors, CFOs, and their teams meet evolving critical needs along their business life cycle. Baker Tilly has a diversely skilled group that aligns with virtually all needs within the office of CFO.

Our services

Strategic finance

- M&A transaction support

- Carve-out financial statement preparation

- Financial modeling and FP&A

- Valuation analysis

Financial operations

- Finance function assessment

- Benchmarking

- Dashboard and business intelligence

- Performance improvement

- Treasury and cash flow management

Compliance

- Audit readiness

- SEC reporting

- GAAP and IFRS conversions

- Accounting and control deficiency remediation

Reporting

- Close process support and optimization

- Use of business systems

- Management reporting

- Lender and investor reporting

- Public company readiness