Article | ESG and sustainability regulations checklist

Global regulations are reshaping corporate sustainability. Are U.S. companies prepared for mandatory reporting?

The global ESG and sustainability reporting focus is shifting from being largely voluntary to a mandatory disclosure landscape. Underpinning this shift is a patchwork of global regulations with various environmental, social and governance (ESG) disclosure requirements. The jurisdiction, scope, and timeline for these regulations are incredibly dynamic challenging U.S. companies to determine the applicability and requirements.

This article discusses the most impactful mandatory ESG and sustainability reporting regulations, which redefines the need for organizations to formalize their ESG reporting capabilities. This includes:

- California Climate Accountability Package: SB 253 California Climate Corporate Data Accountability Act

- California Climate Accountability Package: SB 261 Greenhouse Gasses: Climate-Related Risk

- California Voluntary Carbon Market Disclosure Rule: AB-1305 Voluntary Carbon Market Disclosures

- New York Climate Corporate Accountability Act

- Illinois Climate Corporate Accountability Act

- SEC’s Enhancement and Standardization of Climate-Related Disclosures

- Corporate Sustainability Reporting Directive (CSRD)

- Federal Supplier Climate Risks and Resilience Proposed Rule

While Europe has led the way in ESG and sustainability regulation with its comprehensive sustainability regulations, the U.S. is a close follower with the recent finalized SEC climate-related disclosures, the introduction of the California Climate Accountability Package, along with the state of Illinois and New York’s proposed climate-related disclosure rules and the Federal Supplier Climate Risks and Resilience Proposed Rule.

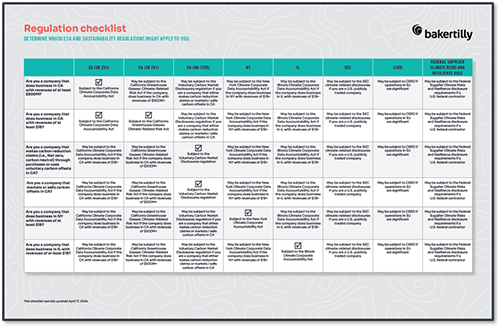

Organizations should determine which ESG and sustainability regulations apply to them and prepare now to protect against risks associated with inaction. Download the easy-to-follow checklist of regulatory applicability to understand if your organization is impacted.

Take action

With the web of regulations regarding sustainability reporting that are either proposed or final, almost all U.S.-based companies will be impacted in one regard or another. At a minimum level, you may be required to provide climate data to larger suppliers and, for certain companies, you may need to align reporting across several regulatory jurisdictions. By taking action now and understanding the full breadth of impacts, companies can develop appropriate systems and controls that are feasible to implement, cost effective to deploy, and yield dividends for competitive advantage ahead of regulations.

Get ahead of the changing regulatory landscape by acting today to understand how your organization could be impacted in the future. Lean on our specialists to guide the way and act now to protect and enhance your organization’s value.

1. California Climate Accountability Package: SB 253 California Climate Corporate Data Accountability Act

The California Climate Accountability Package was released in October 2023, including two pieces of regulations (SB 253 and SB 261) impacting both public and private organizations that do business in California. The Act requires companies to publicly report on their full greenhouse gas (GHG) inventories, which include scope 1, 2 and 3. Limited assurance requirements (ESG data audit) for the GHG data reported will begin in 2026 and will increase to reasonable assurance requirements beginning in 2030.

Companies with over $1 billion in revenue that do business in California

Single (financial materiality)

Scope 1 and 2 GHG reporting requirements will begin in 2026 for 2025 data, while scope 3 GHG reporting requirements will begin in 2027 for 2026 data. *Note that reporting timelines are based on the final ruling but is subject to change given regulatory review or agency adoption.

Companies will be required annually to publicly report scope 1, 2 and 3 GHG emissions data.

2. California Climate Accountability Package: SB 261 Greenhouse Gasses: Climate-Related Risk

The California Climate Accountability Package was released in October 2023, including two pieces of regulations (SB 253 and SB 261) impacting both public and private organizations that do business in California. The Act requires companies to prepare a climate-related financial risk report, in line with the TCFD framework, publicly disclosing climate-related financial risk and measures adopted to reduce and adapt to those risks on a biannual basis.

Companies with over $500 million in revenue that do business in California

Single (financial materiality)

The first reports are due Jan. 1, 2026. *Note that reporting timelines are based on the final ruling but is subject to change given regulatory review or agency adoption.

Publish a climate-related financial risk report, in line with the TCFD framework publicly on the company’s website.

3. California Voluntary Carbon Market Disclosure Rule: AB-1305 Voluntary Carbon Market Disclosures

Released alongside the California Climate Accountability Package in October 2023, the California Voluntary Carbon Market Disclosure Rule, also known as Assembly Bill 1305 (AB-1305), seeks to bring transparency to the voluntary carbon market by requiring specific annual disclosures for organizations who make carbon reduction claims, market or sell carbon credits, or purchase carbon credits.

- Businesses making claims about net zero, carbon neutrality, or significant GHG reductions in California who purchase or use voluntary carbon offsets

- Companies that market or sell voluntary carbon offsets in California

The concept of materiality is not incorporated into this bill. Companies are required to disclose if they make carbon reduction claims, market or sell carbon credits, or purchase carbon credits.

The bill went into effect January 1, 2024, however, there is uncertainty regarding disclosure reporting effective dates.

- For companies that make carbon reduction claims regarding the achievement of net zero emissions through the purchase of carbon credits, (i.e., net zero, carbon neutrality) in the state, the bill requires disclosure regarding details of the carbon offset project(s), how the claim is determined to be accurate, and how progress against the claim is measured. Additionally, the bill requires disclosure of whether the data has received assurance by a third party. Disclosures are required on an annual basis and must be made publicly available.

- For companies that market or sell carbon credits in the state, the bill requires disclosures regarding details of the carbon offset project and the amount of emissions reduced or carbon removed. Disclosures are required on an annual basis and must be made publicly available.

4. New York Climate Corporate Accountability Act

The Climate Corporate Accountability Act, introduced in February 2023, is a proposed amendment to the environmental conservation law which would require New York companies to report on and obtain assurance (ESG data audit) over their full GHG inventories, which include scope 1, 2 and 3. The act would require annual GHG emissions reporting to the state’s GHG emissions registry. GHG inventory reports would be due to the registry no later than July 31 for the previous calendar year’s scope 1 and 2 data, while scope 3 data would be due no later than Dec. 31.

Companies with $1B+ in revenue who do business in the state of New York. The following activities constitute doing business in the state of New York:

- operating a branch in New York State

- operating a loan production office in New York State

- operating a representative office in New York State or

- operating a bona fide office in New York State

Single (financial materiality)

The timing has yet to be determined, but the act will take effect two years after becoming law. GHG inventories for the previous year would be due by the end of July for scope 1 and 2 GHG emissions, while scope 3 GHG emissions would be due by the end of December.

Companies will be required to annually and publicly report scope 1, 2 and 3 GHG emissions data.

5. Illinois Climate Corporate Accountability Act

The Illinois Climate Corporate Accountability Act (HB4268) is a recently enacted law in Illinois that mandates entities with over $1 billion in annual revenue that do business in Illinois to publicly report on their full greenhouse gas (GHG) inventories, which include scope 1, 2 and 3.

Entities with $1B+ in revenue who do business in the state of Illinois. Generally, “doing business” is defined as regularly engaging in transactions for financial gain, having employees or property located within the state of Illinois. Partnerships, corporations, limited liability companies and other business entities formed in the United States that do business in Illinois with total annual revenues in excess of$1 billion would have reporting requirements under the Illinois Climate Corporate Accountability Act.

Single (financial materiality)

Disclosure requirements will be begin on January 1, 2025 and annually thereafter.

Companies will be required to annually and publicly report scope 1, 2 and 3 GHG emissions data.

6. SEC’s Enhancement and Standardization of Climate-Related Disclosures

In March 2024, the U.S. Securities and Exchange Commission (SEC) voted to approve final rules for the enhancement and standardization of climate-related disclosures which requires publicly traded companies to disclose climate-related information in annual reports and registration statements. Reporting requirements include financial and non-financial disclosures and vary depending on the registrant type. Many of the disclosures are in line with the recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD) with a goal to provide consistent, comparable and reliable disclosure of climate-related risks.

U.S. listed companies

Single (financial materiality)

Reporting requirements are phased-in based on the registrant type.

- Large accelerated registrants will be the first to face disclosure requirements beginning in 2026 for the 2025 reporting year with limited assurance over GHG emissions required in

2029 over the 2028 reporting year. - Accelerated registrants will be required to disclosure in 2027 for the 2026 reporting year with limited assurance over GHG emissions required in 2031 over the 2030 reporting year.

- Non-Accelerated Filers (NAF), Smaller Reporting Companies (SCR), and Emerging Growth Companies (EGC) face fewer disclosure requirements beginning in 2028 for the 2027 reporting year.

Please see the SEC factsheet for further details on the final rule.

Non-financial disclosures will include disclosure of climate-related risks, strategy and processes, governance, and GHG emissions. GHG emission scope 1 and 2 reporting will require assurance for both Large Accelerated and Accelerated filer types. Financial statement disclosures will include capitalized costs, expenses, charges and losses incurred as a result of severe weather events and other natural conditions, The aggregate amount of carbon offsets and renewable energy credits (RECs) recognized, and the aggregate amount of losses incurred on the capitalized carbon offsets and RECs, and lastly, whether the estimates and assumptions used to produce the financial statements were materially impacted by severe weather events and natural conditions, or any climate-related targets or transition plans.

7. Corporate Sustainability Reporting Directive (CSRD)

The CSRD went into effect in the European Union (EU) in January 2023 requiring companies to report on the impact of corporate activities on the environment and society, while requiring disclosures on various governance topics. To ensure accuracy of the data reported, the CSRD requires assurance (ESG data audit) of reported information. The CSRD amends and builds on the Non-Financial Reporting Directive (NFRD) which required disclosure regarding ESG topics. The enhanced regulation will require disclosures according to the European Sustainability Reporting Standards (ESRS). The first set of ESRS were finalized in July 2023 with sector-specific standards expected in June 2024. The disclosure requirements of the CSRD are comprehensive and may differ depending on applicability. Contact an expert to ensure your compliance.

- U.S. companies that are considered “large EU company” or “large group” including those listed on EU-regulated markets and not listed as well as U.S. parent company subsidiaries located in the EU and non-EU companies generating a net turnover of €150 million in the EU.

- Organizations are considered a “large EU company” including EU based subsidiaries of non-EU parent companies if they meet two of the three criteria: average number of employees during the fiscal year is 250 employees, total assets are more than €25 million and net turnover more than €50 million.

- Non-EU companies generating a net turnover of €150 million in the EU and have:

- A subsidiary in the EU that meets the forementioned criteria or

- A branch in the EU generating a net turnover more than €40 million

Double (financial and impact materiality)

The CSRD is currently in effect. Large companies who are currently subject to the NFRD are required to provide disclosures starting in 2025 for fiscal year 2024. Large EU companies not currently subject to the NFRD will report in 2026 for fiscal year 2025. Non-EU companies that meet criteria will be required to publish a 2028 report in 2029.

Disclosure of five main dimensions from NFRD [1] (precursor), and disclosure of general, environmental, social and governance topics [2]. Additionally, the report must be in a standardized, electronic and searchable reporting format.

8. Federal Supplier Climate Risks and Resilience Proposed Rule

In November 2022, the Department of Defense (DoD), General Services Administration (GSA), and National Aeronautics and Space Administration (NASA) announced the Federal Supplier Climate Risks and Resilience Proposed Rule which would increase the transparency of climate-related information related to government contracting. This proposed rule directly engages the federal contractor supply base, specifically impacting two categories of contractors, significant contractors and major contractors, registered in the System for Award Management (SAM). Significant contractors are those that received between $7.5 million and $50 million in federal contract obligations in the prior federal fiscal year. Major contractors received more than $50 million in federal contract obligations in the prior federal fiscal year.

U.S. government contractors that received $7.5 million or more in federal contracts

Single (financial materiality)

The rule is currently proposed and had a comment period, which concluded in February 2023. The implementation of the final rule is unknown. However, beginning one year after publication of the final rule, contractors must have completed their GHG inventory and disclosed total scope 1 and 2 GHG emissions in the SAM. The remaining requirements, applicable only to major contractors, would need to be satisfied beginning two years after publication of the final rule.

If considered a significant contractor [3], the requirements include GHG emissions (scope 1 and 2) disclosures. If considered a major contractor [4], the requirements include GHG emissions (scope 1, 2 and 3), a report on the entity’s climate risk assessment process and any risks identified, completion of the CDP Climate Change Questionnaire sections that align with TCFD and development of science-based targets that are validated by the SBTi.

Learn more about the proposed Federal Supplier Climate Risks and Resilience Proposed Rule

Footnotes

[1] The five main dimensions from the NFRD, a precursor to the CSRD include disclosures regarding environmental protection, social responsibility and workforce treatment, respect for human rights, anti-corruption and bribery, and diversity of boards. The CSRD goes further than the NFRD and expands on the sustainability reporting standards of the NFRD.

[2] General disclosures include double materiality, business model and strategy, climate transition plans, time-bounded targets, sustainability due diligence, information on own operations, value chain, business relationships and supply chain. Specific to the supply chain, documentation of adverse impacts and actions to prevent/mitigate risk is required. Environmental disclosures include disclosures covering each of the EU Taxonomy environmental objectives which are climate change mitigation (incudes scope 1, 2 and 3 GHG emissions), climate change adaptation, water and marine resources, biodiversity, and eco system, resource use and circular economy. Social disclosures include disclosures regarding diversity and inclusion, human rights, working conditions, health and safety, employee relations, pay gaps, related rights, workers in the value chain, affected communities, consumers and end-users. Governance disclosures include disclosures regarding policies, risk management and internal controls, ownership and structural transparency, independence and oversight, responsible business practices, ethics, anti-corruption and executive pay fairness.

[3] Significant contractors are those that received between $7.5 million and $50 million in federal contract obligations in the prior federal fiscal year.

[4] Major contractors are those contractors that received more than $50 million in federal contract obligations in the prior federal fiscal year.