Charitable trust planning: share your wealth and defer capital gains

Sure, it feels good not having to pay capital gains taxes, but think about how that would feel on top of giving to a charitable cause.

High-net-worth individuals who are exploring charitable giving have many different options, but charitable remainder trusts (CRTs) and charitable lead trusts (CLTs) are two straightforward planning vehicles that will help them realize their giving aspirations among other benefits, including deferring long-term capital gains.

When a donor pursues this path, the decision of which type of trust really comes down to their financial needs: Do they or their beneficiary need the money now or later?

Why choose a CRT or CLT?

First, this type of trust works best for someone who may be coming into a large amount of money (e.g., selling a business for millions of dollars) but don’t need all of that money to live off now. With either a CRT or CLT, they will be able to lessen their tax liability, give to charity and still distribute part of their estate to themselves or their beneficiaries.

Charitable remainder trusts

A CRT is best for people who need an income stream now.

With a CRT, the donor transfers assets to an irrevocable trust. The term of the trust is based on the results from an actuarial program that estimates the donor’s lifespan. The amount and frequency of the income stream distribution to the designated recipient(s) will be determined by the established term in order to ensure the charity receives 10% of the present value of the assets at the expiration of the trust.

At the outset, the donor receives a charitable contribution deduction, but they can also sell assets of the trust at any time without personally generating capital gains. They can even use those proceeds to diversify the trust’s portfolio, which could potentially increase their beneficiary’s income stream as well as the ultimate gift to charity.

The trust’s assets are not transferred to the charity until the term of the trust expires or the income beneficiary dies. This is also a caveat for the donor since the charity will receive the remainder of the trust’s assets no matter when the income beneficiary dies. For example, if the donor only selects one income beneficiary and that person dies unexpectedly the next year, the charity will receive all of the contents of the trust, no matter the term of the trust. The use of life insurance can mitigate this issue.

When a donor chooses a CRT, they have the option of a charitable remainder annuity trust (CRAT) or charitable remainder unitrust (CRUT). The trusts are set up the same; the dissemination of the income stream is where they diverge. With a CRAT, the income beneficiary receives a fixed amount each year independent of how the trust’s assets perform. A CRUT’s income beneficiary will receive a variable amount based on a fixed percentage of the trust assets’ total value. In either case, the beneficiary of the trust would have to pay tax on the income stream in the year it is received. The character of the income would depend on the character of income the trust realized since inception.

Examples

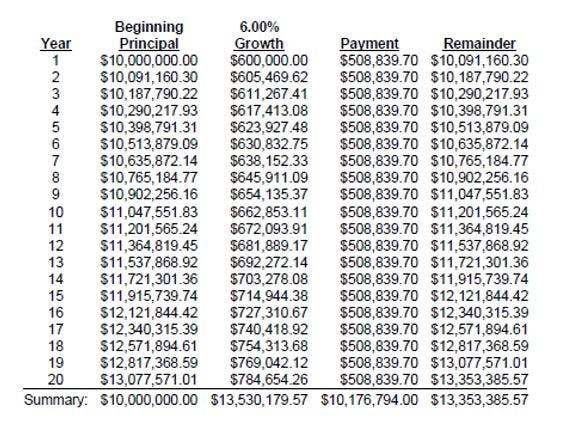

CRAT example: The donor puts $10 million in a trust with a term of 20 years. The donor designates the beneficiary to receive an annual payment of more than $500,000. Assuming 6% growth, the beneficiary will receive more than $10 million over the course of the term, and the specified charity would receive at least $10 million but could receive nearly $13.4 million if the trust’s term doesn’t end early.

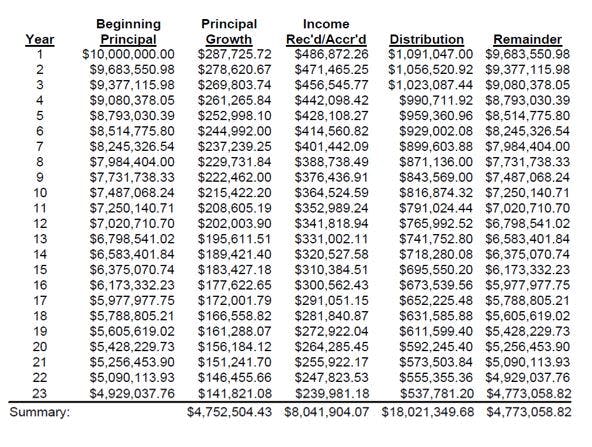

CRUT example: The donor puts $10 million in a trust with a term of 23 years, based on the beneficiary’s life expectancy. The donor designates the beneficiary to receive quarterly payments of 5% of the trust’s present value. This assumes 3% growth. At the end of the trust’s term, the beneficiary will have received more than $18 million over 23 years of accrual, and the charity will receive the nearly $4.8 million remainder.

Charitable lead trusts

In most cases, a CLT allows the donor to see during their lifetime how their selected charity uses their gift — and still let them pass on part of their estate to their beneficiaries.

A CLT is also an irrevocable trust, but the income stream is paid to the charity rather than the donor or their beneficiary. When the term expires, the trust’s remaining assets are paid out to the designated beneficiaries.

Upon creation of the trust, the donor may have to pay a gift tax on the value of assets transferred to their beneficiaries, but if the trust’s assets appreciate over its term, the appreciation will pass to the beneficiaries free of estate and gift tax. Gift tax can be minimized via a “zeroed-out” charitable lead annuity trust (CLAT).

Like the CRT, a donor can create either a CLAT or a charitable lead unitrust (CLUT). With a CLAT, the charity receives a fixed stream of payments that is determined when the trust is created and the remainder will go to the beneficiaries. Under the CLUT, the charity receives a fixed percentage of the trust’s value each year and, again, the beneficiaries receive the remainder at the end of the term.

Examples

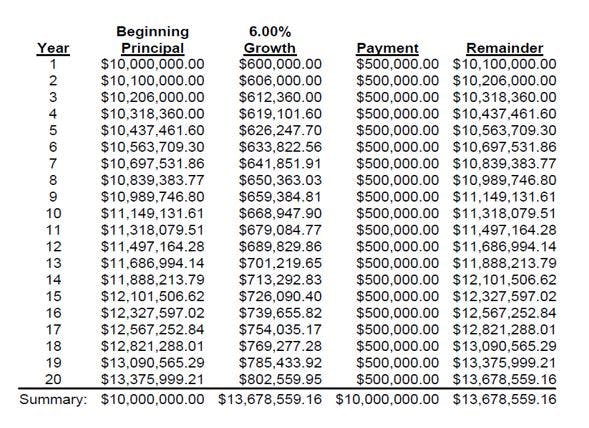

CLAT example: The donor puts $10 million in a trust with a term of 20 years and designates annual payments of 5% of the original value of the trust, or $500,000, to the specified charity. This example assumes 6% growth. At the term’s end, the charity will have received its entire $10 million gift, and the beneficiaries will receive the nearly $13.7 million it has accrued over the term.

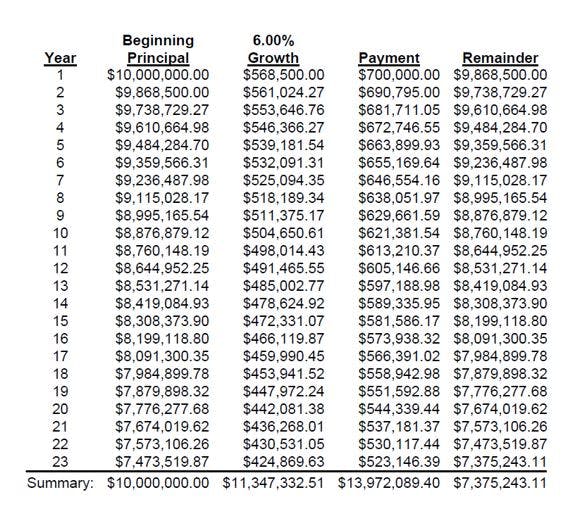

CLUT example: The donor puts in $10 million in a trust with a term of 23 years, based on the beneficiary’s life expectancy. The charity receives an annual gift of 7% of the trust’s value each year. This also assumes 6% growth. At the end of the defined term, the charity will have received more than $13.9 million, and the beneficiaries will receive the remaining $7.38 million.

While there is no wrong time to explore charitable giving options, with the capital gains rate expected to rise in 2022, these types of trusts will be even more attractive to certain individuals. But when donors have charitable intent, they will benefit no matter what the tax rate.

For more information on charitable giving options, contact our team.