City creates successful debt repayment plan and strengthens credit rating while minimizing revenue fund impact

Client background

The City of Independence, Missouri (the City) is the fifth largest city in the state of Missouri with a population of 117,000. The City had provided credit support for bonds issued to partially finance the Crackerneck Creek tax increment financing (TIF) and community improvement district — a 450,000 square foot retail center anchored by a Bass Pro Shops store.

Organization challenge

The Crackerneck Creek development had not achieved full build-out and the constructed elements were financially underperforming, forcing the City to supplement debt service payments from its general, utility and sales tax funds — totaling nearly $18 million over a seven-year period.

Acknowledging that Crackerneck Creek would likely never achieve its originally forecasted revenues, the City turned to Baker Tilly to help craft a solution that would: (1) create a long-term plan for repayment of Crackerneck Creek debt obligation, (2) minimize impact on the City’s general, utility and special revenue funds and (3) strengthen the City’s credit rating.

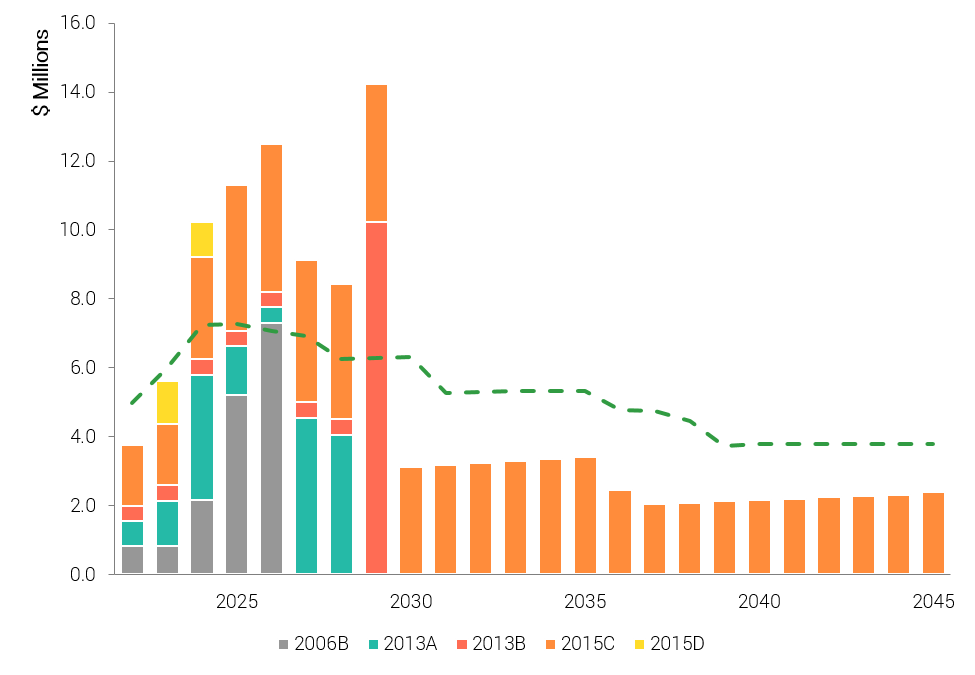

Projected revenue and debt service before refunding

Baker Tilly approach

Working with City staff and bond counsel, Baker Tilly formulated a creative solution whereby increment from sunsetting tax increment finance districts (TIDs) would be voluntarily redirected for Crackerneck Creek debt service. Our team prepared a detailed model to forecast project revenues and redirected funds to implement the solution, which illustrated that the voluntarily redirected funds — combined with interest cost savings achieved through refundings — would be enough to support future project debt service. To aid in implementation of the plan, we drafted a “Tax Increment Financing Supplemental Appropriation Policy,” which was adopted by the City Council. In addition to serving as a guide for the City, this policy gave reassurance to the credit rating agency and to investors that the City had a viable plan that would be followed in the future.

Results

Baker Tilly assisted the City in the selection of an underwriter for the refunding of three bond series totaling approximately $39 million in outstanding principal. Two series of bonds were originally issued as taxable due to their connection to lease payments from Bass Pro Shops. An in-depth tax analysis revealed that the refunding bonds could be issued as tax-exempt, further increasing the potential for interest cost savings.

The City faced headwinds going into the rating process created by the global COVID-19 pandemic and recent general fund operating deficits. In the rating presentation, the City and its financing team emphasized the strength of the Crackerneck Creek refinancing plan and the City’s long-term financial planning approach. Ultimately, S&P Global affirmed the BBB+ rating for Crackerneck Creek related debt and assigned this rating to the refunding bonds.

The refundings were brought to the market during a favorable period, with municipal bond rates near all-time lows. The refunding bonds were 3.5 times oversubscribed and sold at a true interest cost of 3.12%.

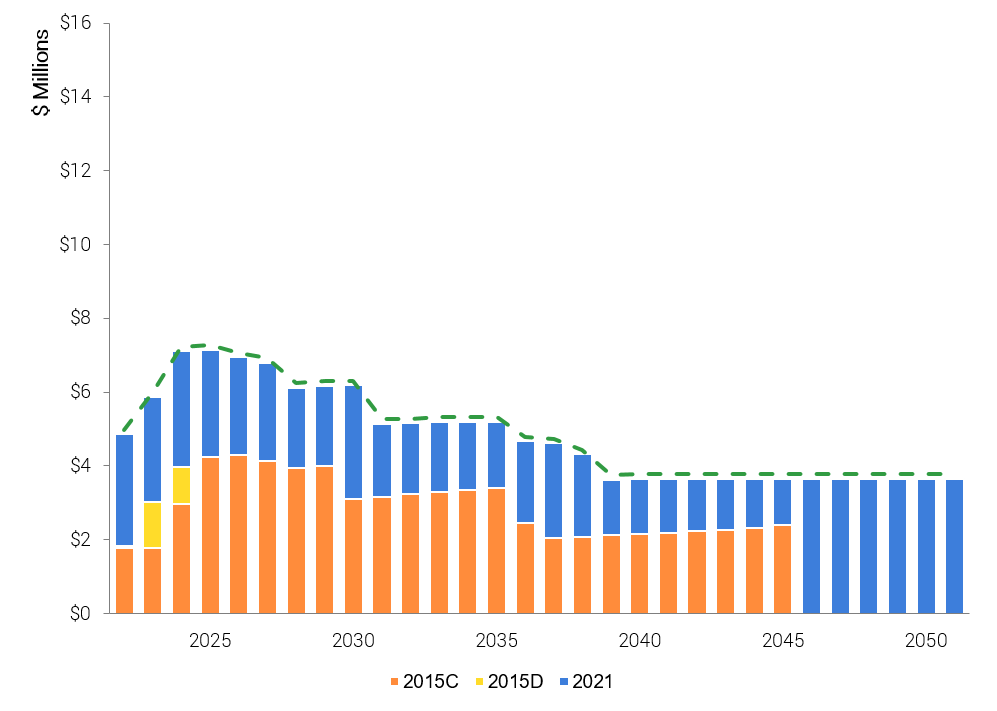

Projected revenue and debt service after refunding

Organizational impact

With this financing and the Supplemental Appropriation Policy in place, the City of Independence achieved each of its financing goals. The City can now look to the future confident in its plan for this major financial obligation.

For more information, or to learn how Baker Tilly can help your organization, contact our team.