Healthcare M&A update: H2 2020

2020 healthcare M&A finishes strong

Healthcare M&A rebounds

M&A activity plummeted during the second quarter of 2020, as COVID-19 forced shutdowns, largely erased voluntary procedures, and caused liquidity to dry up. M&A slowly began to come back in the 3Q20 before a flurry of end of the year deals. Thanks to a strong fourth quarter, there were 738 reported transactions that closed during the second half of 2020, a strong increase from the 608 transactions during the first half of the year. Those second-half results were also up 8.5% from the same period in 2019, indicating sustained growth.

The aggregate value of M&A deals also jumped in the second half of the year – from $84.5 billion in 1H20 to $109.4 billion in 2H20. Three large acquisitions accounted for the bulk of that increase:

- Gilead bought Immunomedics for $20.4B

- Teladoc bought Livongo for $15.9B

- Bristol-Myers bought MyoKardia for $12.2B

Quarterly U.S. healthcare M&A activity for transactions closed aggregate transaction value and number of deals

Source: S&P Capital IQ

The growth of home healthcare

The pandemic has brought the need for healthcare home. Literally.

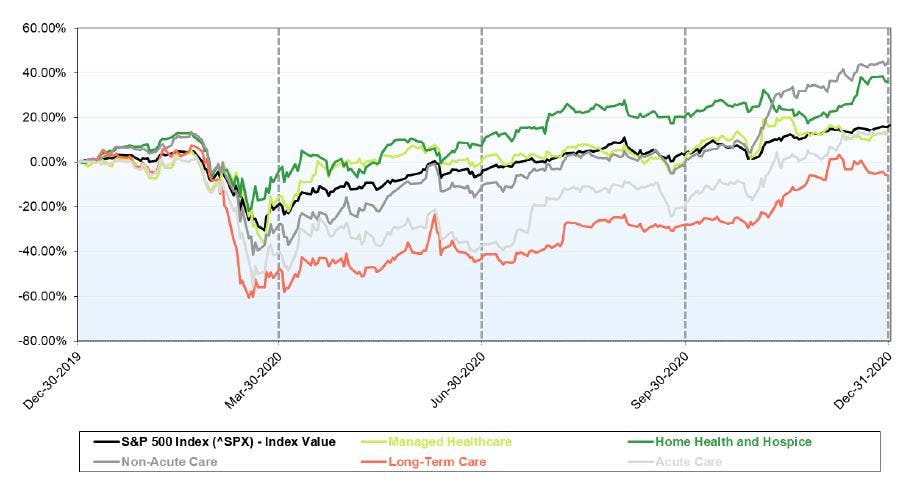

In the second half of 2020, the home health & hospice industry was among the fastest growing healthcare segment in the U.S. Throughout the year, home health & hospice and non-acute care significantly outperformed the S&P 500, the only two healthcare segments to do so.

Healthcare providers’ relative market performance

Source: S&P Capital IQ

Two major trends drove the growth of home healthcare in 2020. In-person doctor visits were constrained, especially for high-risk patients, and facility-based providers faced depleted resources and fewer available beds. Two other industry trends, which have been developing for years, further accelerated in 2020:

- A shift from the fee-for-service model towards a more holistic, value-based care approach

- The evolution of where healthcare is provided, with a focus on bringing healthcare to people instead of bringing people to their healthcare

Moving forward, new partnerships announced by large industry players show that these trends will continue. For example, CVS Health recently announced that it would partner with the Cancer Treatment Centers of America to offer in-home chemotherapy to cancer patients, while Humana announced that it is making a $100 million investment in Heal, a provider of house-call-based primary care to patients.

Get the pulse of the industry

Download your free copy of healthcare M&A update: H2 2020 for more information on:

- Financial performance of every healthcare sector

- How Medicare and Medicaid are driving further industry consolidation

- Where private equity firms are investing

- How the Home Health Value Based Purchasing (HHVBP) model is expanding

- Industry challenges in 2021

More M&A H2 2020 reports

To view more on this topic or learn how Baker Tilly specialists can help, contact our team.