As SPACs remain popular, here’s what you need to know

One of the buzzwords in business in 2020 has carried over into 2021 in a major way. While special-purpose acquisition companies (SPACs) are hardly new, the concept took off last year in a way that we had never seen before. And in just three full months of 2021, the numbers are simply staggering.

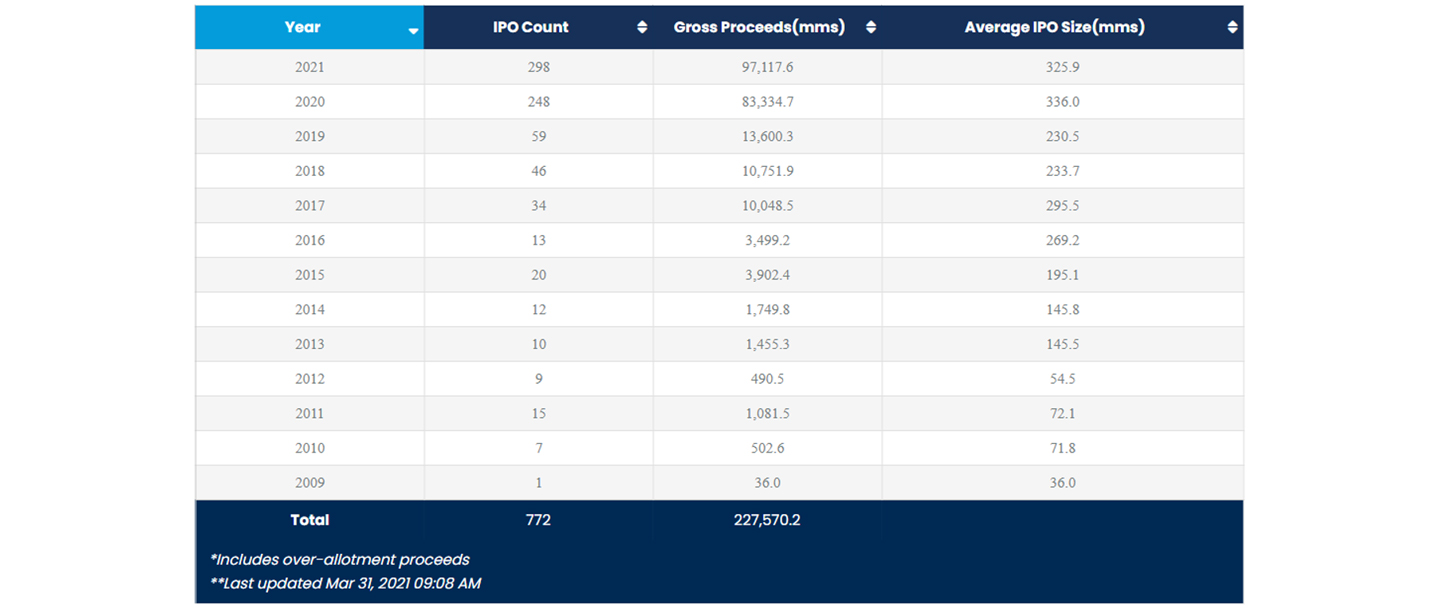

Per SPACInsider.com, there already have been more SPAC IPOs this year (298) than there were all of last year (248). There already has been more than $97.1 billion in SPAC gross proceeds this year, eclipsing last year’s mark of $83.3 billion and obliterating the $13.6 billion generated from SPACs just two years ago.

Even as recently as 2016, a total of 13 SPACs that year generated $3.5 billion in gross proceeds. Clearly, the popularity of SPACs has exploded in the last 12-24 months. But why? And should you get involved? What are the benefits, and what major risks do you need to know about? Let’s explore each of those topics, along with how Baker Tilly’s Value Architects™ from coast-to-coast can serve as your SPAC advisors every step of the way.

SPACs: the basics and the benefits

A SPAC is a shell corporation, essentially a “blank-check company,” formed with the sole intention of raising capital through an IPO. The goal of a SPAC is to acquire an existing private company (or multiple companies), thus making the company (or companies) public. Upon going public, SPACs have no business operations and typically do not even have any stated targets for acquisition. The shell company’s management team, known as the sponsors, typically has two years to complete an acquisition, or else funds are returned to the investors.

SPACs have existed for decades, but as referenced earlier, they had not experienced significant growth until the last two years. Why have SPACs surged in popularity? There are a variety of reasons, which are directly associated with the following benefits that SPACs present to private companies.

- Ability to go public via a faster and easier process than a traditional IPO

- Access to public markets and the significant capital that often accompanies it

- Opportunity to partner with experienced sponsors who offer leadership, expertise and financial support

- Increased flexibility thanks to SPAC sponsors acting as partners, rather than displacing the company’s existing management

But why the sudden surge? Years ago, SPACs had a negative connotation. There were some horror stories – fraudulent shell companies that either did not exist or did not have everyone’s best interests in mind. However, crooked shell companies are not as common these days, which has helped improve the way SPACs are viewed in the marketplace.

The pandemic has played a role in the recent popularity of SPACs, as well. To begin with, many companies postponed their plans to go public through a traditional IPO due to the complicated COVID-19 environment. Many of these companies have been seeking alternate routes to becoming public, with SPACs being the most popular. Another factor is that the growth in the stock market has created more people with money to spend and more overall liquidity in the market. And finally, the backing of hedge funds has been significant. For instance, by underwriting SPACs in large numbers, Goldman Sachs and Citi have created a stable foundation and a steady look for SPACs in the marketplace. Due to these factors, the public has more confidence in SPACs – and more ability to take advantage of their benefits – than ever before.

A word of caution

Some companies have been swept up in the excitement over SPACs and are diving into the water before they’re ready to swim. Companies, in some cases, are underestimating their IPO readiness, including whether their financial records and reporting are up to PCAOB standards and whether their tax compliance and tax structure are where they need to be. The risk is that many companies are going to end up becoming public companies before they are truly ready.

Furthermore, the SEC has cautioned businesses and investors to beware of SPACs that are backed by celebrities. “It is never a good idea to invest in a SPAC just because someone famous sponsors or invests in it or says it is a good investment,” the SEC warned. Shaquille O’Neal, Serena Williams and Colin Kaepernick are some of the celebrities who are involved with SPACs in various capacities.

Short sellers are also showing that they are skeptical of SPACs. Investments made by short sellers, who profit when a company’s stock price declines, have risen in value to $2.7 billion from $724 million this year alone.

With all this in mind, it is critical to find the right advisors to help determine whether a SPAC is a logical path for your company. The ability to go public relatively quickly can be attractive, but the SPAC boom has made the process seem easier than it actually is. Additionally, the grass is not always greener on the other side. The implications of being a public company are significant – the regulatory compliance, the frequency of the filings, the additional liability, the lack of control and the increased cost, just to name a few. Having the right advisors – experienced and candid communicators – is an imperative step of this complicated process.

SPACs: what we’re seeing in specific industries

SPACs are not limited to any one industry, although we see them more frequently in certain key sectors. We primarily talk to clients that are exploring SPAC possibilities across the industries highlighted below.

- Software and technology: We are seeing a lot of excitement about SPACs in the software and technology industry. In fact, it borders on irrational exuberance at times. Everyone in this industry is talking about raising money through SPACs, particularly software as a service (SaaS) companies. The software and technology sector has experienced a boom in the last year due to life becoming remote in so many respects, and many tech companies are experiencing extreme growth. This makes software and technology companies very attractive targets for SPACs.

- Life sciences: Certain segments of the life sciences industry are doing quite well at the moment. Obviously, anything even remotely connected to COVID-19 is very hot these days. For many life sciences companies, SPACs are being discussed as an alternative way to raise significant capital. However, with the current fundraising environment being very favorable for life sciences companies, there may not even be enough life sciences companies out there for these SPACs to acquire. Still we encourage life sciences companies to evaluate all of their fundraising opportunities, including SPACs whose sponsors have a background in life sciences.

- Real estate: SPACs appear to be a model that resonates well with the real estate industry, particularly with real estate companies that have a technology component. SPACs are attractive to real estate investment trusts (REITs), as well. It is worth noting that real estate-related SPACs come with a layer of complexity in terms of tax elections and other tax nuances, which is important to highlight because oftentimes companies view the process of going public strictly from an audit perspective, whereas the tax implications are quite significant – and not to be ignored.

How we can help

When we look back one day at the rise of SPACs in 2020 and 2021, there are going to be winners and losers. What companies are going to win? The ones that prepare in advance, the ones that connect with the right SPAC sponsors and the ones that work with experienced advisors every step of the way.

Baker Tilly is currently assisting many companies interested in SPACs at every stage of the process – from initial planning discussions to the detailed intricacies of becoming a public company through a SPAC, including the complications involved with major transactions. As we mentioned, being attractive to potential SPACs is about much more than just being auditable. It’s about the infrastructure and scalability of your company. It’s about your management team, your operations, your internal controls, your tax structure, and so much more.

Baker Tilly specialists understand these key areas from multiple viewpoints, as not only are we are audit and tax advisors, but we work closely with investors, SPAC sponsors, and private and public companies at every stage of their lifecycle.

As you contemplate a journey involving SPACs, we can assist you with every phase of the process, collaborating with your management team as much as you require and as much as you desire. We can help enhance the variables of your company that SPACs examine closely, allowing you to appear as an attractive fish in a competitive ocean.

Baker Tilly partners Mallory Thomas and Ernest Miranda are ready to listen and happy to discuss whether a SPAC is the right path for your company. SPACs can be a smart strategy and a profitable option. With your needs in mind, our Value Architects can help you achieve your vision.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.