Contractual commitments and consequences for petrochemical business interruption losses

Introduction

Following an incident, an Insured party may be restricted by the conditions of the contract, which could significantly impact the business interruption loss, due to the effect on (i) the costs of raw material / feedstock or (ii) sales of final products to the business. However, the policy language does not always take into account the contractual commitments.

Feedstock / Raw Material Commitments

There are various contracts available on the “buy” side, however two common forms are:

- Take-or-Pay-Contracts – these are longer term commitments (typically 1 to 5 years) where the buyer must pay the contracted price even if the minimum volume of feedstock is not taken;

- Rolling Order Contracts – this is where the quantity supplied is set out over a defined rolling period with a shorter-term commitment, for instance 3 months.

If the minimum orders are not taken, it could result in additional costs to the buyer particularly if the clause restricts the buyer’s ability to consume the product at alternative locations or sell the product to a third party. The basis of the costs depends on the conditions of the contract and could be in the form of:

- Value of sales shortfall against the commitment – this is where a seller has the right to sell the volume in question to another entity at market price, with any value lost being passed on to the buyer. These costs could be significant especially if the contract price does not take account of changes in prices, such as the drop in oil or natural gas prices in 2015;

- Cost of distressed sale incurred by the seller (i.e. the lost sales value and additional selling costs in a third party sale);

- Percentage of the minimum volume.

These costs may be avoided if there is a make-up clause allowing catch-up in later months, or if a Force Majeure Clause is triggered.

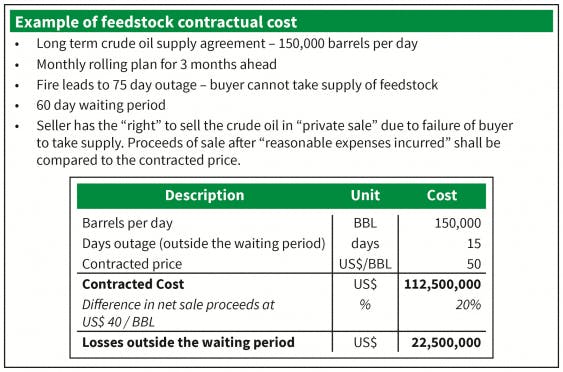

In the event of an insured incident which results in lower feedstock requirements, and if the contractual commitments cannot be avoided, it is not uncommon for the loss to form part of a Business Interruption claim, which can be substantial, as set out in the example below:

Raw materials / feedstock are usually uninsured costs, and as such, purchases are assumed to vary directly with sales and are therefore “saved” if sales reduce following an incident. However, if feedstock purchases are below the minimum offtake, then the cost will not vary with sales / production, resulting in part of the cost continuing. Although a financial loss has been sustained, this may not be indemnifiable as part of the loss of gross profit.

A feedstock loss is frequently claimed as an increased costs of working (ICWs), but this raises the question as to whether it would satisfy the policy definition of being

“necessarily and reasonably incurred for the sole purpose of avoiding or diminishing the reduction in turnover…but not exceeding the sum produced by applying the Rate of Gross Profit to the amount of the reduction thereby avoided.”

Ultimately, it is for Insurers to interpret the policy wording, however consideration would need to be given as to whether these costs “avoid or diminish the reduction in turnover”. Given the nature of the cost it may be difficult to link this to a mitigation of lost turnover.

Some policies may include Additional Increased Costs of Working (“AICW”) or Extra Expense (“EE”) extension. These extensions frequently require the costs to “protect turnover” or “resume or maintain normal business operations”, and are not subject to an economic limit, but are often sub limited. As such, it is necessary to consider whether the contractual cost is considered to be “protecting turnover” or “maintaining normal business operations”. However, these issues would need to be addressed on a case by case basis by Insurers / Adjusters after taking into account the circumstances and the wording of the policy.

Sales Commitments

A supply agreement to a customer may be for a specified volume each month / year or as stipulated by a forward sales commitment. Although in some regulated markets, the volume may simply state “market demand”.

If an insured incident occurs where such supply of final product cannot be satisfied, the options to the insured supplier would include:

- Incur the contractual penalties – which may have major financial implications;

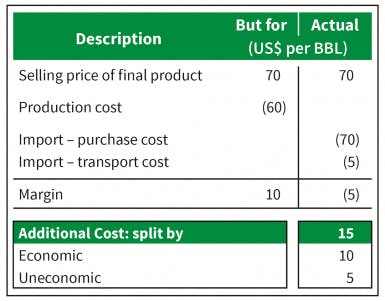

- Outsourcing – this is where the Insured buys in final products from a third party to meet supply obligations. These costs may mitigate a loss of turnover; however they are unlikely to be economic as the cost of buying-in would be at market price plus transport / import costs, which is likely to exceed the insured gross profit per tonne produced. An example of the financial implication is set out here:

Force Majeure

Another option that may be open to the Insured is to declare Force Majeure.

This clause is frequently included in contracts and releases both the buyer and seller from the obligation to perform when an extraordinary circumstance beyond the control of the parties prevents either party from fulfilling its contractual commitment. The ability to declare Force Majeure can depend on many factors, including the wording of the clause and the nature of the event.

If the declaration is successful, this could avoid the obligation to incur the contractual penalties for feedstock / sales commitments, or to buy in final products.

Summary

The Insured’s response following an incident may not always be in its control, but driven by contractual commitments. Understanding the contractual commitments for both feedstock and product sales are key to ascertaining the potential impact to both the Insured and the Insurer, and whether suitable cover has been provided to indemnify the Insured for its losses to successfully transfer the risk.

The level of uneconomic costs being incurred could be significant, therefore consideration needs to be taken as to whether the AICW or EE cover would indemnify such costs, and if a sub limit is in place to provide the appropriate amount of cover.

Such losses may be diminished or avoided if the contract allows mitigation measures such as outsourcing, make-up clauses or through the declaration of Force Majeure. However, these deliberations would need to be carried out early in the claims review process to ensure the window for viable mitigation measures or Force Majeure declaration is not missed. Assuming at the underwriting stage that it would be possible to declare Force Majeure in the event of a loss is risky for both parties.

As appeared in Dubai - Onshore Energy Conference Magazine - 18 May 2016

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

*Effective December 2018, RGL Forensics joined Baker Tilly US, LLP. This article was published while we were RGL Forensics. The author(s) or team member(s) quoted from RGL are now employees of Baker Tilly.