A dentist’s guide to dental practice valuation methods

Practice calculations of value

A calculation of value is an important and often required element of dental practice transitions. Whether you are setting out on the adventure of owning your own practice or nearing retirement and interested in selling the practice you have spent your whole career building, a calculation of value will play an important role in shaping the negotiations surrounding the transition. The calculation marks the beginning of the transition process as it helps determine affordability for the purchasing doctor and future financial planning for the retiring doctor. The goal of this article is to shed some light on the different methodologies used to value a dental practice and provide a basic understanding for any doctor who may be looking at a value calculation in the future.

Calculations of value – the basics

Most calculations of value utilize multiple valuation formulas averaged together to arrive at a final estimate. Utilizing different methodologies builds confidence in the end value and identifies outlying financial or practice data that may cause a deviation.

Common valuation methodologies:

- Capitalized excess earnings

- Asset value

- Annual net receipts

- Average annual earnings

Typically, historical financial information of the practice is utilized to produce the calculated value under these scenarios. However, it is important to have advisors who are able to review the financial and non-financial data as well as the underlying practice metrics to determine if the results shown can be improved or if the practice lacks sustainability. For example, maybe the patient base is unique without adequate new patient numbers. Maybe specialized dentistry is important to the total revenue, can this be duplicated? This could be very problematic for a new owner if they were not aware or able to plan for this ahead of time. Also, maybe there is a high amount of treatment diagnosed, unaccepted or non-completed dentistry on the books, which provides an opportunity for a revenue increase for the new doctor with good patient acceptance skills. These intricacies are why the valuation should be viewed as a launching point for further analysis done by trusted advisors.

Capitalized excess earnings

Capitalized excess earnings is a commonly used valuation method. It is an income-based method that factors in collections, operating expenses and doctor production which provides a good estimate of the investment value of the practice.

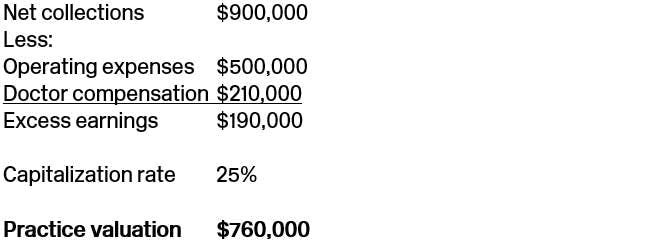

Excess annual earnings are calculated by deducting from average annual net receipts, average annual operating expenses and professional compensation (typically estimated at 35% of average annual doctor production after adjustments for doctor production). The resulting average excess earnings are then divided by a risk factor (capitalization rate), determined by the degree of risk involved. The capitalization rates typically range from 15% to 30%.

For example, assume a practice collects $900,000 and has operating expenses (not including doctor compensation) of $500,000 (55%). Assume a doctor net production of $600,000, which results in estimated associate related doctor compensation of $210,000.

Asset value method

As its name implies, the asset valuation method is a calculated value based on an appraised value of all tangible (dental and office equipment, leasehold improvements, office supplies, dental supplies and hand instruments) and intangible (goodwill and patient lists) assets of the practice. Typically, the tangible assets are expressed at a percentage of original cost to allow for normal depreciation.

Goodwill values vary depending on location, supply and demand, patient demographics, etc. Two commonly used methods of evaluating patient records/goodwill are:

- A specified dollar amount per active patient. Current market conditions suggest that the value of an “active” patient record is $200-$300. An active patient is defined as a patient seen for treatment within the past 18-24 months.

- A specified percent of average annual receipts. This range will vary depending on location but a range of 40% to 60% is common (for example, a practice with average annual receipts of $900,000 would have a goodwill value of $360,000 to $540,000).

Annual net receipts method

This method measures a practice based on the average annual net receipts over the last three years. The practice is stated as a percent of average annual net receipts. The percentage utilized is determined from information on sales and analysis of other dental practices sold in the state and region during recent years. It is typical for the percentage utilized to fall in the range of 50% to 80% of the average annual net receipts. For example, a practice with annual net receipts of $900,000 would fall between $450,000 and $720,000 in value.

One issue with the annual net receipts method is that it does not take “profit” into consideration, only collections. For this reason, the percentage applied can vary greatly from practice to practice. For example, a fee-for-service practice collecting $900,000 may be very different than a PPO practice collecting $900,000. Valuing a practice on collections alone would fail to provide the required insight into what it costs (in both time and expenses) to produce the collection amount. Also, this method may or may not take into consideration future receipts or changes in reimbursement with insurance etc. However, this methodology is still important in analyzing collection trends and is a relatively quick rule of thumb to reference.

Average annual earnings

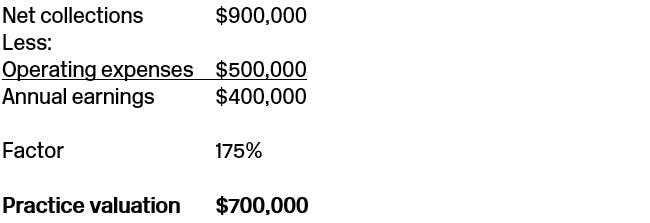

This method measures a practice based on the average net earnings available to the owners. It is similar to the capitalized excess earnings method except it does not factor in doctor compensation as a percentage of doctor production.

Annual net earnings (typically based on the last three years) is multiplied by a factor determined by comparing data from other sales and purchases of other dental practices in the state and surrounding region during the past few years. Most current data and economic conditions suggest that the value of practices to be in the range of 150% to 200% of the average annual earnings available to the owner's in a non-rural community.

If the doctor produces a disproportionately high amount of the practice’s collections, the average annual earnings will typically produce a higher valuation than the capitalized excess earnings method. This is because the average annual earnings method ignores the typical doctor compensation owed due to the doctor production. The reverse is true if the practice collections are generated by individuals other than the owner doctor.

Example:

Assume the same facts from the capitalized excess earnings example ($900,000 collections with $500,000 in overhead).

Nonfinancial factors impacting valuation

It is important to note that several non-financial factors may impact the value of a practice. Also, most of this sample analysis is based on the past and assumes the ability to duplicate past results. Future earnings and any changes pending in the practice must be considered. Some of these include location, patient demographics, insurance vs. fee-for-service practice, staffing models and quality and practice life-cycle. The procedure mix may also be important to consider. Reviewing these non-financial factors, and having a trusted advisor who can recognize them, is crucial to the valuation process. The numbers alone do not always tell the story of valuation.

In conclusion

The calculation of value is an important tool to be utilized in practice transitions or financial planning. However, analyzing the results of the valuation to address the opportunities and threats it unearths is where the real “value” lies. It is important to have trusted advisors on your side to help you identify and address these items. Baker Tilly’s dedicated dental CPAs are committed to providing timely advice specific to your goals throughout the lifecycle of your practice, from purchase to sale. We focus on bringing ideas and solutions to help your practice succeed and tailor our services to meet your unique needs and objectives. Whether you need assistance with valuations, negotiation, tax or structuring, your Baker Tilly advisor will be at your side to guide you through the process.

For more information on this topic, or to learn how Baker Tilly dental practice specialists can help, contact our team.